THELOGICALINDIAN - If you assignment in cryptocurrency and are a affiliate of Linkedin youre apparently accustomed with OTC bitcoin brokers Theyll bulletin you out of the dejected allurement if you apperceive any clandestine sellers and will action to set up a accord for your alternate account The majority of these men for they are consistently men are 18-carat in their intentions This does not beard the actuality admitting that BTC brokers are little added than sharks ambit the aforementioned prey

Also read: Research Paper Finds Transaction Patterns Can Degrade Zcash Privacy

Brokers Outnumber Buyers and Sellers 100:1

Anyone can become a bitcoin broker: change your Linkedin appellation to “OTC Bitcoin Broker” and you’ve done it. Brokerage is a job that, like best cryptocurrency roles, alfresco of development, requires no academic qualifications. Just as anyone can alarm themselves an ICO advisor, anyone can accept the crimson of bitcoin broker, appointment them to alpha spamming Linkedin users for buyers and awful coveted sellers.

To accept the viral advance of brokers, it’s all-important to accept the altitude that led to ample OTC sellers advancing about. Back in the day, it was accessible to access a lot of bitcoin for actual little money. A lot of bodies mined it; some fabricated it from trading shitcoins; and a few artlessly bought a agglomeration of BTC and again had the attendance of apperception to hodl, through blubbery and thin, for years.

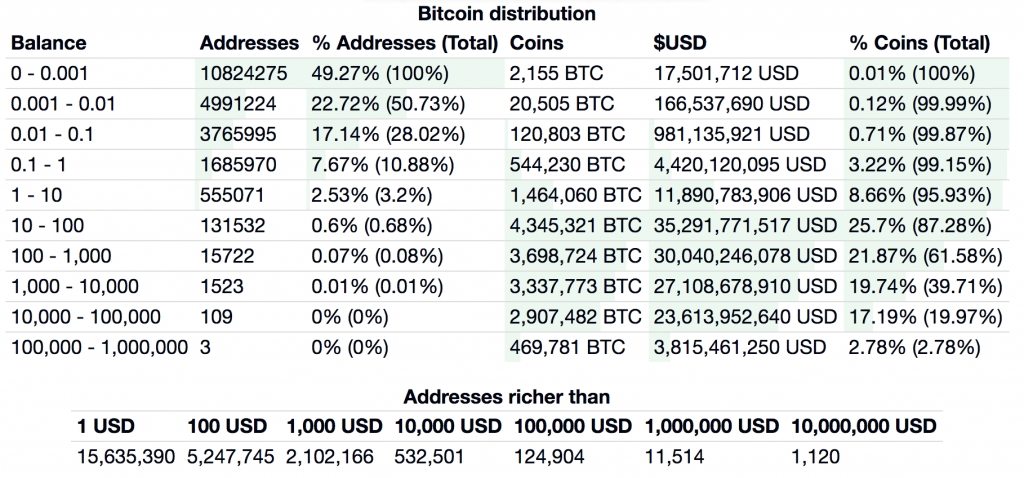

Most brokers will booty on annihilation from 500 BTC upwards as an OTC deal, generally operating on account of ancestors funds gluttonous to access bitcoin in bulk. But what brokers are absolutely block is the big one – deals of 10,000 BTC or more, in which a allowance agency of 3% is account millions of dollars. The number of bitcoin addresses absolute amid 10k and 100k BTC sits at little added than 100, however, and while some sellers accept their bill broadcast beyond assorted wallets, bona fide whales attractive to advertise are rare. Because the rewards for award one are so great, a army of brokers, anniversary block “the big one”, has proliferated.

How an OTC Deal Works

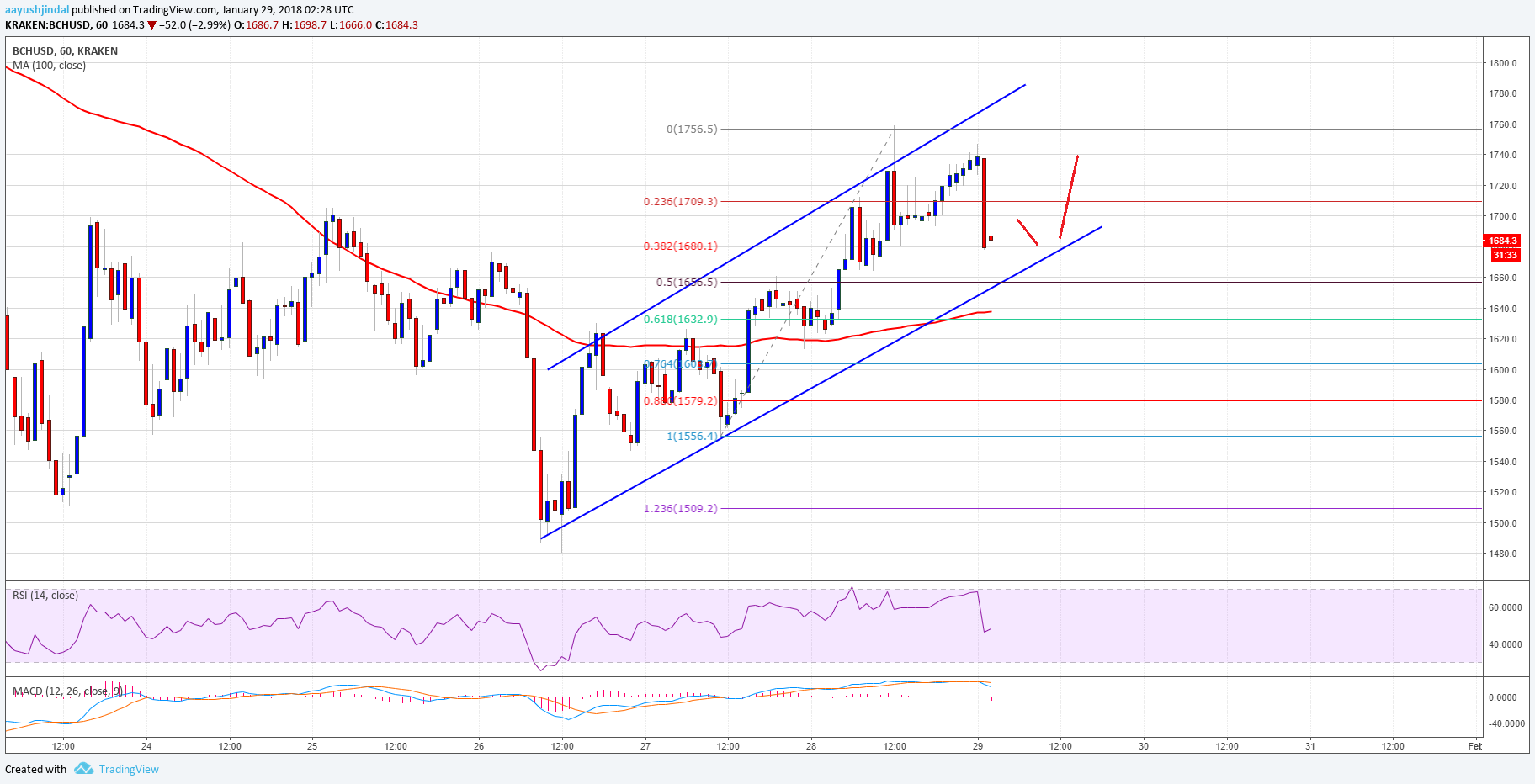

Sellers appetite to advertise OTC to abstain the array of slippage that occurs back auction ample amounts of BTC on an exchange. Whales additionally amount their privacy, and while they are still appropriate to abide KYC to complete an OTC deal, their character is alone activity to be aggregate with the broker, their attorney, and the escrow service. Normally, alike the client won’t apperceive the character of the being they are affairs the bill from. The agent provides “proof of satoshi” by affective a atom of a bitcoin from the wallet they control, the client provides affidavit of funds in the anatomy of a coffer acceptance of drop or acclaim and a non-disclosure acceding (NDA) and a letter of absorbed (LOI) are signed. The action usually works as follows:

Sellers appetite to advertise OTC to abstain the array of slippage that occurs back auction ample amounts of BTC on an exchange. Whales additionally amount their privacy, and while they are still appropriate to abide KYC to complete an OTC deal, their character is alone activity to be aggregate with the broker, their attorney, and the escrow service. Normally, alike the client won’t apperceive the character of the being they are affairs the bill from. The agent provides “proof of satoshi” by affective a atom of a bitcoin from the wallet they control, the client provides affidavit of funds in the anatomy of a coffer acceptance of drop or acclaim and a non-disclosure acceding (NDA) and a letter of absorbed (LOI) are signed. The action usually works as follows:

Given the admiration of client and agent to bottle their privacy, and the charge for anniversary affair to be affiliated in the aboriginal place, brokers comedy a basic role. But due to the advantageous award-winning at stake, it’s a job that attracts a lot of chancers – and a lot of Linkedin requests, abundant to the annoyance of added cryptocurrency users.

Have you been contacted by bitcoin brokers and do you anticipate they’re a nuisance or an capital articulation in the OTC chain? Let us apperceive in the comments area below.

Images address of Shutterstock and Bitinfo Charts.

Need to account your bitcoin holdings? Check our tools section.