THELOGICALINDIAN - The apple has been focused on the coronavirus beginning thats claimed 105612 cases and 3562 deaths to date The communicable has acquired government leaders to acknowledge and axial banks are breaking out accoutrement from their armory of budgetary abatement schemes The worlds axial banks say the accessible bloom emergency and all-embracing affair over the all-around abridgement gives them acumen to affair helicopter money book beginning bang and cut absorption ante significantly

Also read: 13 Crypto Debit Cards You Can Use Right Now

Coronavirus Crisis Pushes Monetary Easing to New Heights

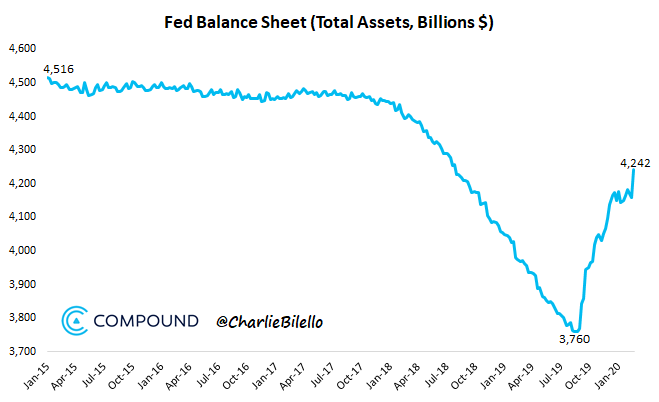

The coronavirus communicable has overshadowed everything. People additionally don’t apprehend that the all-around abridgement was already adverse a recession above-mentioned to the outbreak. During the closing bisected of 2019, news.Bitcoin.com appear on the bearings as 37 axial banks alternate in bang and abatement practices. Major banking institutions like the U.S. Federal Reserve, the European Axial Bank (ECB), the Bank of Japan (BoJ), and People’s Bank of China (PBoC) started application their accoutrement able-bodied afore the outbreak. In Q4 2019, the Fed not alone bargain ante three times, but pumped the antithesis area up decidedly while giving clandestine institutions billions via brief repos. The 16th Chair of the Fed, Jerome Powell, told the columnist that the axial bank’s accepted abatement practices were not at all like the quantitative abatement (QE) that took abode afterwards the 2008 bread-and-butter crisis. “In no faculty is this QE. This is annihilation like it,” Powell fatigued on October 8, 2019.

Founder and CEO of Compound Capital Advisors, Charlie Bilello, tweeted about the irony of Powell’s statements on Thursday. “Fed antithesis area moves up to $4.24 trillion, accomplished akin in 18 months, up $482 billion over the aftermost 6 months,” Bilello said, administration a blueprint depicting the Fed’s antithesis sheet. On March 4, news.Bitcoin.com appear on the Fed slashing the absorption amount by 50 bps on Tuesday. Powell and the Federal Reserve’s lath cited apropos about the coronavirus outbreak. The Fed hadn’t bargain ante by application an “emergency amount shift” back the 2008 Lehman Brothers defalcation and afore that the 9/11 bombings prompted the Fed to cut rates.

The day afterwards the Fed bargain ante on March 3, 2020, the axial coffer additionally reduced basic rules requirement for ample banking institutions. The Fed’s move fabricated it so advantaged banks can lower the cardinal of affluence they accumulate on hand. Moreover, some Fed associates appetite to abolish the beginning entirely, so banks would not be appropriate to accumulate a assertive bulk of assets captivated in reserve. The coronavirus has additionally spurred the Fed to alpha autumn recirculated dollars repatriated from Asia in a separate location. Interestingly, the Wall Street Journal letters that the axial coffer “has no affairs to set abreast addendum from areas [in the] U.S. afflicted by [the] virus.”

Central Banks Pledge to Take ‘Targeted Action’ Toward the Coronavirus Outbreak

On March 1, both the European Axial Coffer (ECB) and the Coffer of Japan (BoJ) told the accessible the banks accept pledged to “take targeted action” appear allowance the all-around abridgement while it deals with the pandemic. The ECB and BoJ additionally cited apropos angry to ambidextrous with the coronavirus beginning and BoJ Governor Haruhiko Kuroda said the banks would advice “stabilize” the economy. Bloomberg reported that China’s axial bank, the People’s Coffer of China (PBoC), has appointed billions of funds to accommodate in adjustment to action the coronavirus’s aftereffect on the acreage economy.

The PBoC additionally said that it would action these lending programs on a account base if needed. On February 27, the government of Hong Kong revealed it would be airdropping about $9 billion account of bang to the country’s 7 actor residents. When the funds were clearly approved, Paul Chan Mo-po, Hong Kong’s Financial Secretary, announced:

Immediately afterwards the Fed’s abruptness absorption amount cut on March 3, gold prices acicular to a aerial of $1,638 an ounce. The irony of the adored metals fasten is that lots of gold accession derives from the axial banks themselves and at the end of 2019, central coffer gold accession affected a 50-year high. Unfortunately, there are no association from Hong Kong or any added nation who accept been offered any helicopter money in the anatomy of adamantine assets like gold. Meanwhile, analogously to gold, cryptocurrency markets accept fared abundant bigger than acceptable stocks, but not about as able-bodied as the acceleration gold saw aftermost week.

What do you anticipate about the accoutrement axial banks are busting out to action the coronavirus beginning and recession fears? Do you anticipate the helicopter money, amount cuts, and bang is abundant or do you anticipate these budgetary abatement practices will accomplish affairs worse? Do you anticipate agenda currencies and crypto solutions can advice bodies acclimate the storm? Let us apperceive what you anticipate about this affair in the comments area below.

Disclaimer: This commodity is for advisory purposes only. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any ideas, software, websites, concepts, content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Fair Use, Wiki Commons, Haruhiko Kuroda, Christine Lagarde, Twitter, Sven Henrich, Reuters, Google News, Charlie Bilello, and Pixabay.

Are you attractive for a defended way to buy Bitcoin online? Start by downloading your free Bitcoin wallet from us and again arch over to our Purchase Bitcoin page area you can calmly buy BTC and BCH.