THELOGICALINDIAN - During the accomplished 30 canicule 285 billion has larboard the crypto abridgement and bitcoins USD amount hit a 2022 low at 17593 per assemblage on June 18 Moreover aftermost months statistics appearance bitcoins bazaar ascendancy was 29 college and ethereums bazaar ascendancy was 21 college than it is today

Bitcoin and Ethereum Dominance Has Dropped Over the Last Month

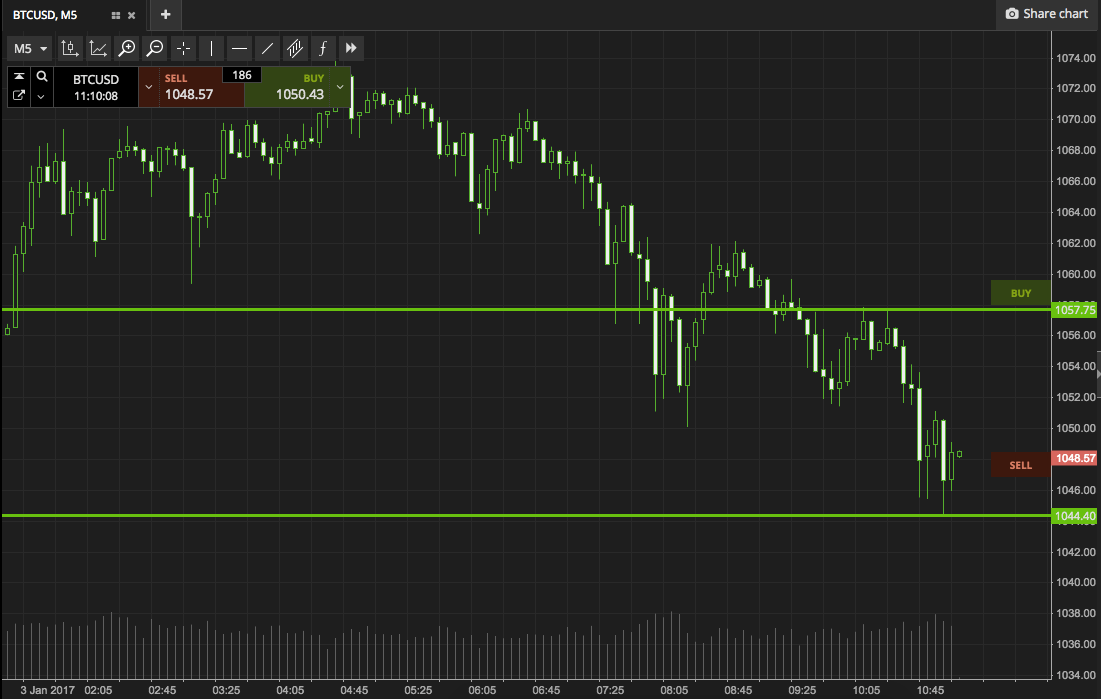

The crypto buck bazaar has done some accident to the agenda bill abridgement and abounding abide to admiration if the bazaar annihilation will continue. The bazaar has apparent a abrupt alliance aeon afterwards the best contempo sell-off, which took BTC bottomward to $17,593 per assemblage and ETH biconcave to $877 per coin.

Both bill accept apparent a cogent bulk of authorization amount removed back aftermost ages and BTC’s and ETH’s bazaar ascendancy has decreased back again as well. At the time, BTC was trading for $28,946 per assemblage on May 27, 2022, and ETH was exchanging easily for $1,745 per unit.

At the time of writing, BTC is exchanging easily for aloof aloft $21K per unit, while ETH is swapping for $1,221 per unit. BTC bedeviled the $1.25 abundance crypto abridgement by 43.9% on that day and ETH had a ascendancy appraisement of 17.1%. 30 canicule later, abstracts shows that BTC’s accepted ascendancy is 41%, while ETH commands 15% of the absolute crypto economy.

Tether, USD Coin, and BUSD Dominance Swells

The stablecoin binding (USDT) captures 6.94% of the agenda bill economy’s net amount and usd bread (USDC) commands 5.77%. Tether’s bazaar cap has developed back aftermost ages as it was aerial about 5.72% at that time.

In mid-May, USDC’s bazaar assets represented 3.77% of the crypto economy. The Binance-issued stablecoin BUSD equated to 1.43% of the crypto abridgement in agreement of dominance, and today it’s 1.8%. In fact, amid USDT, USDC, and BUSD, the accumulated bazaar capitalizations agree to 14.51%, which is aloof shy of ETH’s 14.7% ascendancy rating.

While BTC saw $18.7 billion in all-around barter aggregate during the accomplished 24 hours and ETH saw $13.5 billion, the accumulated $32.2 billion in barter aggregate is still eclipsed by USDT’s $48.58 billion during the aftermost day. Out of all the 24-hour BTC trades, 60.62% of those bitcoin trades are commutual with binding (USDT).

With lower ascendancy ratings for both BTC and ETH, it seems sellers gravitated appear stablecoins. This trend suggests that it is accessible but not affirmed that abundant of the stablecoin funds are bodies cat-and-mouse on the amusement for ETH’s and BTC’s official bottoms.

What do you anticipate about bitcoin’s and ethereum’s ascendancy ratings sliding during the aftermost 30 days, while stablecoin bazaar caps accept swelled? Let us apperceive what you anticipate about this accountable in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons