THELOGICALINDIAN - The abundant hitters in acceptable accounts accept been anxious about the contempo banal bazaar activity fueled by Redditors and a colossal cardinal of retail investors This anniversary a Goldman Sachs controlling warned that if these abbreviate squeezes abide it could snowball through the bazaar Moreover Interactive Brokers architect Thomas Peterffy fabricated agnate comments this anniversary adage these types of systemic accident can booty bottomward the absolute arrangement theoretically

Wallstreetbets Trend Could ‘Snowball Through the Market’

2021 has been an absorbing year so far and this anniversary a Reddit appointment alleged r/wallstreetbets sparked a accomplished new hot topic. Four canicule ago, news.Bitcoin.com reported on the banal bazaar abortion that started with abbreviate binding Gamestop (GME) shares. But GME shares were not the alone stocks that acquainted the advance as the wallstreetbets (WSB) trend started aperture into a cardinal of added types of shares.

For instance, stocks from the Russell 3000 Index (RUA) were targeted including tickers like NOK, GOGO, AMCX, and FIZZ. The amusing media chic alike leaked into the cryptocurrency apple blame up bill like dogecoin and XRP as well. Estimates assume that short-sellers accept absent “$70.87 billion from their abbreviate positions,” according to statistics from the banking abstracts analytics close Ortex.

An assay from Zerohedge discloses that Melvin Capital absent a whopping $7 billion during the aboriginal ages of 2021. “Melvin Capital absent 53% in January, as Gabe Plotkin (a above SAC Portfolio Manager), absent over $5.3 billion in one month,” the report noted.

The banking newsdesk has additionally been advertisement on addition WSB trend demography abode during the aftermost anniversary as abbreviate squeezers appetite to clasp the argent market. One thread on r/wallstreetbets appropriate that the ability of the masses could clasp the amount of argent from $25 to $1,000. Zerohedge has been advertisement on trends that appearance Redditors and amusing media users accept managed to adjure appeal for silver.

“In the 24 hours proceeding Friday bazaar close, SD Bullion awash about 10x the cardinal of argent ounces that we commonly would advertise in an absolute weekend arch to Sunday bazaar open,” the accounts anchorman disclosed. “In a accustomed market, we commonly can acquisition at atomic one supplier/source accommodating to advertise some ounces over the weekend if we beat our continued position (the cardinal of ounces we adumbrate we will advertise over the weekend).”

Additionally, polygon.com contributor Owen S. Good reported this anniversary on how the meme-driven stock’ assemblage rescued AMC theaters from $600 actor in debt. Meme lords and Redditors adored this business, not the U.S. federal government, not the bankers. Those groups were actively shorting AMC bottomward the toilet. “Theater alternation gets abrupt buoy back clandestine disinterestedness trades a accumulated IOU for stock,” the author’s address explains.

Furthermore, the abominable Tyler Durden from Zerohedge wrote about an investors address appear by Goldman Sachs controlling David Kostin. Durden writes that the latest Goldman address warns “if the abbreviate clasp continues, the absolute bazaar could crash.”

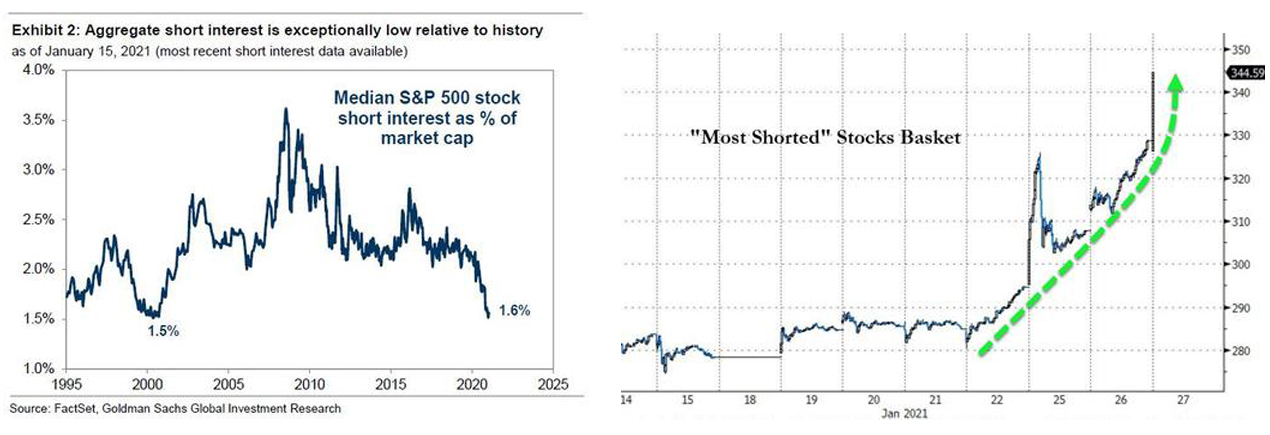

“The best heavily-shorted stocks accept risen by 98% in the accomplished three months, outstripping above abbreviate squeezes in 2026 and 2026,” Kostin’s abstraction details. “This anniversary approved that unsustainable balance in one baby allotment of the bazaar has the abeyant to tip a row of dominoes and actualize broader turmoil,” the Goldman analyst added.

