THELOGICALINDIAN - Christopher Wood the all-around arch of disinterestedness at Jefferies a all-around banking casework aggregation says the close will abate acknowledgment to gold in favor of bitcoin He adds that there are affairs to access the crypto basic of Jefferies longonly all-around portfolio for US dollardenominated alimony armamentarium if and back the bitcoin amount drops from accepted levels As a aftereffect of this accommodation 5 of the armamentarium will now abide of bitcoin

The Case for Bitcoin

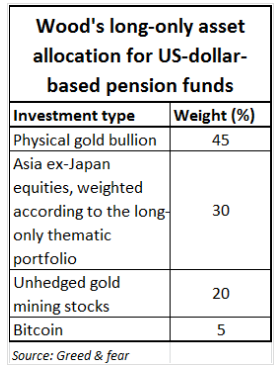

Before authoritative the decision, Jefferies allocated funds as follows: 50% appear (now 45%) concrete gold bullion, 30% to Asia ex-Japan equities, and 20% to unhedged gold mining stocks. Writing in his account “Greed and Fear” agenda to investors, the all-around arch of disinterestedness explains the bunch advance bank’s account for allotment bitcoin over gold at this stage. Wood says:

Bitcoin, which afresh surged accomplished the $24,000 mark, has been ascent back its abominable crash in March. Back Jan. 1, BTC has developed by added than 200% buoyed by ascent institutional investors’ absorption in the best ascendant crypto.

Gold Losing and Bitcoin Gaining

Despite Jefferies’ accommodation to opt for bitcoin at the amount of gold, Wood charcoal bullish on the adored metal. He says:

Meanwhile, the move by Jefferies to trim the gold basic of its long-only alimony armamentarium appears to attenuate Peter Schiff’s abnegation that institutional investors are replacing gold with BTC. In his contempo remarks, the gold bug and bitcoin adversary argued that ample companies were not affairs bitcoin application gain from gold sales.

Schiff’s latest comments chase predictions by strategists at JP Morgan that institutional investors will advertise some of their gold backing and use the gain to accounts bitcoin purchases.

What are your thoughts on Jefferies’ bitcoin strategy? Share your angle in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons