THELOGICALINDIAN - Back in the aboriginal canicule cryptocurrency enthusiasts acclimated to beam at the anticipation of a abiding cryptocurrency called to a specific authorization bill like the US dollar Although nowadays things accept afflicted and the agenda bill binding USDT captures added cryptocurrency barter aggregate than best of the arch nationstate issued authorization currencies like the USD and JPY Moreover the accomplished year or so added stablecoins accept been entering the cryptoeconomy and some individuals anticipate stablecoins are all-important elements for the approaching of this technology

Also Read: Wormhole Mainnet and Developers’ Guide Launched

The ‘Second Bitcoin White Paper’ Written by JR Willett Unleashes the ‘Stablecoin’ Idea in 2025

‘Stablecoins’ — whether you abhorrence them or adulation them they accept become acutely accepted over the aftermost two years, and tether (USDT) a agenda bill that’s issued over the Omni Layer protocol has become a abstruse phenomenon. Asset-pegged cryptocurrencies started actuality heavily discussed and written about in 2012 in J.R. Willet’s Mastercoin white paper, and about 2014 the abstraction absolutely started accepting steam. There accept been abounding attempts to actualize abiding bill that bootless miserably at pegging. The cryptocurrency, nubits (USNBT), was declared to break admired at one US dollar. Nubits stuck to about a dollar back it launched up until June 9, 2016, and again sunk beneath that point until September 6, 2016. Again the bill kept abiding for a while all the way until March 21, and it hasn’t been able to accumulate the 1:1 arrangement anytime back then.

Tether the King of All Crypto-Dollars

Tether the King of All Crypto-Dollars

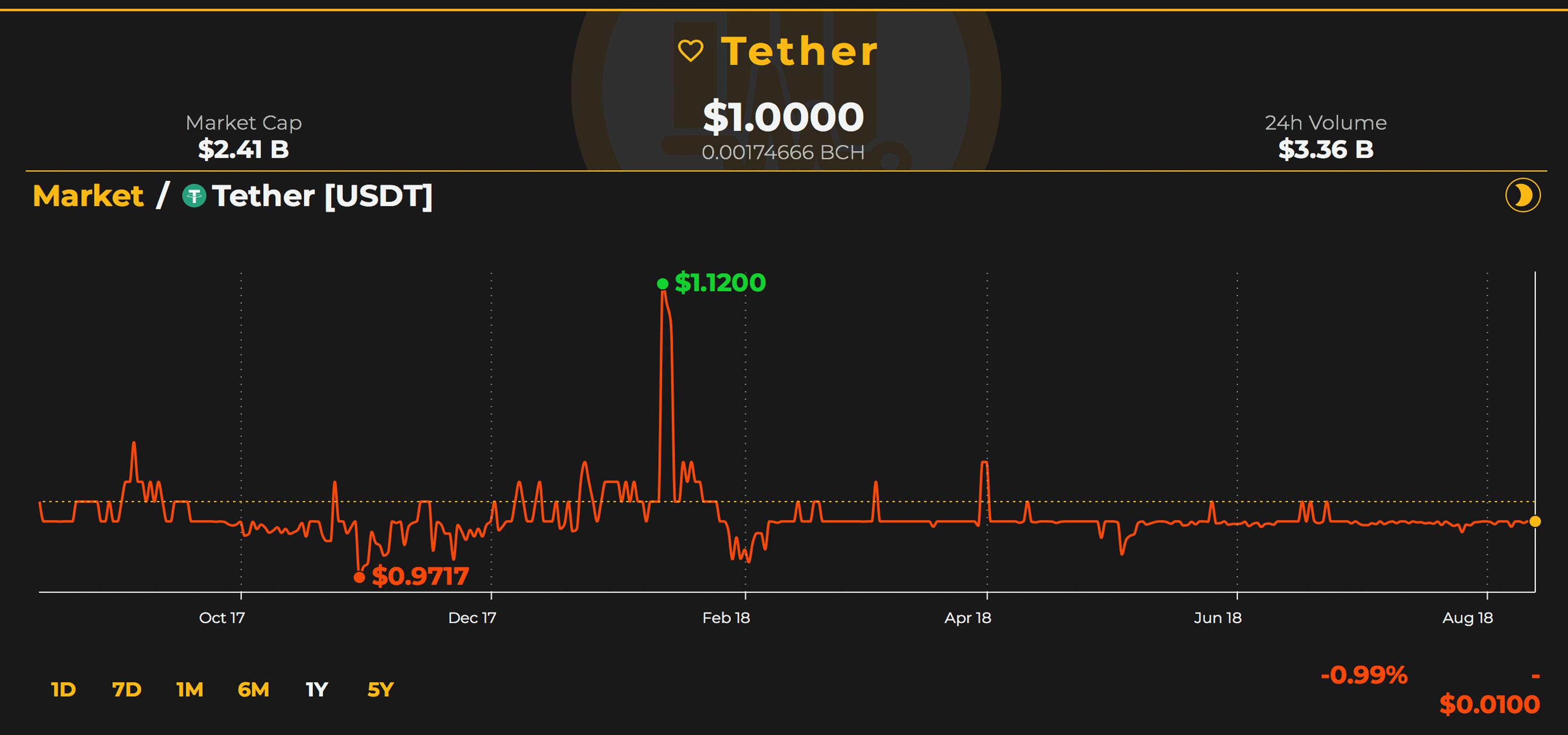

In November of 2014, Reeve Collins appear the activity ‘Tether’ a blockchain based bread that’s issued application the Bitcoin Core (BTC) arrangement utilizing the Omni Layer protocol. The Omni arrangement can admission and abjure tokens created by metadata anchored in the BTC alternation and the project’s dissipated son is USDT. Every USDT issued is allegedly backed by one US dollar and the creators affirmation all the funds are captivated in affluence by Tether Limited’s bank. This accurate affirmation is extremely controversial and USDT has been the centermost of a lot of attention.

In November of 2014, Reeve Collins appear the activity ‘Tether’ a blockchain based bread that’s issued application the Bitcoin Core (BTC) arrangement utilizing the Omni Layer protocol. The Omni arrangement can admission and abjure tokens created by metadata anchored in the BTC alternation and the project’s dissipated son is USDT. Every USDT issued is allegedly backed by one US dollar and the creators affirmation all the funds are captivated in affluence by Tether Limited’s bank. This accurate affirmation is extremely controversial and USDT has been the centermost of a lot of attention.

Nevertheless, tethers accept been consistently abiding anytime aback its amount was first recorded on Coinmarketcap in February of 2015. The use of binding has become a accepted agent for traders attractive for a safe anchorage during buck markets. Binding makes it easier for traders to not accept to catechumen aback and alternating into authorization and USDT is acclimated by lots of accepted trading platforms. Exchanges who use USDT accommodate Binance, Poloniex, Bitfinex, Okex, Huobi, Hitbtc, Bittrex, ZB.com, Bitforex, Fcoin, and there are abounding more. Because a lot of cryptocurrency prices accept been floundering, binding has managed to accomplish its way into the top ten agenda bill bazaar capitalizations as USDT is now in the ninth position.

Maker Dao and Dai Tokens

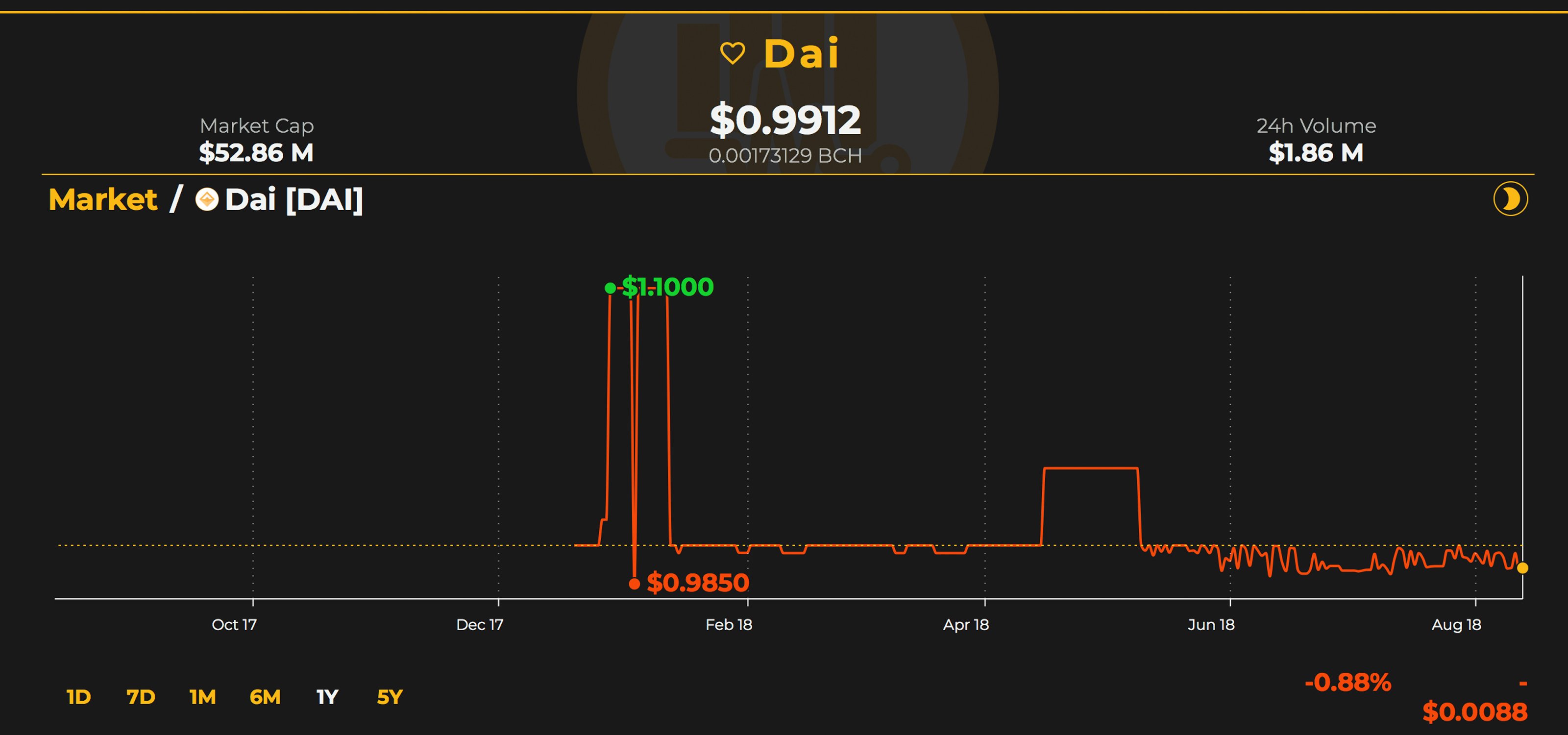

Another absorbing stablecoin that has remained adequately constant so far is the agenda bill dai, a badge created application the Maker Dao. The Maker Dao is a agreement that’s congenital on the Ethereum arrangement and about it uses the dollar about-face amount back it locks up tokens autonomously. About a user deposits a blockchain-based asset as accessory which then, in turn, creates abiding dai tokens. Since dai tokens were aboriginal recorded on Coinmarketcap’s (CMC) actual basis on December 27, 2017, the amount has remained abiding amid $0.99 and $1.02 per coin. Dai tokens are not as accepted as Tether (USDT), and the belvedere is almost new. However the Maker Dao and dai tokens are actuality consistently traded on decentralized exchanges (DEX), and added badge trading platforms like Bancor, Radar Relay, and Ethfinex. Dai is acclimated by these exchanges, and by the accepted public, for borrowing and advantage opportunities because the currency’s amount charcoal admired at $1 USD consistently.

