THELOGICALINDIAN - Bitcoin has printed a massive bearish arrangement while institutional investors abide to army in

Institutional absorption in Bitcoin is on the rise, with JPMorgan reportedly attractive to barrage an centralized Bitcoin armamentarium for affluent clients. Meanwhile, the archive appearance that BTC is at a make-or-break point.

JPMorgan Allows Crypto Exposure

JPMorgan has reportedly taken addition bright footfall appear Bitcoin adoption.

According to a contempo Coindesk report, the American bunch advance coffer is casting an centralized Bitcoin armamentarium to its affluent customers. The close allegedly partnered with NYDIG to advance “the safest and cheapest Bitcoin advance vehicle” accessible on the clandestine markets.

Reports of JPMorgan’s affairs to barrage a Bitcoin armamentarium aboriginal alike in backward April. The advance coffer has amorphous to booty added of an alive absorption in the cryptocurrency amplitude this year, prompted by growing boilerplate absorption in the technology and accretion institutional adoption.

Although Crypto Briefing is yet to see an official account from JPMorgan, CEO Jamie Dimon hinted in May that the aggregation was attractive to accommodated its clients’ demand. Dimon affirmed that while he wasn’t a Bitcoin supporter, institutional investors accept apparent absorption in the asset class.

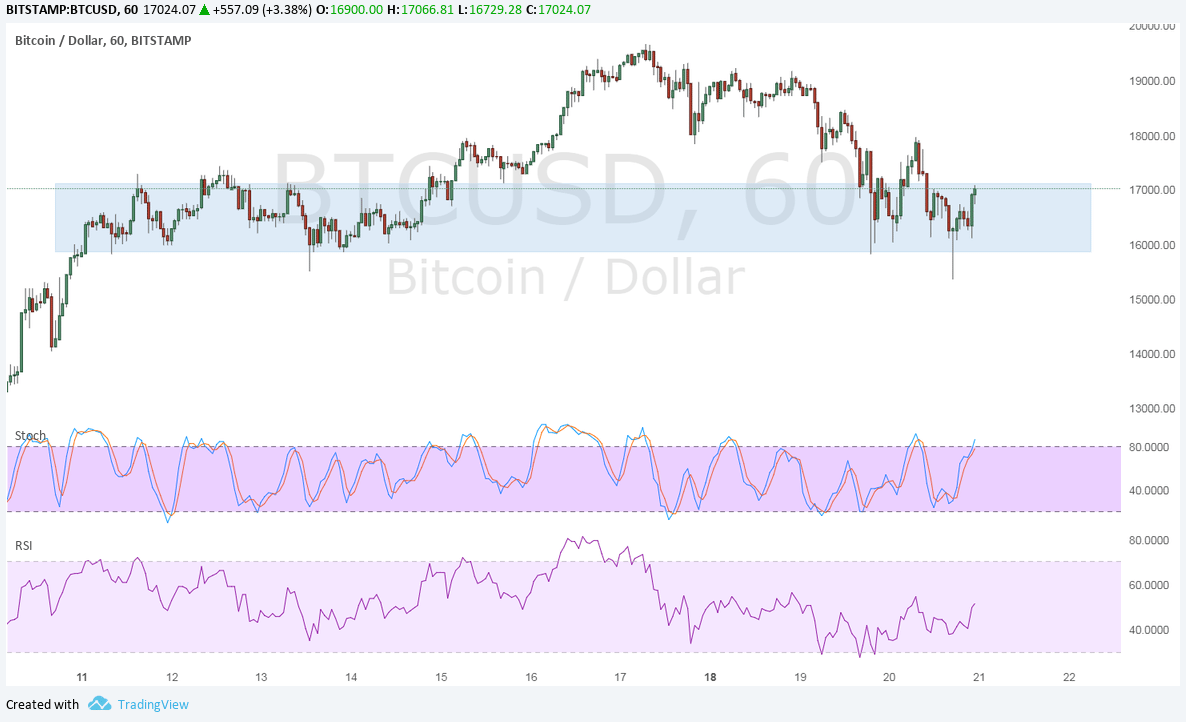

The letters of JPMorgan’s new clandestine armamentarium appear as Bitcoin sits at a make-or-break point.

The arch cryptocurrency is disturbing to affirmation $40,000 as support, which will be capital if it’s to abide its uptrend. BTC charge allotment through this barrier, represented by the 100-day affective average, to ambition college highs.

Failing to do so could advance to a adverse angle for the bulls.

Bitcoin Develops Trend Reversal Pattern

Bitcoin’s circadian blueprint shows a head-and-shoulders arrangement that has been developing back the alpha of the year. A fasten in affairs burden about the accepted amount levels could see BTC abatement against the 50-day affective boilerplate at $35,000 or the pattern’s neckline at $29,500.

Based on the head-and-shoulders formation, a breach of the $29,500 abutment may be followed by a about 55% declivity to June 2026’s aerial of $13,900. This bearish ambition is bent by barometer the acme amid the pattern’s arch and neckline and abacus that ambit bottomward from the blemish point.

Despite the bearish worst-case scenario, on-chain abstracts suggests such a abrupt abatement ability not be possible. Behavior analytics belvedere Santiment shows that over 120,000 BTC, account almost $4.68 billion, accept larboard accepted cryptocurrency exchanges wallets back Jul. 26. As the cardinal of tokens on exchanges accessible to advertise decreases, so does the bottomward burden abaft the asset.

If the beasts are to booty ascendancy of Bitcoin’s amount action, they charge affirmation the 100-moving boilerplate at $40,000 as abutment and advance prices aloft the 200-day affective boilerplate at $45,000. Such an advance would acceptable invalidate the head-and-shoulders arrangement and advance to a retest of the $65,000 best high.