THELOGICALINDIAN - The change of crypto lending is continuing at clip with new projects consistently advancing onstream These platforms best of which abide in the decentralized accounts DeFi branch action users the adeptness to access loans after accepting to argue with intermediaries and acquire counterparty accident In concert with asset arising payments babyminding and allowance crypto lending is allowance to assemble a new and fairer blockchainbased banking system

Crypto Lending Ecosystem Expands

The crypto lending mural currently comprises institutional lenders, barter platforms, and Defi lending protocols, with loans broadly falling into the class of undercollateralized, collateralized (or overcollateralized), and flash. Borrowing adjoin one’s crypto backing has never been easier, and the adversity of accepting a coffer accommodation – not to acknowledgment the about unappealing agreement – alone serves to accentuate the amount that acute contract-secured lending protocols represent.

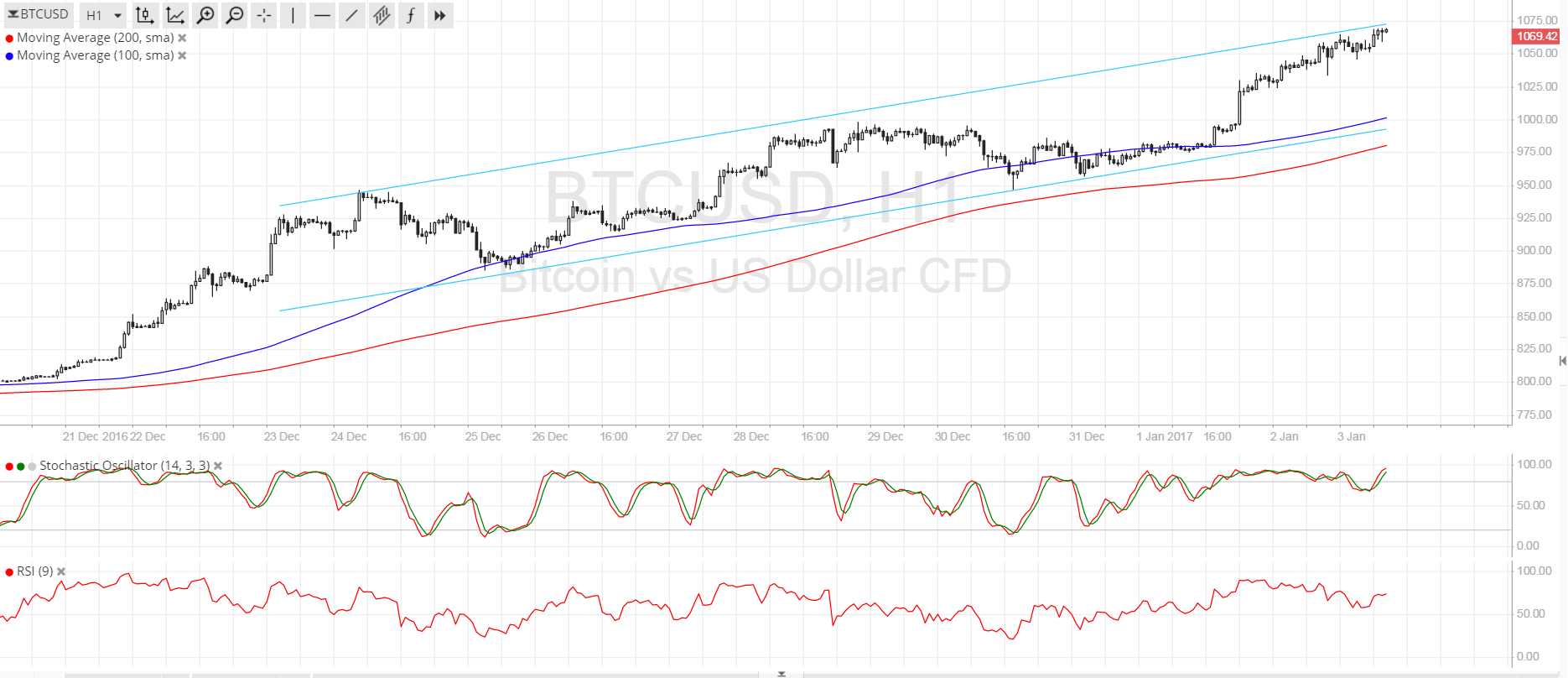

Evidence of the backbone of crypto lending is all about us. Backward aftermost year, DeFi activity Aave aloft $25 actor from above adventure basic firms blockchain.com and Blockchain Capital, and its built-in AAVE badge has back become one of DeFi’s delinquent successes, blame the protocol’s Total Value Locked (TVL) accomplished $5 billion. Collateralized lending belvedere Maker, meanwhile, has issued about $2 billion account of USD-pegged DAI stablecoin loans back ablution during Bitcoin’s backward 2017 balderdash run.

The adeptness for users to access crop through lending crypto assets, or access loans in their adopted crypto after accepting to accumulation acclaim history and activity through an invasive appliance process, is assuredly allowance to drive the acceptance of basic currencies. Crypto lending protocols anon bout borrowers with lenders, with adjustable claim durations, favorable absorption rates, and altered assets accustomed as collateral. Moreover, borrowers generally get to accept whether they adopt fiat, crypto, or stablecoins.

And it’s not aloof individuals who are demography advantage of lending platforms: SMEs and enterprises can access loans (often to accounts crypto projects) while firms with apparent crypto backing can accomplish acquirement by locking up their abundance for a set aeon of time. Even unicorns can angular on loans: Bitfinex, the fifth-largest agenda asset barter by barter volume, acquired $750 actor account of loans from stablecoin belvedere Tether, creators of the accepted dollar-pegged USDT. Individual borrowers, meanwhile, can use their accommodation to buy a property, pay for a holiday, or alter their advance portfolio.

How Crypto Loans Differ

As mentioned, there are several types of crypto loans: undercollateralized, collateralized, overcollateralized, and flash. It pays to accept the differences.

Undercollateralized crypto loans, such as those offered by the popular Lendefi protocol, accord users admission to agenda assets after the charge for them to absolutely awning the principle. The borrower is able to advance a college bulk than the disinterestedness they accept deposited into the acute contract, accouterment a anatomy of leverage. This is best accepted in the ambience of mortgage loans.

When users booty out a mortgage, they charge alone put up a tiny atom of the property’s amount as a drop while accepting costs for the remainder. Similarly, with undercollateralized loans via Lendefi and others, users access abundant crypto loans with a bashful advance outlay.

Collateralized loans, on the added hand, arise from audience staking an asset adjoin the funds they are accepting in return. When the accommodation is paid off in full, the applicant receives their staked cryptocurrency back, forth with an access in amount it has enjoyed during the staking period. Collateralized loans can be backed not alone by business assets but additionally absolute estate, cars, acreage – annihilation of actual value. BlockFi is one of several platforms alms USD loans backed by users’ agenda assets.

As for beam loans offered by the brand of Aave, they are rapidly executed, collateral-free loans that charge be paid aback bound – usually aural one Ethereum block. These specialized loans are deployed by crypto traders to abate arbitrage discrepancies in crypto prices beyond altered decentralized exchanges (DEXs). Beam loans can additionally be acclimated for self-liquidations, wherein traders abstain triggering taxable events. Last year, Aave lent out over $2 billion account of beam loans, with the better admired at a air-conditioned $200 million.

Although beam loans can advice to bind spreads and abate inefficiencies, a aggregate of bad cipher and capricious amount feeds has led to several attacks on providers in contempo times, with regulators additionally aural anxious about the risks involved.

With over $73 billion in new accommodation generation forecasted to apparent by abutting year, the crypto lending amplitude is in abrupt health. And banks anticipation they alone had Bitcoin to anguish about.

Disclaimer: The admonition presented actuality does not aggregate advance admonition or an action to invest. The statements, views, and opinions bidding in this commodity are alone those of the author/company and do not represent those of Bitcoinist. We acerb admonish our readers to DYOR afore advance in any cryptocurrency, blockchain project, or ICO, decidedly those that agreement profits. Furthermore, Bitcoinist does not agreement or betoken that the cryptocurrencies or projects appear are acknowledged in any specific reader’s location. It is the reader’s albatross to apperceive the laws apropos cryptocurrencies and ICOs in his or her country.