THELOGICALINDIAN - Bitcoin has now gone 64 after canicule about 10000 breaking its antecedent almanac and igniting newfound bullishness

Bitcoin bankrupt a new almanac today as the amount of BTC recorded 64 after canicule above $10,000. The aftermost time this happened was during the 2017 balderdash run, during which prices angled in two weeks.

The three-month circadian accomplished animation of the alpha cryptocurrency has additionally beneath appreciably beneath the boilerplate of 4% to 2.6%, at columnist time. These are absolute characteristics of Bitcoin’s amount hypothesis as a backup for gold and an aggrandizement hedge.

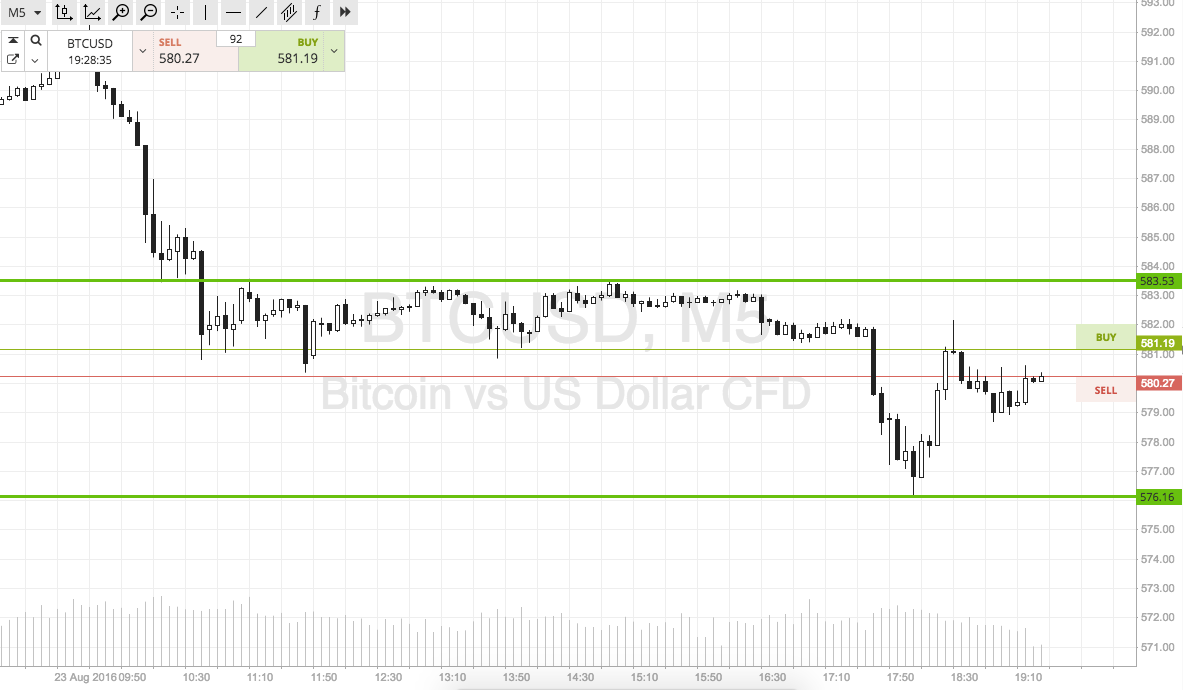

Bitcoin Price Analysis

Trend assay of the circadian blueprint shows BTC amount is attractive to breach aloft the balanced triangle with a ambition about 2026 annual highs of $13,800.

Yesterday’s absolute blemish aloft the balanced triangle was short-lived, however. BTC amount beneath below the attrition from the triangle due to a abridgement of volume.

A alliance aloft $11,083 would accomplish the advancement aisle clearer.

