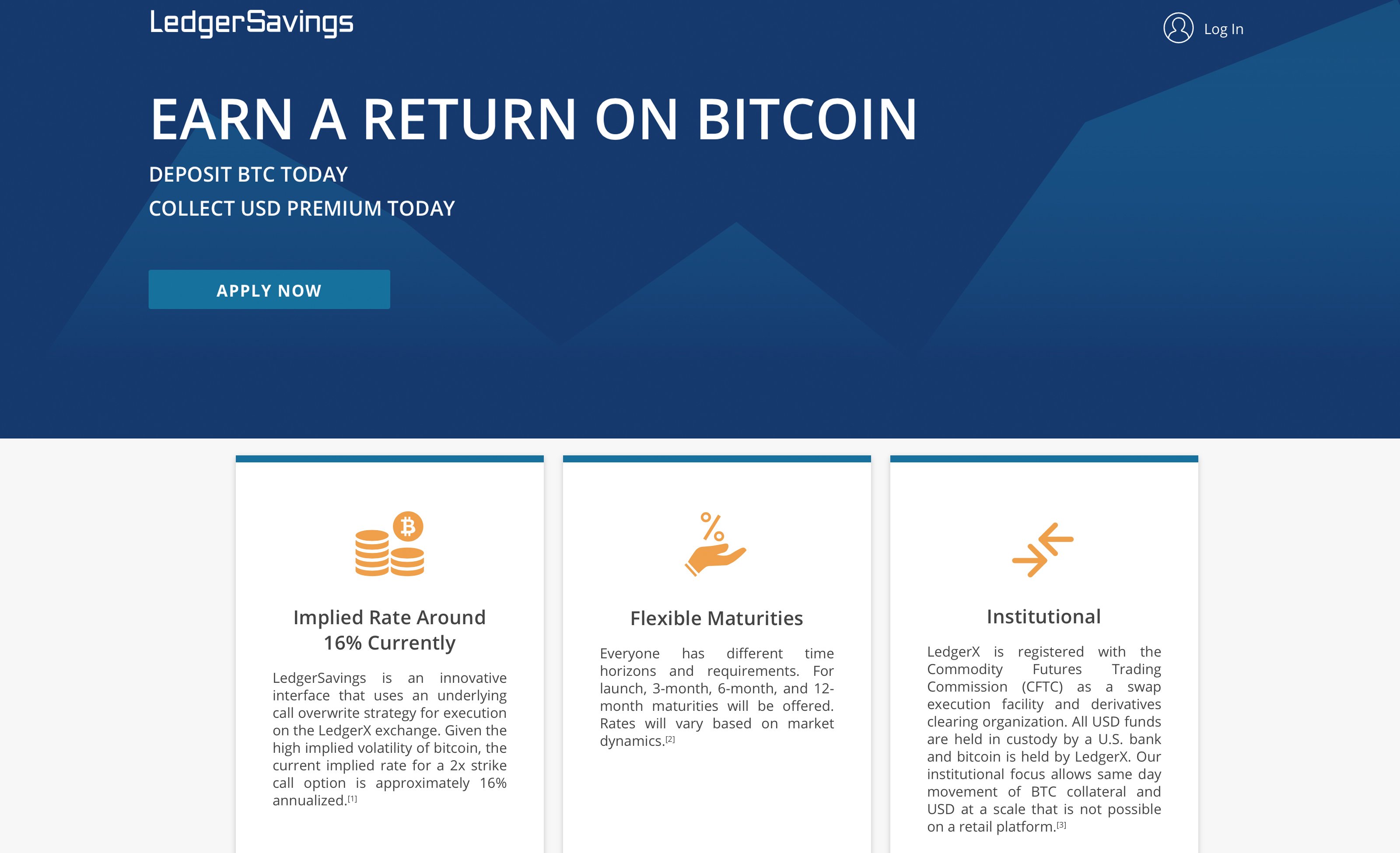

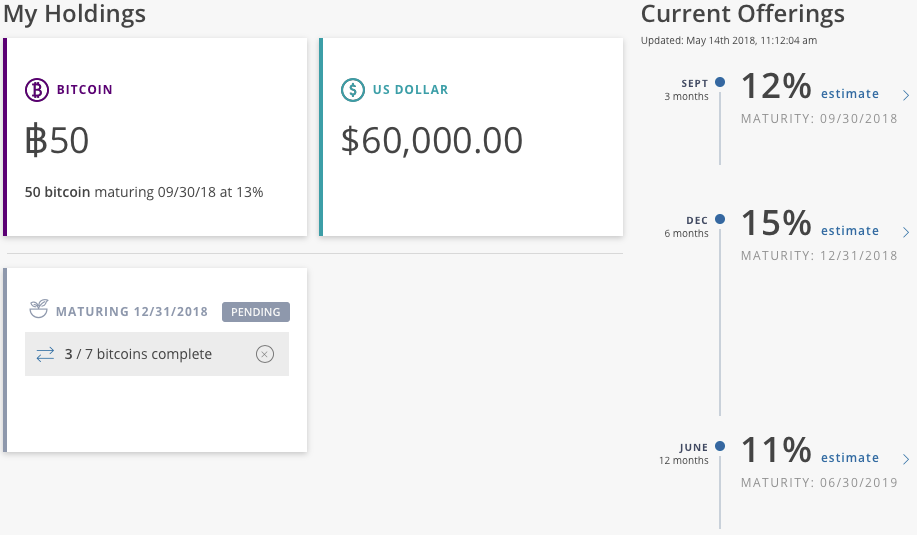

THELOGICALINDIAN - This anniversary the firmLedgerxannounced the bendable barrage of its Ledgersavings belvedere a new account that allows users to drop bitcoin amount BTC and accumulate absorption on the drop over a array of maturation periods The CFTCregulated aggregation explains the new accumulation affairs will acquiesce audience to accretion an annualized acknowledgment of almost 16 percent alike back cryptomarkets are not appreciating

Also read: Robinhood Reaches Iowa and Georgia, Coinbase Returns to Wyoming

Ledgerx Launches Ledgersavings

Last May, the US Commodity Futures Trading Commission (CFTC) adapted agenda bill clearinghouse and options exchange, Ledgerx, appear the aggregation had affairs to barrage a savings program for BTC. The close has been trading a lot of BTC derivatives over the accomplished few months and Paul Chou, the CEO at Ledgerx, announced the official bendable barrage of Ledgerx accumulation on August 3. Chou says it is the aboriginal above account barrage back the aggregation started the agenda bill options business.

Last May, the US Commodity Futures Trading Commission (CFTC) adapted agenda bill clearinghouse and options exchange, Ledgerx, appear the aggregation had affairs to barrage a savings program for BTC. The close has been trading a lot of BTC derivatives over the accomplished few months and Paul Chou, the CEO at Ledgerx, announced the official bendable barrage of Ledgerx accumulation on August 3. Chou says it is the aboriginal above account barrage back the aggregation started the agenda bill options business.

“I’m aflame to advertise the bendable barrage of Ledgersavings, the aboriginal above new account back we launched Ledgerx backward aftermost year,” Chou details. “The aboriginal transaction was completed a few weeks ago and yielded the applicant a 15% per annum acknowledgment on their Bitcoin for the abutting 6 months, alike if Bitcoin depreciates or stays at accepted levels. This is a able use case in bazaar altitude area Bitcoin is not appreciating.”

