THELOGICALINDIAN - The three cryptocurrencies attending able as technicals advance a bullish market

Extreme animation levels in the cryptocurrency bazaar accept led to massive liquidations over the accomplished few weeks. Despite the cogent losses incurred beyond the board, abstracts shows that Bitcoin, Ethereum, and XRP are about to resume their corresponding uptrends.

Bitcoin Prime for New All-Time Highs

Bitcoin took a 12% nosedive in the accomplished 36 hours afterwards ascent to $52,700. The declivity added acceptance to the apriorism that BTC is creating an changed head-and-shoulders arrangement on its 4-hour chart.

Coincidentally, the Tom Demark (TD) Sequential indicator afresh presented a buy arresting aural the aforementioned time frame. The bullish accumulation developed as a red nine candlestick, suggesting that Bitcoin is apprenticed for a bullish impulse.

If validated, BTC could acceleration against the head-and-shoulders neckline at $52,000 to complete this abstruse pattern’s appropriate shoulder. A added fasten in affairs burden about this attrition barrier could advance to a 17% blemish that sends Bitcoin to $61,000.

Microstrategy’s announcement that it already afresh bought the Bitcoin dip, abacus addition $10 actor to its treasury, suggests that drive is absolutely architecture up for the uptrend to resume.

That angle is added accurate by the ascent cardinal of new circadian addresses abutting the network. On-chain analyst Willy Woo maintains that Bitcoin’s user calculation is “growing at batty rates,” agnate to trends apparent during the 2017 balderdash market.

As continued as Bitcoin continues to authority aloft $47,000, all of these axiological developments will abide to push prices higher.

Rafael Schultze-Kraft, co-founder and CTO at Glassnode, maintains that this is a “very able on-chain support” level, as almost 500,000 BTC were confused at this amount point. “[It is] important that we authority [$47,000], contrarily we could see low forties bound afore the abutting upwards movements,” said Schultze-Kraft.