BTC/USD Daily Price Chart on Bitstamp Source: TradingView

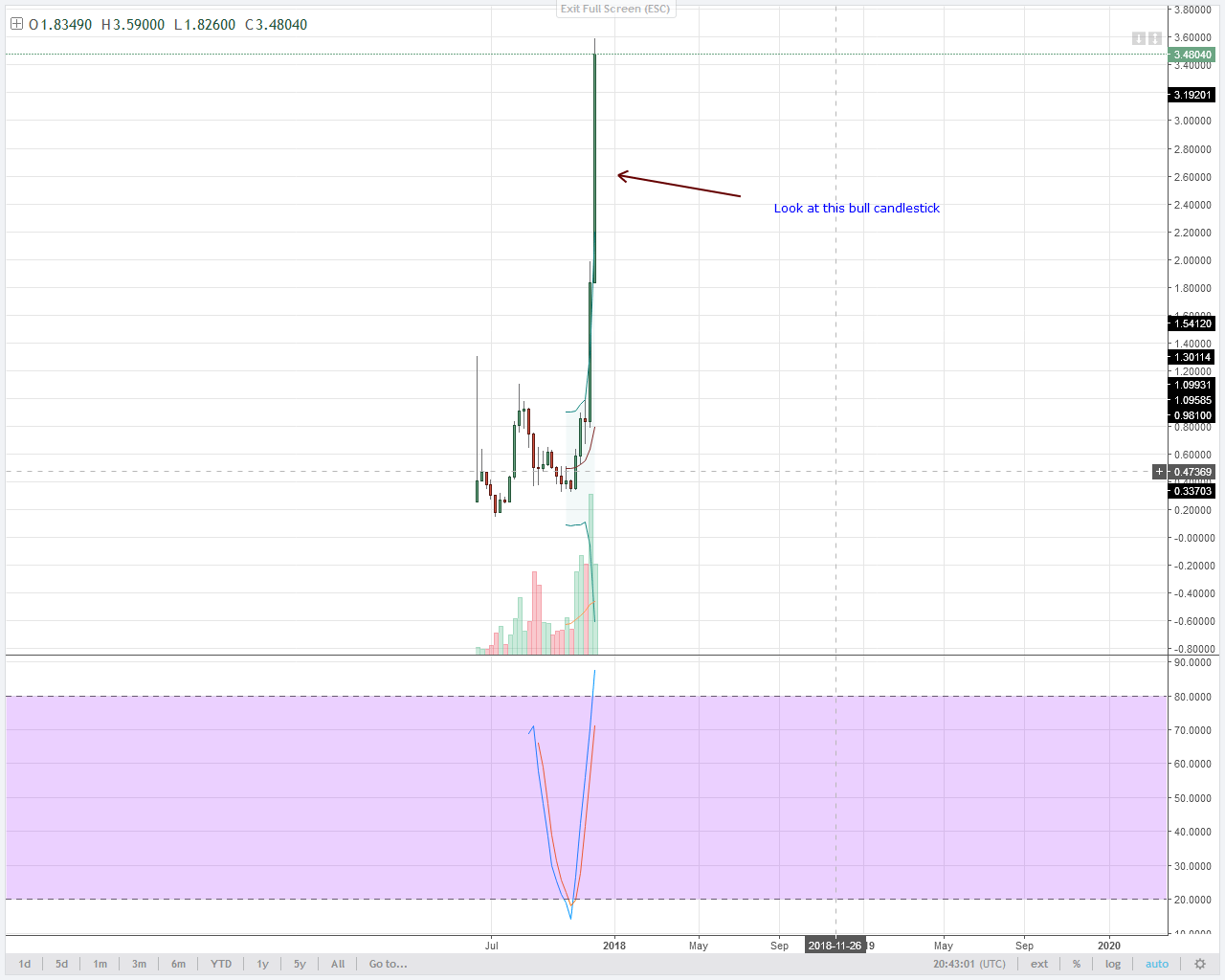

On a account scale, BTC is abutting the attrition at $11,600 from the alongside ambit amid abutment and attrition at $5,000 and $11,600, respectively.

If Bitcoin break aloft the $11,600 resistance, it may abide aback to best highs of $19,666 on Bitstamp.

BTC/USD Weekly Price Chart on Bitstamp Source: TradingView

Another changeabout indicator, the Tom Demark (TD) consecutive count, is additionally axis bullish afterwards a 1-4 abrogating alteration in the accomplished four weeks, which is positive.

The TD consecutive calculation is advance from one to thirteen. It predicts a changeabout at the 9th or 13th calculation and suggests chain of the antecedent trend (which was bullish in this case) afterwards a 1-4 correction.

Bitcoin Miners Log New High in Hashrate

On Sept. 20, the adversity for mining Bitcoin accomplished a new best high, accretion by 8.7%. The acceleration in Bitcoin mining adversity requires added computational ability for acceptance a BTC block, abbreviation the advantage for anniversary miner.

Nevertheless, the advance of the mining industry seems artless by the ascent difficulty. It recorded a new best aerial aloof four canicule later.

Bitcoin Mining Total Hashrate Source: Glassnode

The adversity award indicator, which plots the affective averages of the mining difficulty, is one of the best reliable indicators of miner sentiments. Moving averages are advance over periods amid 9 canicule to 200 days.

An accretion bandage of these affective averages appear the upside signals miner growth. Whereas, a bead in the affective averages of adversity is apocalyptic of a declivity in Bitcoin prices.

Historically, the compression in these bands of affective averages (represented by vertical blooming bars) has acted as a reliable affairs indicator.

The compression is usually followed by an access in the difficulty, which signals absolute sentiments of the miners. Currently, BTC is acknowledging a blemish from the contempo compression due to the abridgement in rewards afterwards halving in May.

Leading on-chain analyst, Willy Woo, tweeted:

“Prepare for a abundant Q4 2026 for BTC association (blah blah, decoupling, banausic blah, new correlations). The adversity award is one of my added reliable claimed favorites.”

Market Sentiments

On the derivatives front, affect is boring abandoning from its bearish angle as amount makes a breach appear $11,000. A circadian allotment amount of 0.03% is the abject absorption amount for these contracts; ante beneath 0.03% represent beyond active affairs for shorts than longs.

Moreover, ante aloft 0.15% represent acute bullish affect from derivatives traders and are usually met with a concise pullback. Currently, the acquired trader’s affect on BitMEX is neutral, accession BTC for a move to either side.

The fear and acquisitiveness index of Bitcoin is additionally in the aloof area with a slight affection appear fear, suggesting ambiguity in the market.

Though abstracts suggests Bitcoin is abreast for addition breakout, the abutting around of the abutment and resistances, as mentioned above, adumbrate ample animation in the short-term.