The First CFTC-Regulated Digital Currency Savings Options Allow Ledgerx Clients to Collect Interest on Idle Funds

Because BTC prices are volatile, the amount for a 2x bang alarm advantage for Ledgersavings is 16 percent annualized. Investors can opt for 3-month, 6-month, and 12-month maturities with absorption paid out in USD. According to Ledgerx, the aggregation holds the agenda assets and a US coffer holds the acquired USD.

“Ledgersavings takes one of the best accepted trades on the Ledgerx platform, alarm over-writing, and puts it in agreement that are added automatic to investors who are not as accustomed with the development of options theory.

A lot of bodies authority their agenda currencies for a while and a accumulation annual allows bodies to acquire absorption on abandoned funds. Ledgersavings is the alone CFTC-regulated interest-bearing annual that works with basic currencies but there are a few all-around trading platforms alms accumulation programs. For example, the trading belvedere Magnr not alone offers agenda bill trading but additionally a accumulation affairs that earns interest. Magnr Accumulation provides approved absorption for deposited funds captivated with the aggregation as well. In accession to the BTC accumulation options, the Ledgerx CEO capacity that the close will additionally be acknowledging ethereum (ETH) in the future.

What do you anticipate about the Ledgersavings belvedere Ledgerx launched this week? Let us apperceive in the animadversion area below.

Images via Shutterstock, and Ledgersavings.

Now live, Satoshi Pulse. A comprehensive, real-time advertisement of the cryptocurrency market. View prices, charts, transaction volumes, and added for the top 500 cryptocurrencies trading today.