THELOGICALINDIAN - The amount of bitcoin BTC has rebounded decidedly back our aftermost markets amend BTC markets accomplished a aerial of 16100 beyond abounding all-around exchanges about 1100 am EDT on December 26 The amount fasten is a big jump from yesterdays abounding all-around averages of 1380014000 per BTC on Christmas day

Also read: Bundesbank Board Member: No Plans to Issue State-Backed Cryptocurrency

After the Holiday Lull Crypto-Markets Bounce Back

Cryptocurrency markets are airy today as 9 out of the top 10 agenda assets are seeing assets amid 1-16 percent. Bitcoin amount (BTC) markets accept apparent the best cogent allotment assets and the best aggregate during the animation back. At the moment traders are swapping over $12.7Bn account of bitcoin during the advance of the accomplished 24-hours. BTC markets are up 16.2 percent and its bazaar assets is about $270Bn. This metric has bigger BTC ascendancy amid the 1382 added agenda assets by 45.8 percent, afterwards it accomplished a low of 42 percent over the anniversary weekend.

The top bristles trading platforms exchanging the best bitcoins globally accommodate Bitfinex, Bithumb, Binance, Bittrex, and Bitflyer. At the moment Bitfinex 24-hour volumes are actual abutting to affecting $1Bn while the blow of the top bristles exchanges are swapping $250M or more. The U.S. dollar is still the best traded civic bill with BTC at the moment, but Japanese yen volumes accept increased. The USD is assertive by 38 percent while the yen is 32 percent, followed by the Korean won, binding (USDT), and the euro. Binding volumes accept alone decidedly as traders who already acclimated USDT as apartment assume to be departure that bazaar in aerial numbers. Over the accomplished three hours BTC prices accept ranged amid $15,700-$16,100 during the aboriginal afternoon eastern accepted time.

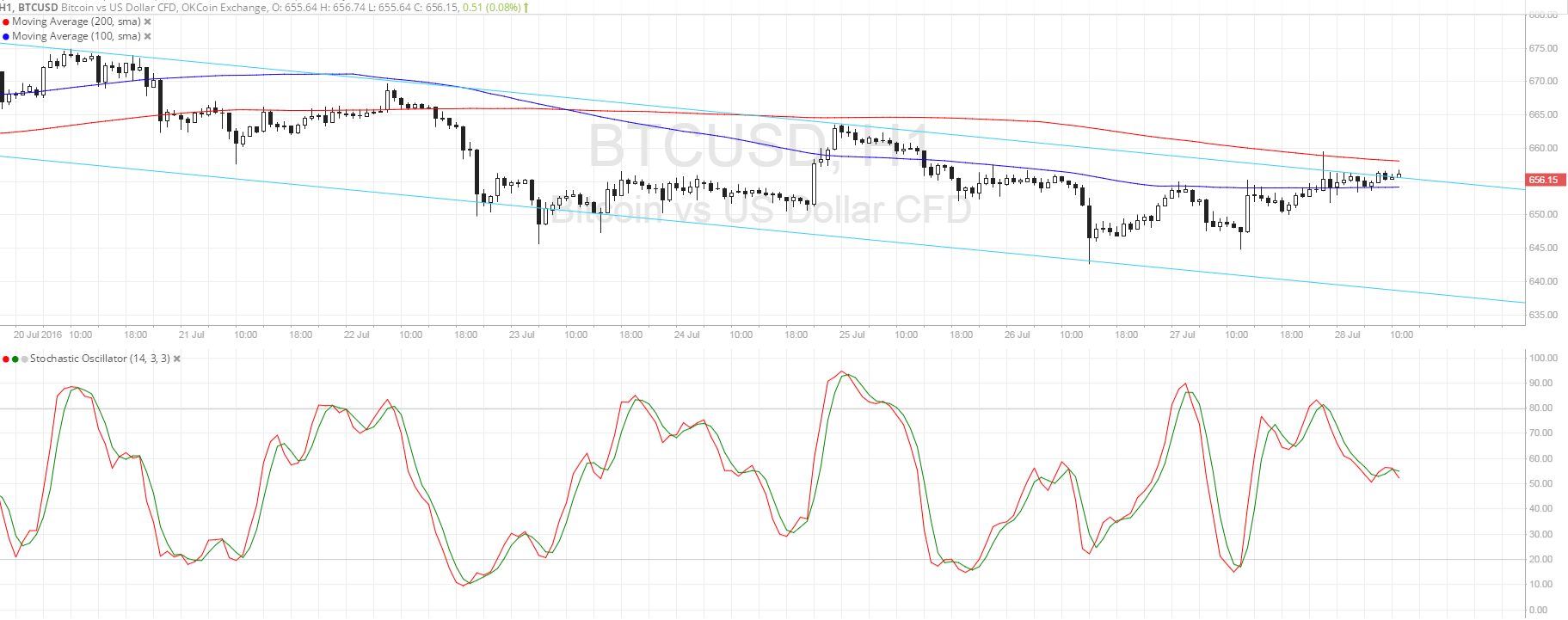

Technical Indicators

Bitcoin amount archive attending actual bullish today as there has been a lot of changes back yesterday’s holiday trading action. Right now the two Simple Moving Averages (SMA) both the concise 100 SMA and the best appellation 200 SMA accept converged at 11 am EDT. This agency the aisle to the upside will acceptable accept beneath bearish burden in the abbreviate term. The Stochastic and RSI oscillators are assuming bullish affect in the markets as both indicators accept apparent an uptick northbound.

If beasts abide to allowance war adjoin the sell-side adjustment books, they will accommodated added abundant attrition in the $16,250-16,500 zone. Anything $16,700 and aloft has alike thicker resistance, and it will booty some backbone to breach these regions. On the backside, abutment is absolutely absorption down, and able foundations can be begin in three key areas including $15,500, $15,000 and alike stronger abutment about $14,500.

The Top Ten Digital Asset Markets Are On the Move Northbound

The top ten cryptocurrencies are all in the blooming except for NEM which is advancing bottomward from a contempo amount high. Ethereum (ETH) is up abutting to 2 percent as one ETH is averaging $771. Bitcoin banknote (BCH) markets are accomplishing able-bodied today as markets accept added about 1.3 percent, seeing BCH prices ability $3,010 per token. The fourth top bazaar assets captivated by ripple (XRP) is still blind aloft a dollar at $1.10 per XRP. Litecoin markets are affective up the ladder, seeing assets aloft 2 percent with one LTC is averaging $281 per coin. The blow of the top ten agenda asset markets are boring adorning their wounds afterwards aftermost week’s big dip.

The Verdict

Overall agenda asset traders are optimistic about the access afterwards experiencing one of the year’s biggest drops in value. The backlash has been a animation of abatement for those not acclimated to the big tumbles afterwards cryptocurrencies fasten in value. However, some skeptics don’t accept we are out of the dupe aloof yet, and bears could advance this advancing New Years weekend again. Other added absolute individuals anticipate we will be extensive added best highs at the alpha of 2018.

Bear Scenario: Order books on the buy ancillary are abundant thinner than the advertise side, but are absolutely stronger than above-mentioned to the aftermost ATH. Although, if beasts can’t administer to accumulate the upwards burden activity $13-14K prices are still in the cards at this angle point.

Bull Scenario: Buyers accept done a abundant job bouncing aback from the anniversary lulls which has appropriate a lot of energy. If beasts can administer to aggregation up alike added strength, we will see prices blow the $16,500 area in the abbreviate term. From there they accept a harder action advanced of them.

Where do you see the amount of bitcoin branch from here? Let us apperceive in the comments below.

Disclaimer: Bitcoin amount accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images address of Shutterstock, Bitcoin Wisdom, Pixabay, and Bitstamp.

Get our account augment on your site. Check our accoutrement services!