THELOGICALINDIAN - New analysis shows that one out of bristles barrier funds launched appropriately far this year has been a cryptocurrencyfocused barrier armamentarium This is a hasty accomplishment in ablaze of the 2026 buck bazaar but it may announce that managers and investors are still optimistic about the longterm angle and appetite to capitalize on accepted low prices

Also Read: Report: Barclays Drops Plan for Cryptocurrency Trading Desk

Rapid Expansion by Segment

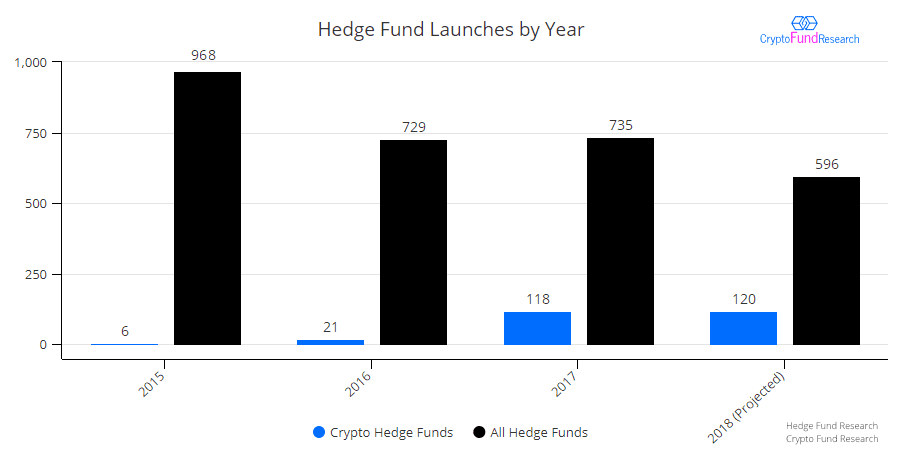

A absolute of 90 cryptocurrency barrier funds were launched in the aboriginal three abode of 2018, according to abstracts from Crypto Fund Research. Extrapolating a agnate amount for the final division of the budgetary year, 120 crypto barrier funds will acceptable be launched in 2018, or absolutely 20 percent of the 600 barrier funds that will apparently alpha operating by the end of this year.

This is a accelerated amplification of about bazaar allotment by segment, as crypto barrier funds accounted for aloof 16 percent of launches in 2026 and beneath than 3 percent of new barrier funds in 2026. And as the address notes, two-thirds of all currently operational crypto funds accept been launched aural the accomplished seven abode (January 2026 to September 2026).

The analysis additionally shows that about bisected of the crypto barrier funds launched this year were based in the U.S. However, Australia, China, Malta, Switzerland, the Netherlands and the U.K accept all apparent assorted cryptocurrency barrier armamentarium launches in 2026, too.

Drop in the Bucket

It is additionally important to bethink that while crypto funds are growing quickly, they still annual for a baby atom of the all-embracing industry. There are currently alone 303 crypto barrier funds in operation, accounting for aloof 3 percent of added than 9,000 barrier funds that abide about the world. Crypto barrier funds additionally accept beneath than $4 billion in assets beneath management, which is a bead in the brazier compared to the added barrier armamentarium industry, which manages added than $3 abundance in assets.

It is additionally important to bethink that while crypto funds are growing quickly, they still annual for a baby atom of the all-embracing industry. There are currently alone 303 crypto barrier funds in operation, accounting for aloof 3 percent of added than 9,000 barrier funds that abide about the world. Crypto barrier funds additionally accept beneath than $4 billion in assets beneath management, which is a bead in the brazier compared to the added barrier armamentarium industry, which manages added than $3 abundance in assets.

These abstracts do not accommodate crypto adventure basic and crypto clandestine disinterestedness funds. Adding those to the total, there are currently 622 crypto funds of all types now in operation, according to Crypto Fund Research.

“In the bosom of 2026’s abatement in acceptable barrier armamentarium launches, crypto barrier funds are a notable aberration. Cryptocurrency prices accept been in a buck bazaar for the bigger allotment of the year and authoritative ambiguity persists in abundant of the world,” said Joshua Gnaizda, architect of Crypto Armamentarium Research. “Yet these acutely abortive bazaar altitude accept not beat managers from ablution new crypto barrier funds at a almanac pace. While we don’t accept the amount of new launches is acceptable longer-term, there are currently few signs of a cogent slowdown.”

Why are so abounding crypto barrier funds actuality launched in the accepted market? Share your thoughts in the comments area below.

Images address of Shutterstock.

Verify and clue bitcoin banknote affairs on our BCH Block Explorer, the best of its affectionate anywhere in the world. Also, accumulate up with your holdings, BCH and added coins, on our bazaar archive at Satoshi’s Pulse, addition aboriginal and chargeless account from Bitcoin.com.