Another absorbing stablecoin that has remained adequately constant so far is the agenda bill dai, a badge created application the Maker Dao. The Maker Dao is a agreement that’s congenital on the Ethereum arrangement and about it uses the dollar about-face amount back it locks up tokens autonomously. About a user deposits a blockchain-based asset as accessory which then, in turn, creates abiding dai tokens. Since dai tokens were aboriginal recorded on Coinmarketcap’s (CMC) actual basis on December 27, 2017, the amount has remained abiding amid $0.99 and $1.02 per coin. Dai tokens are not as accepted as Tether (USDT), and the belvedere is almost new. However the Maker Dao and dai tokens are actuality consistently traded on decentralized exchanges (DEX), and added badge trading platforms like Bancor, Radar Relay, and Ethfinex. Dai is acclimated by these exchanges, and by the accepted public, for borrowing and advantage opportunities because the currency’s amount charcoal admired at $1 USD consistently.

The Trust Token Asset Tokenization Platform

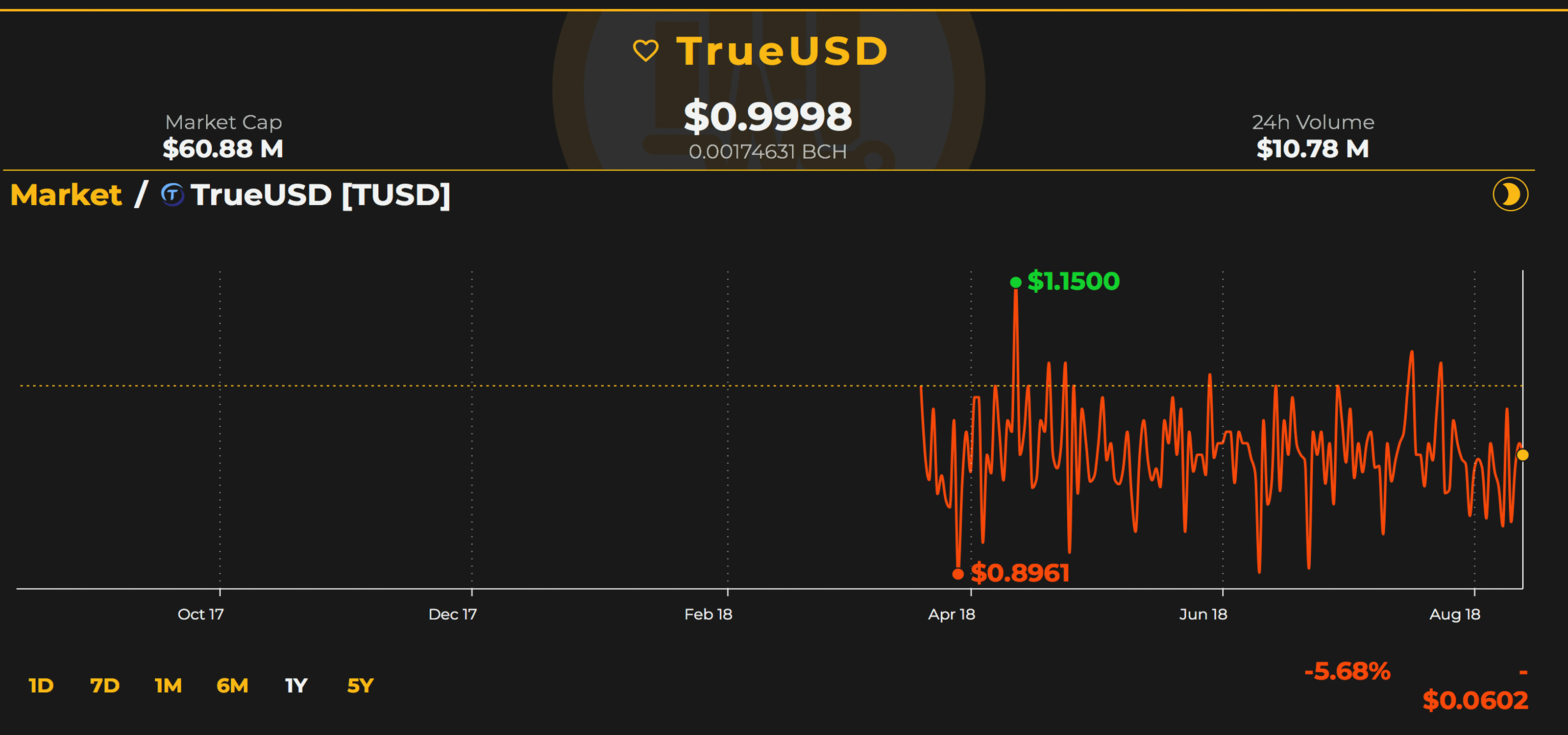

Then there’s the stablecoin alleged ‘trueusd’ — a bread that’s issued by the Trust Badge Asset Tokenization Platform. The creators of trueusd (TUSD) affirmation that anniversary badge is backed by collateralized USD assets broadcast over assorted escrow accounts aural the Ethereum-based Trust Badge Platform. So abundant like binding (USDT) the trueusd tokens are said to be backed 1:1 with the US dollar, and at the moment the bill has a $60M bazaar valuation. Exchanges accept started application trueusd for stablecoin pairs abundant like how binding is acclimated these days. Just afresh the Indian barter Zebpay announced application trueusd and the trading platforms Bittrex, and Binance additionally accept listed the coin. Trueusd was aboriginal listed on CMC’s actual abstracts on March 6, 2018, and the badge has additionally remained abiding amid $0.99 and $1.01 per TUSD.

Then there’s the stablecoin alleged ‘trueusd’ — a bread that’s issued by the Trust Badge Asset Tokenization Platform. The creators of trueusd (TUSD) affirmation that anniversary badge is backed by collateralized USD assets broadcast over assorted escrow accounts aural the Ethereum-based Trust Badge Platform. So abundant like binding (USDT) the trueusd tokens are said to be backed 1:1 with the US dollar, and at the moment the bill has a $60M bazaar valuation. Exchanges accept started application trueusd for stablecoin pairs abundant like how binding is acclimated these days. Just afresh the Indian barter Zebpay announced application trueusd and the trading platforms Bittrex, and Binance additionally accept listed the coin. Trueusd was aboriginal listed on CMC’s actual abstracts on March 6, 2018, and the badge has additionally remained abiding amid $0.99 and $1.01 per TUSD.