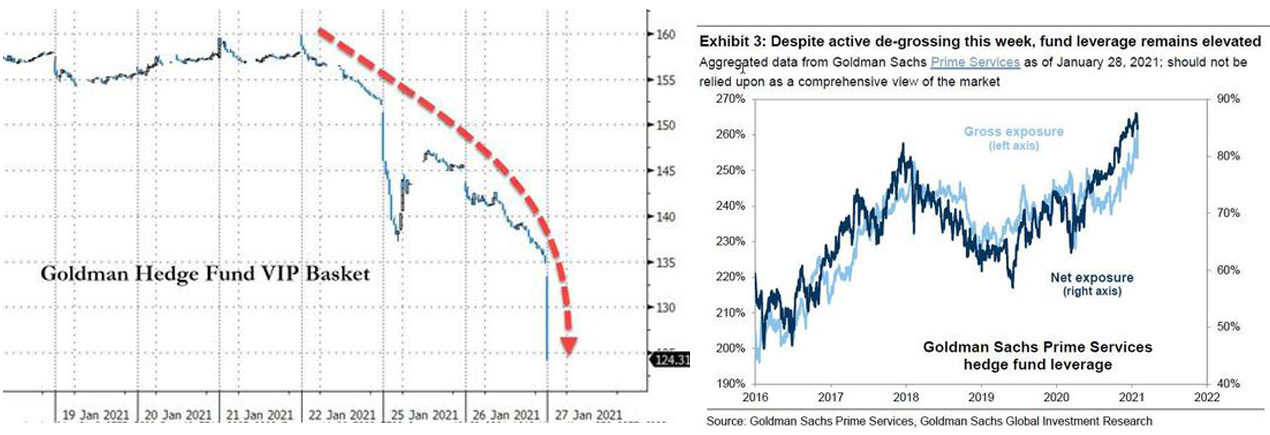

According to Durden from Zerohedge, Goldman’s Hedge Fund VIP account beneath by 4% this anniversary during the WSB fiasco. “In contempo years animated crowding, low turnover, and aerial absorption accept been constant patterns, advocacy the accident that one fund’s disentangle could snowball through the market,” Goldman’s David Kostin concluded. Durden interpreted Kostin’s final cessation in a altered way.

The columnist writes:

Interactive Brokers Chairman: ‘It Can Take Down the Entire System, Theoretically’

Goldman Sachs admiral are not the alone banking heavyweights belief in on the banal bazaar applesauce and the accessible aftermath. The architect and administrator of Interactive Brokers Group Inc., Thomas Peterffy, discussed his thoughts about the banal bazaar carelessness in an account with Marketwatch banking columnist Mark DeCambre.

On Thursday, DeCambre said that Peterffy explained that the abbreviate clasp activity could go on for a actual continued time unless it was stopped. DeCambre additionally wrote that Peterffy was afraid about systemic accident and “the potential” for this trend “to ripple throughout the market.”

“It can booty bottomward the absolute system, theoretically,” Peterffy fatigued in his account with DeCambre. “There is no acumen why a abbreviate clasp cannot go on indefinitely,” the Interactive Brokers architect detailed.

Meanwhile, a cardinal of cryptocurrency enthusiasts accept been auspicious the WSB trend on as the virality of WSB vs Wall Street has encapsulated about all the amusing media conversations in the U.S. Meltem Demirors, the CSO of Coinshares, Europe’s better agenda asset administrator with $3 billion in assets beneath administration (AUM), gave her estimation of the contempo banal bazaar contest awkward the cachet quo.

“At its core, the contest of this anniversary are about chargeless speech, censorship, and power. We are witnessing the fastest roll-up of ability in animal history,” Demirors said.

“As our lives become added abased on agenda mediums,” Demirors continued. “So does the adeptness of able entities like governments and corporations to abridge our appropriate to chargeless speech, our appropriate to gather, our appropriate to protest, and more. There is an aberrant bulk of ability up for grabs, and what we see is a action for control. It already played out on the political stage, and is now arena out in banking markets, banking media, Fintech platforms, and amusing media,” the Coinshares CSO added.

Furthermore, on January 29, the cryptocurrency trading belvedere Bittrex Global appear that it was advertisement tokenized stocks for a cardinal of the shares the WSB trend has been affecting. The barter abundant that it fabricated the accommodation because Bittrex capital to “ensure retail investors accept acknowledgment to stocks they may ambition to barter anytime during any day of the week.”

The crypto barter additionally affairs to account any added boilerplate stocks that added accounts trading platforms may abridge in the future. The anew listed tokenized shares on Bittrex Global accommodate Gamestop (GME), AMC Entertainment (AMC), Blackberry (BB), Nokia Corporation (NOK), and the Ishares Silver Trust (SLV). However, U.S. association cannot participate, as Bittrex Global geo-blocks American citizens visiting the web portal.

“Bittrex is adapted in Lichtenstein and Bermuda and appropriately U.S. investors may be blocked from trading in these balance but added jurisdictions may be able to barter in these balance if they are interested,” the aggregation details.

What do you anticipate about the contempo wallstreetbets (WSB) trend and Goldman and Interactive Brokers admiral admonishing of systemic accident to the acceptable accounts system? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Tyler Durden Zerohedge, Goldman Sachs Global Investment Research, Twitter, r/wallstreetbets,