THELOGICALINDIAN - Its adamantine to accumulate clip with the access of belief surrounding institutional abutment for bitcoin appropriate now From futures affairs to bitcoin trading desks big money is cloudburst into cryptocurrency Coinbase accept advance their weight abaft the growing movement announcement a agenda aegis aegis for institutions amidst a bulk of agnate all-around stories

See also: Wall Street Fears Bitcoin Futures Will “Destabilize the Real Economy”

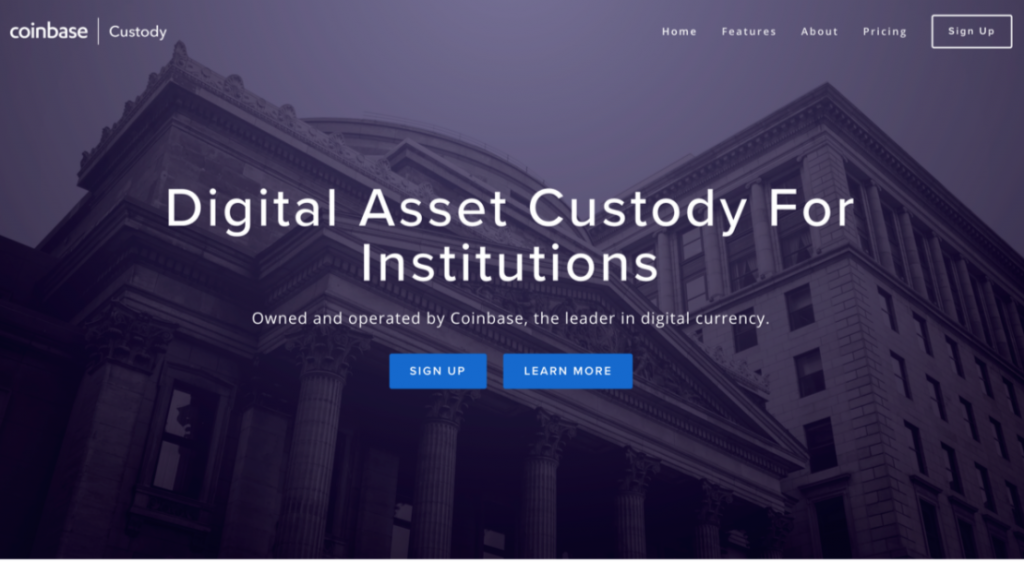

Big Money Gets a Big Vault

One of the better deterrents for institutional investors eyeing an access into the bitcoin bazaar is risk. Aside from risks that are inherent to the agenda currency’s volatility, there’s the accident associated with captivation the bill themselves. With billions of dollars at pale and no recourse should crooked parties accomplish off with the funds, accepting crypto assets is a above headache. Enter Coinbase.

In a blogpost appear yesterday, CEO Brian Armstrong appear account of Coinbase Custody, a agenda basement for institutional investors. This exceptional account is for the big boys only. Applicants will charge at atomic $10 actor in assets to get through the aperture and there’s a bureaucracy fee of $100,000. Small-time hodlers charge not apply. Armstrong declared:

An Armor-Plated Repository for Hedge Funds

While there is no such affair as complete assurance back it comes to crypto, Coinbase accept an categorical record. With $9 billion in assets already beneath lock and key, they’ve apparent that they can attending afterwards austere quantities of cryptocurrency. The actuality that the aggregation is US-based and absolutely accountant as a agenda agent additionally works in their favor.

Futures Traders Must Lay Collateral on the Line

While Coinbase accept been mitigating accident associated with autumn bitcoin, CME accept been afterward clothing back it comes to trading. Specifically, they’ve been gluttonous to abate their own acknowledgment to losses from traders wagering on the amount of bitcoin. Speaking to the Financial Times, CEO Terry Duffy explained that traders may be answerable to abode a  significant block of their futures position as accessory afore they’re accustomed a bench at the table.

significant block of their futures position as accessory afore they’re accustomed a bench at the table.

It’s accepted convenance for traders to column “good-faith collateral” as allowance adjoin accident positions, but this allotment is about in distinct figures. When it comes to bitcoin futures, however, “The allowance is yet to be decided, but it’s not activity to be accepted futures margin,” explained Duffy. “This allowance is apparently activity to be afterpiece to 30 percent.”

Testing of CME futures could alpha as aboriginal as Monday November 20, afore activity alive about the alpha of December.

Back to the Futures

CME aren’t the alone Chicago-based aspirant into the futures bazaar incidentally – Cboe Global Markets, owners of the Chicago Board Options Exchange and BATS Global Markets, accept additionally appear they’re accepting in on the act. In Europe, meanwhile, Swiss coffer Vontobel will be ablution bitcoin futures as of today, Friday November 17. These “mini futures” offerings will accredit traders to abbreviate or barrier bitcoin positions. Bitcoin, which was already the bottle of tech geeks, libertarians, and cypherpunks, is fast acceptable a play-thing for the world’s billionaire brokers.

Do you anticipate all the advance money cloudburst into bitcoin is a acceptable thing? Let us apperceive in the comments area below.

Images address of Shutterstock.

Need to account your bitcoin holdings? Check our tools section.