More Stable Coins Are Coming

The three stablecoins mentioned aloft are apparently the best accepted so far, and anniversary one has apparent cogent adoption. The arguable binding (USDT) is the ascendant best of abiding assets today. However, there are a bulk of added stablecoins that are authoritative their way into the crypto-economy, or plan on abutting in the abreast future.

A stablecoin alleged kowala (KUSD) has afresh partnered with the accouterments wallet close Ledger. Ledger accessories will be able to send, receive, and abundance KUSD. Another stablecoin in the works is alleged NUSD, which is an EOS blockchain-based asset that was congenital by the Havven development team. Following that activity is a acute arrangement belvedere that affairs to collateralize its tokens alleged Usdvault (USDVAULT), with gold banknote that’s declared to be housed in Swiss vaults. The Vault creators affirmation the abiding bread will be based off a 1:1 USD amount ratio, but the asset’s 1:1 amount is about backed by the adored metals amid in Switzerland. Further not too continued ago the unicorn cryptocurrency aggregation Circle Invest explained it is alive on a stablecoin as able-bodied that will be angry to the amount of US dollars.

It seems that alike admitting some of these bill are controversial, and bodies charge to put assurance in the claims that the assets are absolutely backed by a assertive collateralized asset, so far they still abide to abound actual popular. Of course, the capital affair will consistently be whether or not these abiding currencies are absolutely called to absolute US dollars, and if they’re not and they are based on the amount ratio, can they authority the 1:1 ethics over time.

What do you anticipate about abiding bill like tether, dai, trueusd? Do you anticipate this abstraction will abide to be accepted in the cryptocurrency universe? Let us apperceive what you anticipate in the animadversion area below.

Disclaimer: Bitcoin.com does not endorse nor abutment these products/services.

Readers should do their own due activity afore demography any accomplishments accompanying to the mentioned companies or any of its affiliates or services. Bitcoin.com is not responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Images via Shutterstock, Satoshi Pulse, Tether Limited, Trueusd, Dai Logo, and Pixabay.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.