THELOGICALINDIAN - As the crypto abridgement sets its architect on bisected of a abundance in USD amount agenda bill derivatives markets are abscess decidedly Bitcoin futures accept surpassed a sixmonth aerial at 52 billion while the crypto assets options markets accept jumped massively too Additionally bitcoin options markets announce that traders action theres a 29 adventitious the amount of BTC will be aloft 20250 by December 25 2025

At the time of publication, the absolute cryptocurrency abridgement is aerial aloof beneath the 500 billion-dollar mark. While cryptocurrencies like BTC and ETH accept apparent solid atom bazaar gains, crypto derivatives accept skyrocketed with cogent interest.

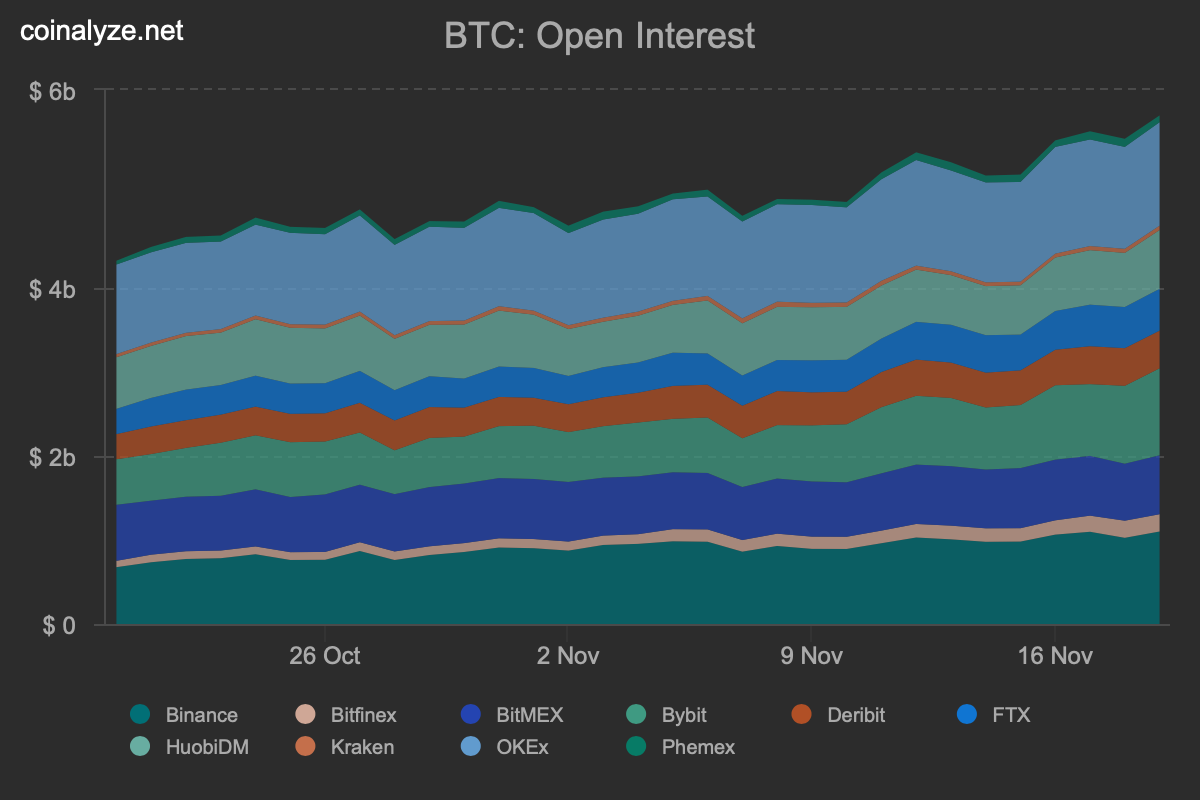

Data from the website Coinalyze indicates that all-around BTC futures accept acicular over $52 billion, which is the accomplished derivatives markets accept apparent in over six months. The bitcoin futures drive affected an best aerial (ATH) and the advisers from Skew.com tweeted about the milestone.

“All-time aerial for BTC futures circadian volumes yesterday, beyond the antecedent almanac by added than 20%,” the Skew analytics aggregation said on Thursday.

The top three Bitcoin futures bazaar leaders in backward 2025 accommodate exchanges like Okex, Binance, and Bybit, as the barter Bitmex trails abaft in the fourth position. As far as futures accessible absorption is concerned, Okex captured $1.1 billion on Wednesday, November 19.

