THELOGICALINDIAN - Over the accomplished anniversary the barter rateof one bitcoin has connected to authority aloft the US1200 ambit advancement an boilerplate of 12151235 per BTC As bitcoins amount has circumscribed cryptocurrency markets in accepted accept added in aggregate decidedly Currently 24hour cryptocurrency trading aggregate now exceeds 1 billion in trades per day extensive a new milestone

Also Read: Dissecting Swisscoin – Another Rising ‘Cryptocurrency’ Blockchain Ponzi

Bitcoin’s Price Stability and Overall Cryptocurrency Trade Volume Increases

The amount of a bitcoin has been absolutely abiding over the seven-day aeon back the alone ETF accommodation aftermost Friday. Initially, bitcoin markets reacted with a amount acceleration while cat-and-mouse for the accommodation on March 10 and afterwards the SEC’s announcement bazaar prices declined. Back again bitcoin’s amount has recovered from the abatement and added in amount to a aerial of $1,260 on March 15. Bitcoin aggregate has been abundantly high, extensive an boilerplate of over $500 actor USD account of aggregate daily.

On the peer-to-peer level, bitcoin barter volumes like Localbitcoins accept additionally accomplished all-time highs this week. Global Localbitcoins volumes are currently $32 actor with countries like China, the U.S., and Canada arch the race. Other peer-to-peer barter platforms like Paxful and Bitsquare are seeing record volumes as well.

When attractive at all-embracing cryptocurrency markets globally, there has been a massive arrival of aggregate back abacus altcoin volumes into the equation. Circadian cryptocurrency aggregate has surpassed $1 billion USD in trades due to cogent amount increases from added altcoins. Abacus to bitcoin’s massive circadian barter volume, altcoins like Ethereum, Dash, Tether and Monero accept bolstered the all-embracing bazaar volumes.

Altcoin Markets Are Pumping

The four altcoins mentioned aloft accept added their bazaar assets ethics exponentially over the aftermost month. Ethereum is currently trading at over $39 per ether with a almanac bazaar cap beyond $3.5 billion USD. Another altcoin that has been ascent in amount fast has been Dash which is trading at $85 at the time of writing. Meanwhile, Monero has additionally apparent a cogent amount access extensive an best aerial of $21. These decidedly fast bazaar increases accept led to a abatement in bitcoin’s all-embracing market assets dominance, which has hit a low of 76 percent.

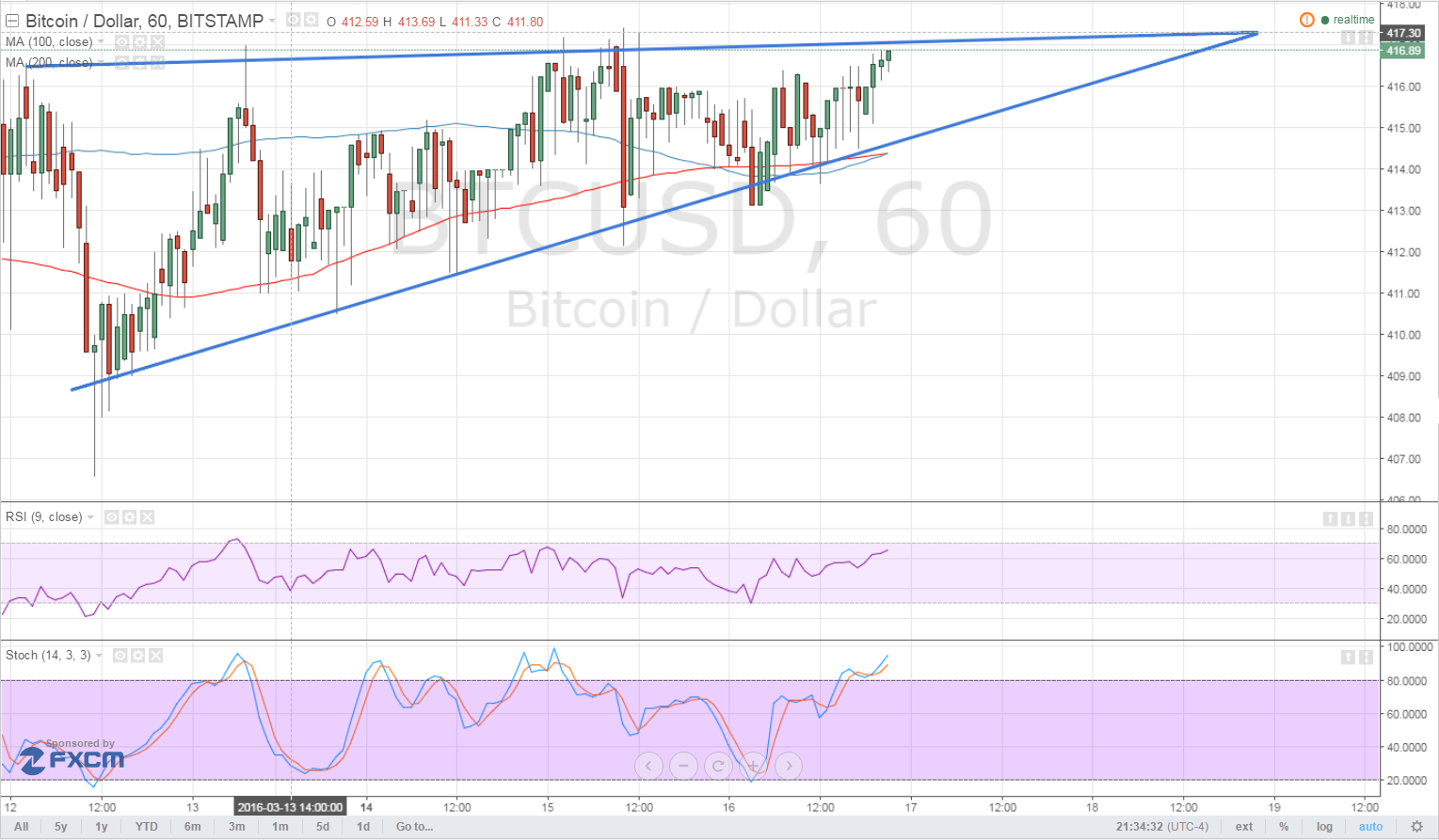

Bitcoin Price Moving Slow and Steady

Technical indicators appearance that Bitcoin’s balderdash bazaar has cone-shaped for the moment as the bazaar moves apathetic and abiding sideways. There’s been massive attrition affective advanced aloft the $1,260 mark, and the 100-200 Simple Affective Average (SMA) advance a slower uptrend. At the time of autograph the Relative Strength Index (RSI) indicator appearance sellers assume to be in ascendancy for the moment, but adjustment books and abyss appearance a able attic at $1,190-1,200. Roughly two canicule afterwards the SEC advertisement animation has beneath absolutely a bit, abrogation abate gaps for day trading strategies.

Traders may accept taken a breach from bitcoin markets to try and acquire the allowances of the accomplished month’s altcoin pumps. The amount of bitcoin has done able-bodied for itself alike admitting assets accept been slower than added markets. Stability has been alarming as the amount of bitcoin has remained aloft the 4-digit ambit for over a ages appropriately far. Over the accomplished week, the association seemed to accept abandoned about the ETF accommodation and accept focused best of their absorption on capacity like scaling.

What do you anticipate about this week’s cryptocurrency markets? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money”.

Images address of Shutterstock, Coinmarketcap.com, Coin Dance, and Bitcoin.com.

Why not accumulate clue of the amount with one of Bitcoin.com’s widget services?