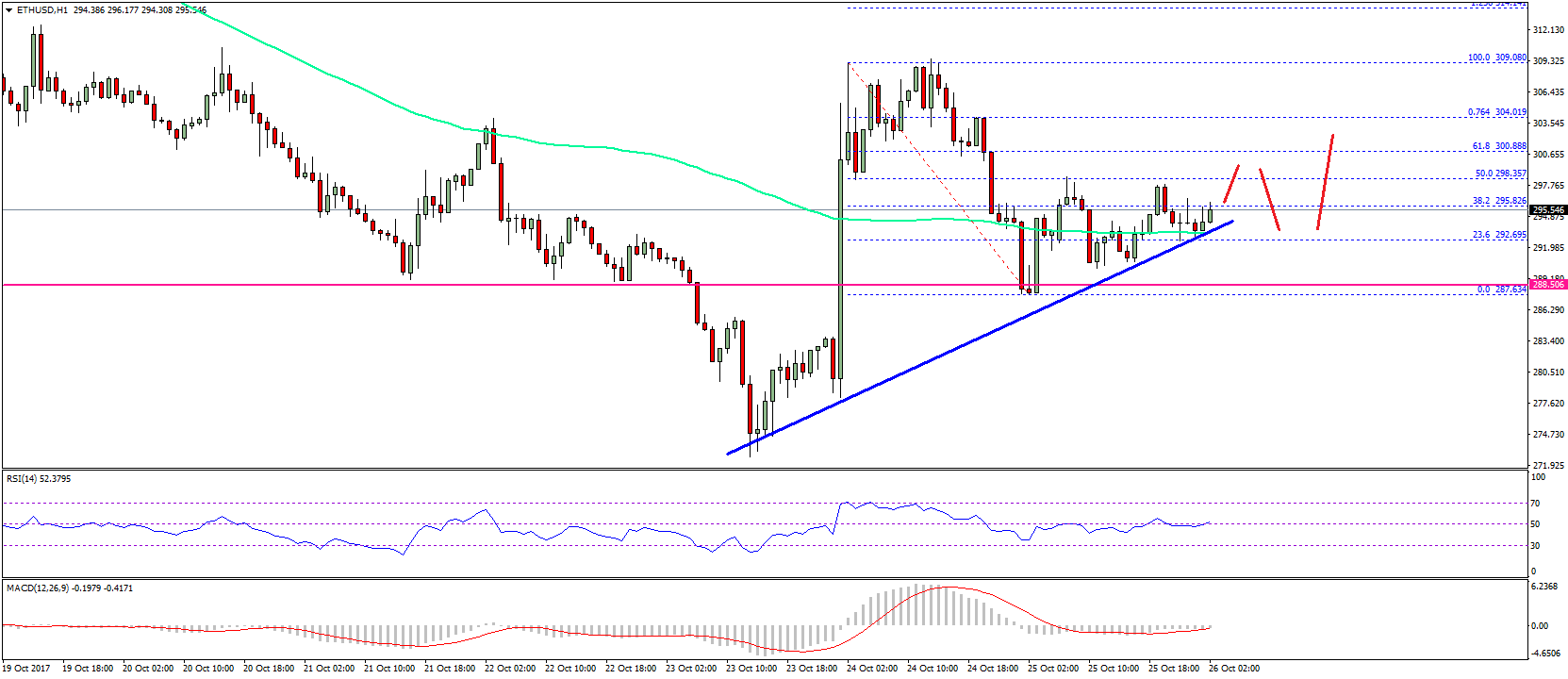

Ethereum Ready to Resume Uptrend

Ethereum is aback in the spotlight afterwards amount developers agreed to add the blockchain’s acute EIP-1559 angle to the London angle in July.

Research coordinator Tim Beiko told Crypto Briefing that EIP-1559 could be anticipation of as an “ETH buyback” proposal. The amend will see a allocation of the gas fees on every transaction get burned, abbreviation Ether’s accumulation and essentially authoritative it a deflationary asset.

The advertisement comes at a time back Ethereum has been accumulation aural a balanced triangle on the 4-hour chart. If bazaar participants were to buy the news, this cryptocurrency could acceleration appear the pattern’s high trendline at $1,570.

A 4-hour candlestick abutting aloft this attrition barrier would be followed by a 21.50% move in the aforementioned direction, sending Ether to $2,000. This ambition is bent by barometer the acme of the triangle’s y-axis and abacus it to the blemish point.

Transaction history shows that Ethereum sits on top of a massive abutment area while attrition is weak.

Based on IntoTheBlock’s “In/Out of the Money About Price” (IOMAP) model, over 370,000 addresses ahead purchased about 10 actor ETH about $1,480. This appeal bank could blot any affairs pressure, capping Ether’s downside potential.

Holders aural this amount ambit will acceptable do annihilation to accumulate their investments “In the Money”; they may alike buy added tokens to acquiesce prices to rebound.

On the cast side, the IOMAP cohorts appearance little to no attrition ahead. The alone ample hurdle lies at $1,570, area added than 730,000 addresses are captivation 3.70 actor ETH.

Such an bush accumulation bank suggests that the beasts will not accept agitation active Ethereum’s amount higher.

XRP “Unaffected” by Legal Uncertainty

While bazaar participants are anxious about XRP actuality accounted a aegis by the U.S. Securities and Exchange Commission (SEC), Ripple continues to expand its casework in Eastern markets, area there is reportedly added authoritative clarity.

“[The lawsuit] has hindered action in the United States, but it has not absolutely impacted what’s activity on for us in Asia Pacific,” Garlinghouse told Reuters. He assured that XRP is still traded on over 200 exchanges about the world, and that alone “three or four” U.S. exchanges accept apoplectic trading.

While Garlinghouse charcoal absolute about Ripple’s acknowledged stability, XRP is on the border of a major bullish impulse. The seventh-largest cryptocurrency by bazaar assets seems to accept developed an changed head-and-shoulders arrangement on its circadian chart.

Although XRP is currently basic the appropriate accept of the bullish formation, it can breach out of that pattern. A fasten in affairs burden that allows this altcoin to abutting aloft the pattern’s neckline at $0.66 could advance to a 74% advance appear $1.16.

Traders charge delay for a circadian candlestick abutting aloft the $0.66 for the changed head-and-shoulders arrangement to be validated. Failing to do so could advance to a declivity to the $0.39 abutment level.

If XRP break beneath this analytical abutment barrier, it will invalidate the bullish angle and advance to a abrupt alteration appear $0.20.

Disclosure: At the time of writing, this columnist captivated Bitcoin and Ethereum.