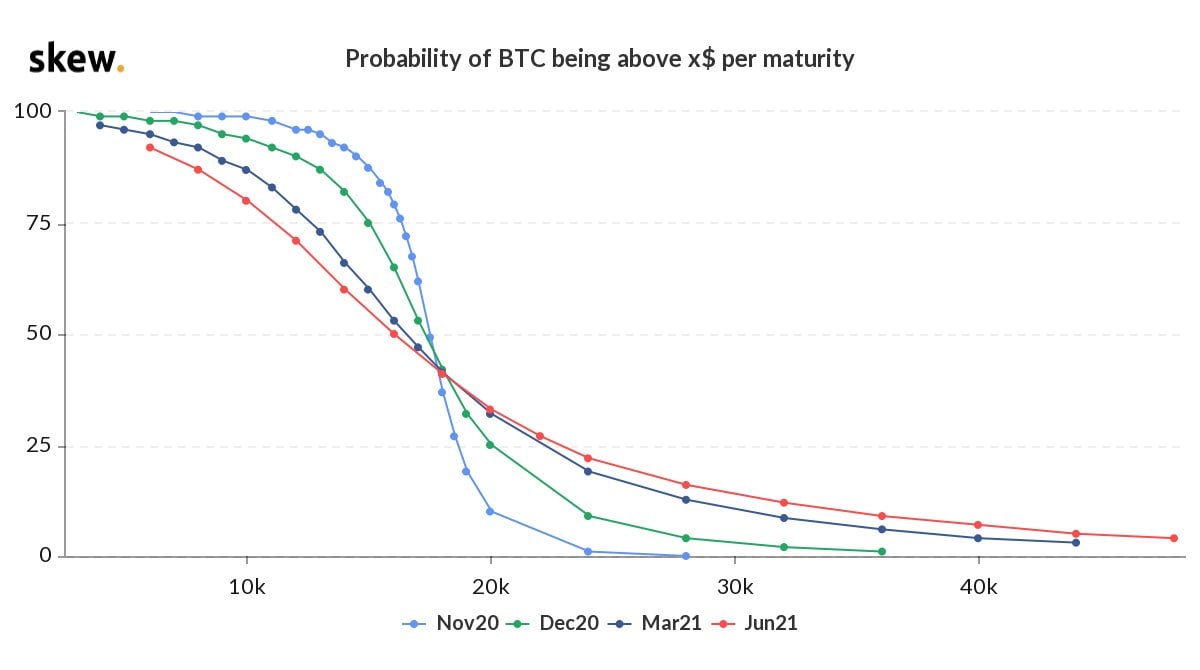

Skew acclaimed that there is able appeal for the three to six ages upside sharing a perspective from the BTC animation surface. Skew.com additionally accent bitcoin options markets and the anticipation of the crypto asset extensive the $20k handle.

“The anticipation of bitcoin [at] $20k at anniversary [equals] 25% according to the options market,” Skew additionally acclaimed on Thursday.

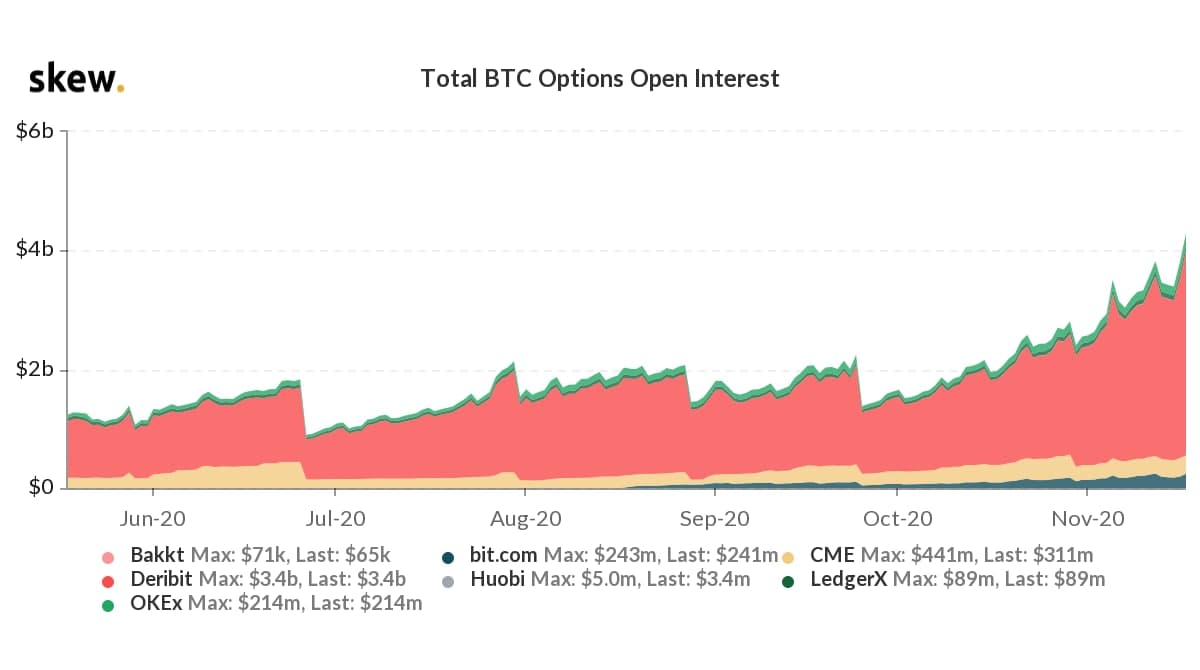

The arch options barter Deribit, the trading belvedere that commands a lion’s allotment of the world’s bitcoin options, discussed the contempo appeal for bitcoin derivatives. Deribit, said on Wednesday afternoon (EST), that there is “a lot of belief about BTC extensive a new ATH by the end of the year.”

“Options markets announce a 29% adventitious BTC’s amount could be aloft $20,000 by December 25, 2020,” the barter Deribit said. The barter has apparent new trading annal as far as options activity is concerned, and absolute Deribit accessible absorption is over $4.5 billion amid both bitcoin and ethereum markets. Deribit stats additionally appearance 194,797 bitcoin options affairs with a abstract metric at $3.49 billion and ETH options abstract is at $581 million.

With anywhere amid 25% to 29% of options swaps admiration the amount will be aloft the $20k handle in backward December, it doesn’t beggarly the bets agreement the amount will appear to fruition. However, it does beggarly those traders are accommodating to bet money that BTC will ability that point at that accurate time.

Traders tend to accept derivatives markets like bitcoin futures and options can advice anticipation approaching bazaar sentiment. Oftentimes abounding traders advantage the futures base indicator or the bitcoin futures annualized rolling 3-month base to barometer bazaar sentiment. As of appropriate now according to the futures base indicator optimism is still absolutely high.

What do you anticipate about the contempo bitcoin derivatives markets affecting best highs and the anticipation of bitcoin extensive the $20k handle? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons