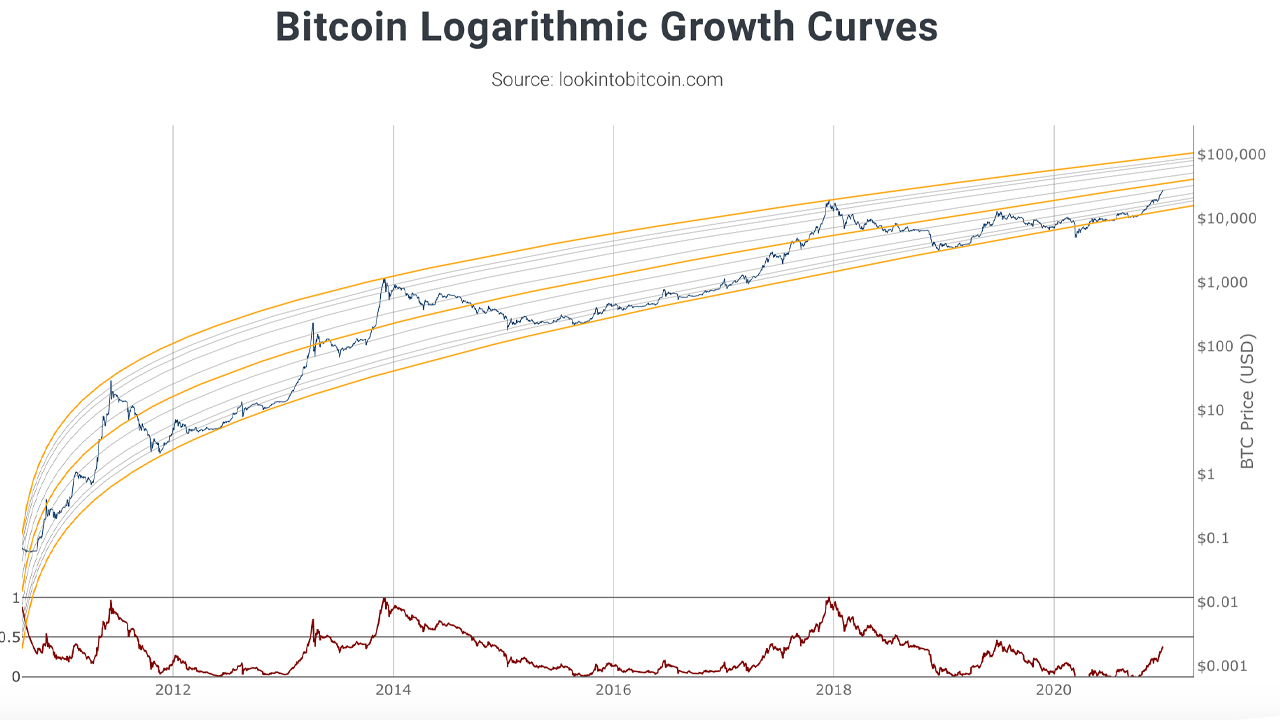

THELOGICALINDIAN - The amount of bitcoin affected an alltime aerial at 312 am EST during the aboriginal morning trading sessions extensive 28600 The crypto assets bazaar appraisal is over 519 billion on Wednesday as bitcoin markets command over 14 billion dollars in all-around barter volume

Bitcoin (BTC) markets soared afresh on Wednesday morning, as the amount per assemblage jumped to an best aerial (ATH) of about $28,600. BTC’s ascendancy index, in allegory to the 7,500 crypto asset valuations in existence, is over 70% or $519 billion out of crypto economy’s $741 billion.

Statistics appearance that BTC has acquired over 20% during the aftermost seven days, 41% over the advance of the month, 162% in the aftermost three months, and a whopping 288% for the year adjoin the U.S. dollar.

Bitcoin has apparent $19.28 billion in transaction aggregate during the aftermost 24 hours. Moreover, BTC miners accept captured $2.85 actor in 24-hour fee revenue. On Wednesday there are 1,146,131 alive bitcoin (BTC) addresses.

A contempo address appear by the agenda bill barter Luno capacity that bitcoin (BTC) “crushed banal markets this year.”

“The big champ of 2020 is bitcoin, seeing a massive access of 269%. This is compared to aloof 45% for Nasdaq,” the Luno report notes.

“In 2026, bitcoin assuredly got the absorption of institutional investors,” Luno’s anniversary 52 amend explains. “The ample banking markets accept been airy amidst the Covid-pandemic, but the axial banks accept intervened blame budgetary bang and governments accept launched ample budgetary bang packages. The accomplishments of the action has been a aciculate access in M2 ( 25%) and looming fears of inflation. This in about-face brought institutional absorption to Bitcoin, due to its abundance of amount properties.”

The web aperture bitcointreasuries.org shows there are now 29 companies with over 1.1 actor BTC or 5.48% of the supply. Using today’s barter ante the bitcoin treasuries account is admired at over $32 billion on December 30.

While bitcoin prices affected new highs, the articulate gold bug and economist, Peter Schiff, said that he believes bitcoiners should be afraid about the U.S. government. “Bitcoin promoters accept that Bitcoin is an absolute blackmail to axial banks and the authorization budgetary system,” Schiff tweeted on Wednesday. “Yet admitting this belief, they additionally accept that the U.S. government, which has the best to lose if bitcoin succeeds, will booty no activity to assure itself from this threat.”

Shapeshift architect Erik Voorhees disagreed with Schiff’s account and said: “Literally no bitcoiner believes the accompaniment will booty no activity adjoin bitcoin. The absolute arrangement is advised with the acceptance of absolute adversity,” Voorhees added.

What do you anticipate about bitcoin extensive $28,600 on all-around exchanges? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, lookintobitcoin.com/charts, Bitcoin Wisdom,