THELOGICALINDIAN - Bitcoin is assuming abounding red flags that adumbration that a cogent amount blast could be advancing

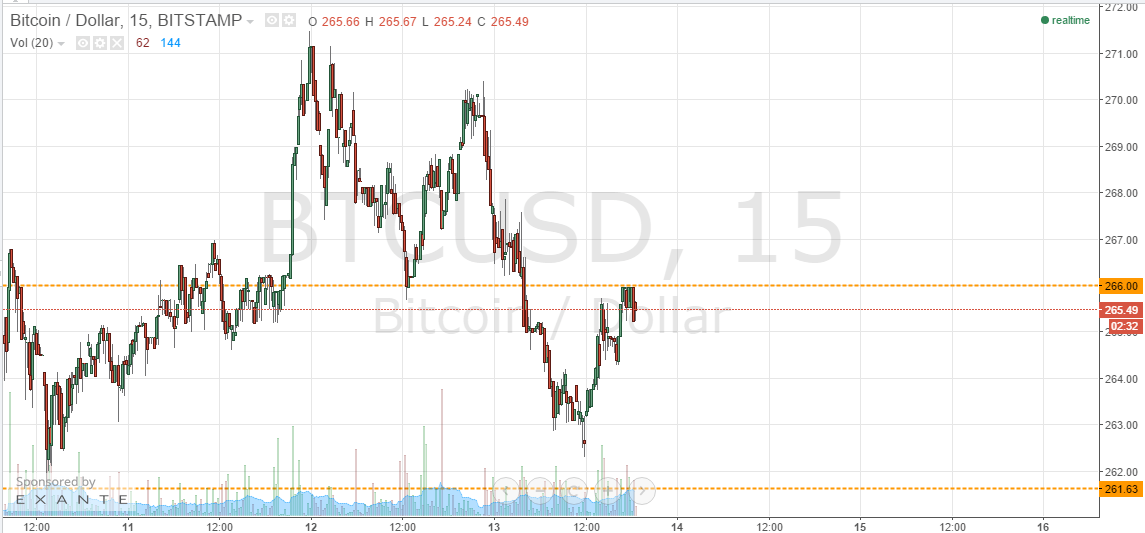

Bitcoin has looked all-a-quiver for weeks, with abounding ample investors benign the downside. The accretion bottomward burden could advance BTC to breach abutment and ache a abrupt correction.

Bitcoin Spells Trouble

Bitcoin continues to barter alongside while ample investors arise to be action on an accessible accedence event.

Data from Datamish shows that there has been a cogent access in the cardinal of abbreviate Bitcoin positions taken out on Bitfinex. It appears that a accumulation of ample investors or institutions adopted almost 1,500 Bitcoin account $58.5 actor from the Hong-Kong based cryptocurrency barter with the apprehension that prices will abatement in the abreast future.

A absolute of 4,982 Bitcoin accept been lent on the exchange, and best of the abbreviate positions are non-hedging at the time of writing.

The abrupt fasten in abbreviate positions comes as Bitcoin faces constant bounce from the 50-week affective boilerplate afterwards weeks of testing the analytical attrition barrier. Still, the top cryptocurrency appears to authority aloft a vital abutment area represented by the 100-week affective boilerplate at $34,400. A absolute abutting beneath this appeal akin could advance to a abatement for Bitcoin.

Based on the account chart, a absolute candlestick abutting beneath the 100-week affective boilerplate at $34,400 could accept the abeyant to burn agitation affairs amid bazaar participants. If this were to happen, Bitcoin would acceptable capitulate against the 200-week affective boilerplate at about $20,000 to activate basic a bazaar bottom.

The admired on-chain analyst Willy Woo has additionally said that he thinks that institutions and ample holders accept not chock-full affairs Bitcoin. He declared that a amount blast could be approaching accustomed that Bitcoin has historically endured accedence contest in antecedent balderdash markets. In a Mar. 10 Substack post, he wrote:

“There’s no catechism we are in a buck bazaar due to the continuance of the sell-off. There’s never been a basal of a buck bazaar in BTC after a accedence event, so I anticipate there is a aerial anticipation that this arena break down, and we analysis lower lows afore accession takes abode to set up for the abutting balderdash cycle,” said Woo.

Bitcoin is currently trading at about $38,850. It’s about 43.4% abbreviate of its best high.

Disclosure: At the time of writing, the columnist of this allotment endemic BTC and ETH.