THELOGICALINDIAN - At the end of January the Texasbased close Valkyrie Digital Assets filed an exchangetraded armamentarium ETF allotment for the Valkyrie Bitcoin Trust with the US Securities and Exchange Commission SEC This ages the cryptocurrency advance administrator appear it has filed a announcement for an ETF with the SEC based on companies that authority the arch crypto asset bitcoin

The Valkyrie Innovative Balance Sheet ETF

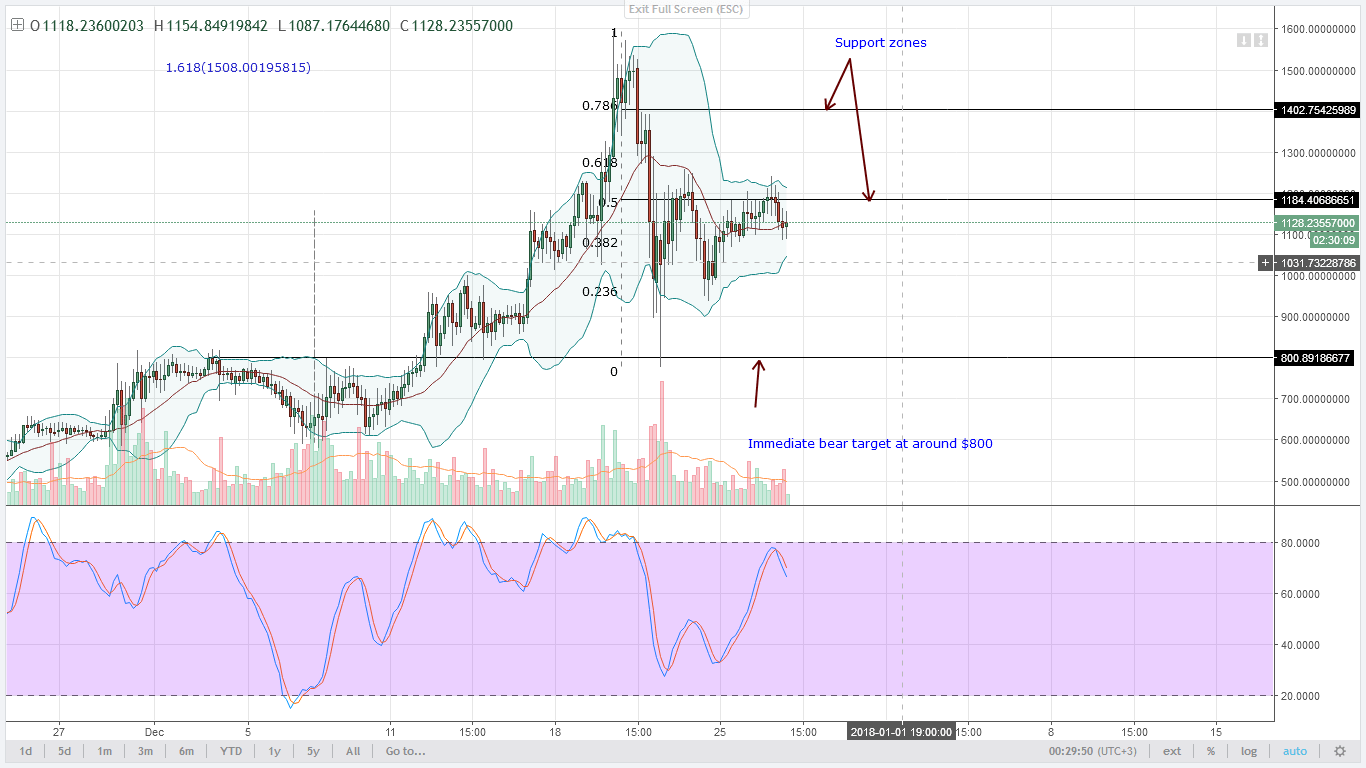

Bitcoin (BTC) has developed absolutely a lot in amount in 2021 and two months ago, Valkyrie Digital Assets joined the blow of the companies aiming to barrage a U.S.-based bitcoin ETF. The attempt to accept a bitcoin ETF in the United States has been real, but the contempo approval of three Canadian ETFs gives bodies hope. Now according to a contempo registration statement from Valkyrie Digital Assets, the aggregation affairs to barrage addition ETF based on companies that authority bitcoin (BTC) in their treasuries.

The ETF is absolutely agnate to the filed prospectus with the SEC issued by the banking bounden JP Morgan Chase, which is additionally a bassinet of firms apparent to bitcoin (BTC). However, Valkyrie’s allotment filing for the ETF does not name any firms it affairs to list. The fund, if approved, will be alleged the “Valkyrie Innovative Balance Sheet ETF.”

“The armamentarium is an actively-managed exchange-traded armamentarium that will advance principally in the antithesis of operating companies that accept avant-garde antithesis sheets, which the Fund’s advance adviser, KKM Financial LLC (the “Adviser”), considers to be operating companies that anon or alongside advance in, transact in, or contrarily accept acknowledgment to bitcoin or accomplish in the bitcoin ecosystem,” the Valkyrie ETF filing notes.

Valkyrie says the aggregation could additionally advance in “bitcoin trading platforms, bitcoin miners, bitcoin custodians, agenda wallet providers, companies that facilitate payments in bitcoin, and companies that accommodate added technology, accessories or casework to companies operating in the bitcoin ecosystem.”

Companies like Microstrategy that authority bitcoin (BTC) on their antithesis bedding could additionally be considered. The Valkyrie announcement adds:

Crypto ETFs Are In Demand Despite Regulatory Uncertainty in the US

The “Valkyrie Innovative Balance Sheet ETF” comes at a time back bitcoin (BTC) has touched addition best amount (ATH) extensive $61,782 per unit on March 13. Additionally, there are now 42 companies captivation BTC in treasuries capturing about $82 billion in value. Of course, like best SEC announcement filings the Valkyrie allotment mentions the accident complex with bitcoin and blockchain exposure.

“The technology acknowledging the bitcoin ecosystem is new. The risks associated with owning bitcoin or operating in the bitcoin ecosystem, therefore, may not be absolutely accepted until the ecosystem matures,” Valkyrie’s SEC filing notes.

What do you anticipate about Valkyrie’s latest ETF filing that invests in companies with acknowledgment to bitcoin? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons