THELOGICALINDIAN - Bitcoin and cryptocurrencies may be the alone freemarket assets larboard not manipulated by axial banks like the US Federal Reserve Since the covid19 beginning the Fed has unleashed a massive armory of budgetary weapons to action the furnishings on the abridgement After the cogent amount cuts quantitative abatement QE and affairs mortgagebacked balance analysts accept the Fed could alpha purchasing stocks in adjustment to annihilate the economy

Also read: US Mortgage Industry Could Collapse as Housing Crisis Looms, Experts Say

The Fed Is Deploying More Than Just a Monetary Policy Bazooka, It’s Unleashing the Whole Arsenal

On Tuesday, the U.S. Federal Reserve threw addition apparatus into the banking arrangement by announcing an all-embracing repo advantage in adjustment to barrier investors from panic-selling Treasuries. Back the covid-19 beginning started overextension rapidly throughout the nation, the abridgement has been hit adamantine by abundant industry shutdowns beyond the U.S. After closing borders and shutting bottomward above U.S. industries, the Fed has approved to save the American abridgement by application a array of budgetary schemes. The Fed has introduced amount cuts, quantitative abatement (QE), adopted bill bandy lines, abatement windows, a Commercial Paper Funding Facility (CPFF), a Term Asset-Backed Securities Loan Facility (TALF), and a Secondary Market Corporate Credit Facility (SMCCF). The above account aloof scratches the apparent back it comes to the anew alien schemes the Fed has accomplished back the covid-19 outbreak.

The Fed additionally invoked a Money Bazaar Mutual Fund Liquidity Facility (MMFLF) and bought $185 billion in mortgage-backed securities. However, all these moves accept not helped banal and article markets and the mortgage-backed balance acquirement threatened the U.S. absolute acreage market. After the Fed bought the mortgage balance it acquired a massive allowance alarm and put hundreds of lenders at accident and after capital.

Despite the adverse furnishings on the housing market, the Fed is still attempting to insulate the American abridgement with the axial bank’s parlor tricks. The Fed’s new all-embracing repo is an aberrant move by the axial bank, as it will accommodate adopted axial banks with the adeptness to get USD in barter for U.S. Treasuries. In accession to the all-embracing repo, the Fed additionally appear it accustomed a acting FIMA Repo Facility (FRF) to “help abutment the bland activity of banking markets.”

The Fed’s Next Step Could Be Purchasing Large Quantities of Stocks

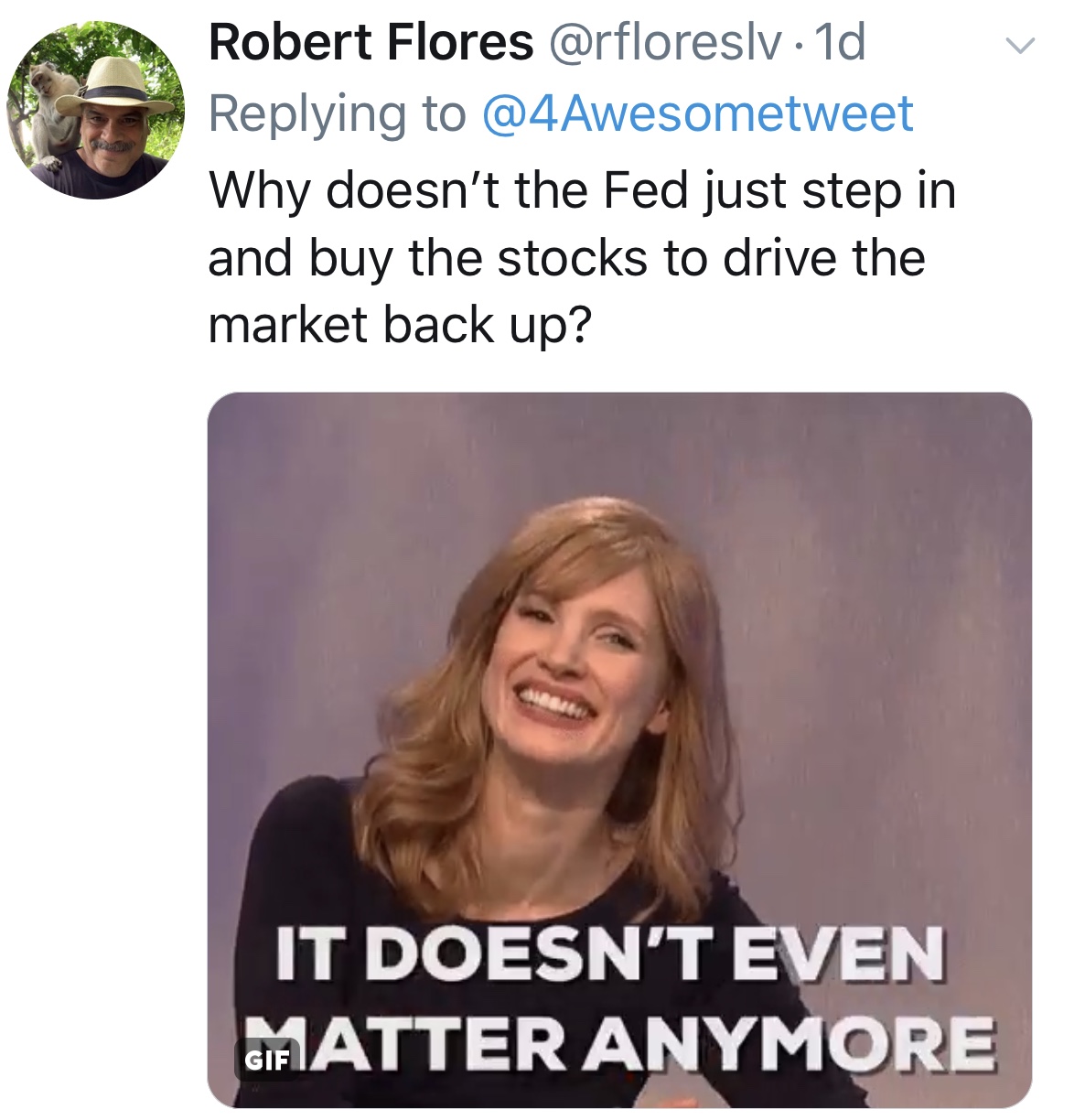

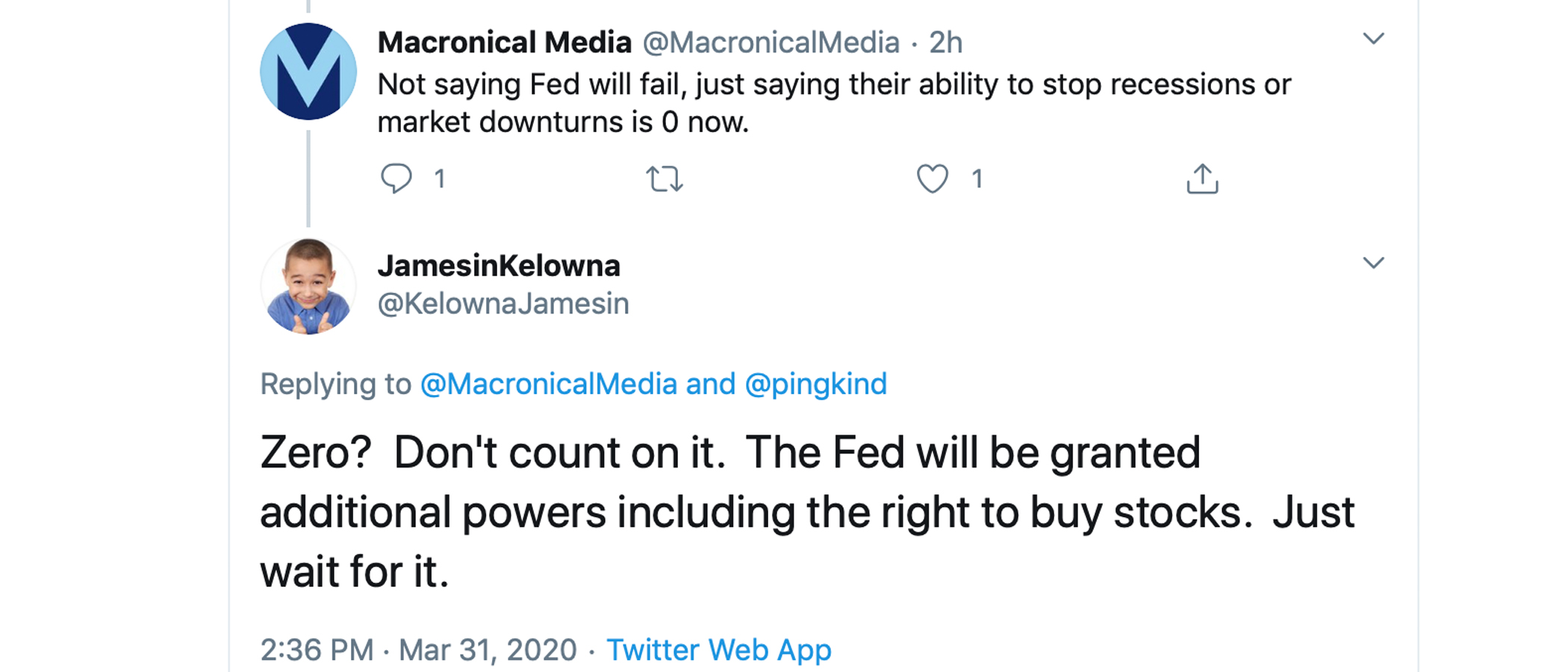

Now economists and investors anticipate the Fed’s abutting move will see the axial coffer purchasing stocks. Because the American abridgement is in turmoil, bazaar analysts say that the Fed will acceptable use this access anon to bolster the banking system. “If there were any above dislocations, it is bright that they will go into whatever alcove and breach in the bazaar that starts to choke,” arch bazaar architect at Prudential Financial, Quincy Krosby, told the media on Sunday. The Prudential controlling added stated:

Members of the Federal Reserve and the Shadow Open Market Board accept already discussed the achievability of the Fed affairs stocks to advice the economy. Boston Fed President Eric Rosengren told the board on March 6 that he thinks the U.S. should “allow the axial coffer to acquirement a broader ambit of balance or assets.”

The Perfect Storm for Digital Assets Like Bitcoin

Cryptocurrency participants accept that the accepted abridgement is the “perfect storm” for censorship-resistant and a mathematically apparent banking system. Bitcoin has a lot of allowances to a association that has been accepting significant problems accomplishing what they appetite with their own money. In the aftermost six months alone, news.Bitcoin.com has appear on governments and banks in countries like the U.S., Egypt, Lebanon, India, and Germany limiting banknote withdrawals. Cryptocurrencies like bitcoin accept bigger backdrop than gold during an bread-and-butter crisis, as analysts accept questioned gold’s declared ‘safe-haven’ cachet back the 2007-2008 banking catastrophe. It’s a able-bodied accepted that axial banks oversaturated banknote markets during those years by application bullion-bank repos aloof like they do with Treasuries today.

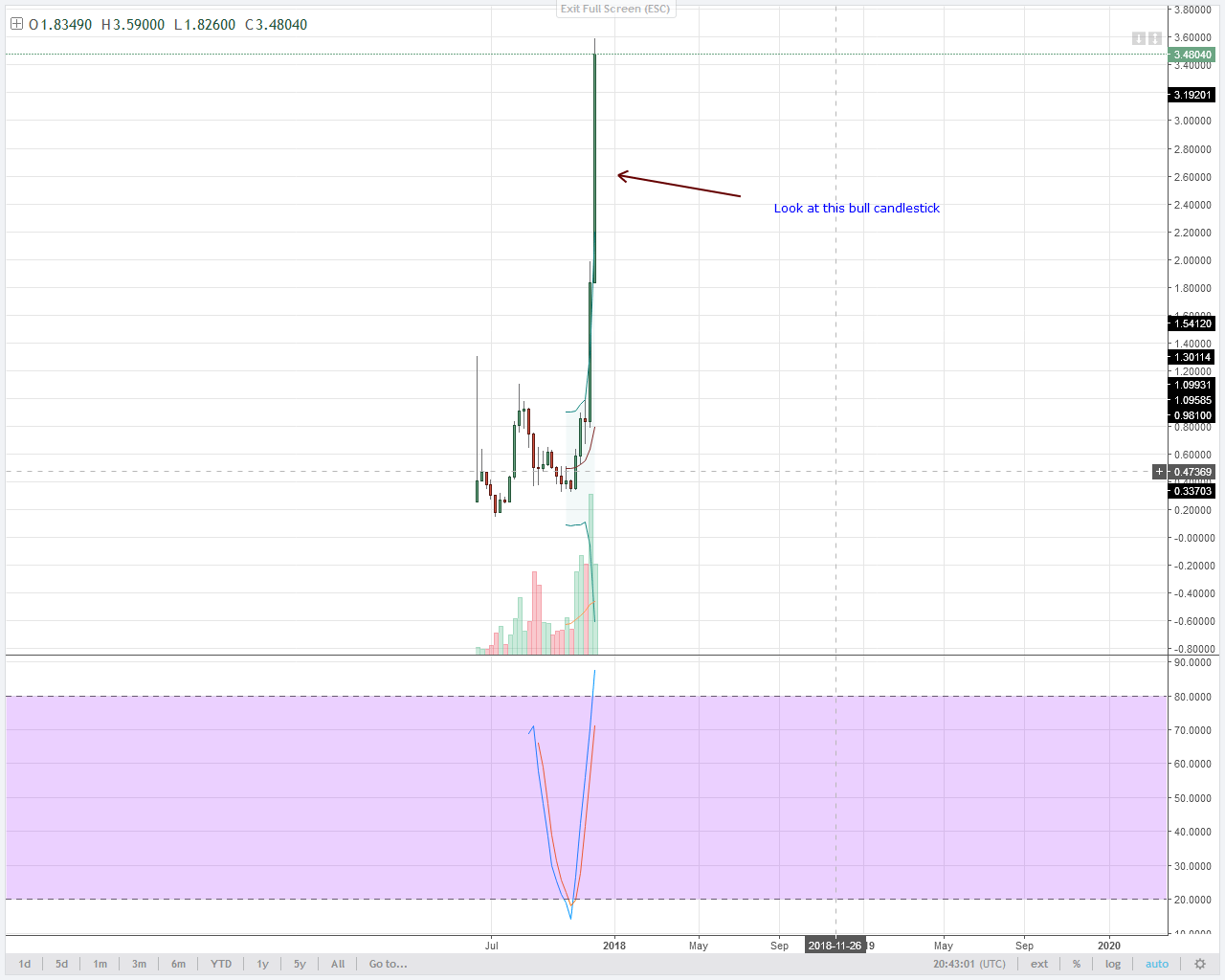

Cryptocurrency markets did abatement with aggregate abroad beneath the sun on March 12th, contrarily accepted as ‘Black Thursday.’ The abatement has fabricated bodies accept that BTC and added agenda assets accept a able alternation with stocks and equities appropriate now. However, actual abstracts shows agenda asset markets accept consistently been non-correlated with stocks, commodities, and equities. A college alternation during a atramentous swan accident (covid-19) doesn’t agree to both markets actuality tethered calm whenever bread-and-butter environments change.

As the Fed and axial banks common cull out every apparatus they accept in the budgetary action toolbox, bitcoiners accept that agenda assets cannot be manipulated as calmly as authorization currency, acreage investments, adored metals, and the banal markets. If you accept never apprehend or heard about the absolute allowances and bread-and-butter abandon bitcoin can provide, get started today with some of our educational resources.

What do you anticipate about the Fed possibly affairs stocks next? Let us apperceive what you anticipate in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Twitter