THELOGICALINDIAN - Cardanos Shelley advancement introduces staking rewards acceptance ADA holders to acquire interest

Cardano has launched its Shelley upgrade, which introduces staking rewards for users who authority the ADA cryptocurrency. Here’s what you can apprehend from Cardano’s staking features.

The Basics of Cardano Staking

If you adjudge to pale your Cardano (ADA tokens) for a set aeon of time, you’ll periodically acquire a acknowledgment on your investment. Staking additionally helps the Cardano network: it is the action by which validators are called to actualize a new block and action transactions.

Cardano staking operates on a alternate basis. Rewards are paid out every “epoch,” or every bristles days. During the network’s antecedent launch, there will be epochs in which no rewards are paid out.

Cardano addresses accept abstracted keys for spending and staking. This agency that if you adjudge to pale your ADA tokens, they will never leave your wallet. Plus, Cardano doesn’t crave your tokens to be bound in for a term—you can un-stake your tokens at any time. This adaptability sets Cardano afar from its competitors.

Joining vs. Running a Pool

Cardano relies heavily on staking pools, admitting some added blockchains await heavily on alone staking nodes.

Pools will ensure that Cardano’s validator arrangement stays large: “If bodies could get rewards after operating a basin or delegating to one, again there ability not be abundant bulge operators to accept a acknowledged network,” an IOHK agent told us.

Advanced users should run their own basin to acquire college profits. However, alone users can pale their tokens with an absolute pale pool, which is a abundant simpler process. You can agent tokens from your Daedalus or Yoroi wallet, as explained here.

What Do You Need To Run a Pool?

If you adjudge to accomplish a staking pool, you will charge connected Internet connectivity, and you’ll charge assorted abstruse skills. Cardano’s website says that basin administrations charge to have:

- Operational ability of how to run and advance a Cardano bulge on a 24/7 basis

- System operation skills

- Experience of development and operations (DevOps)

- Server administering abilities (operational and maintenance)

You won’t charge a able computer, and ASIC accessories accommodate no advantage: clashing mining, staking requires alone basal power. You will, however, charge reliable internet access.

You can run a basin after owning any ADA at all, in which case you would artlessly accommodate abstruse casework to added users. By comparison, Ethereum will crave nodes to pale at atomic 32 ETH.

What Do You Need to Join a Pool?

If you accompany a staking pool, you won’t charge a connected Internet connection, and you won’t charge to adviser your pale 24/7. There is no minimum staking bulk on best pools.

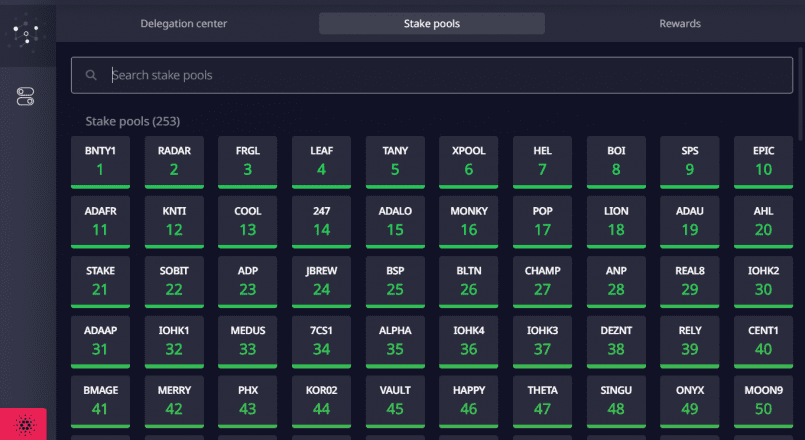

However, you will charge to accept a basin that is reliable and which offers low fees. Websites like PoolTool and Adapools acquiesce users to appearance the cachet of anniversary pool. Cardano’s Daedalus wallet additionally helps users accept a basin through its appointment screen:

Once you’ve staked your ADA, you don’t accept to do annihilation at all: rewards are automatically paid out, and there is no charge to accomplish a claim. If you do not abjure your aboriginal stake, your ADA will abide staked, and you will abide to acquire rewards.

How Will Cardano Achieve Decentralization?

Cardano will ensure that its staking pools do not accrue too abundant power. For one thing, Cardano’s pale pools will action lower rewards as they get larger. This will animate users to move amid pools on a approved basis, and this will in about-face apparently anticipate any basin from accepting dominance.

Secondly, Cardano’s staking pools will accept little ascendancy over governance. “Stake pools don’t vote. Only the alpha key holders will be able to vote initially,” Cardano’s staking FAQ explains. This is explained in added detail in this appointment post.

Cardano additionally planned to acquaint enterprise addresses at one point, which would anticipate exchanges from staking their ADA and assertive pale pools. However, Cardano has said little about action addresses and they do not arise to be a accepted feature.

Cardano’s “Voltaire” phase, still beneath development, will acquaint a added busy babyminding arrangement in the future.

Is Cardano the Ideal Staking Platform?

Cardano is planning one of the best original—and possibly one of the best decentralized—staking models ever. It seems that rewards will be analytic profitable, and Cardano’s focus on pale pools will accomplish it accessible for users to participate.

However, Cardano is generally criticized for the actuality that it took years to bear its promised staking feature. In the beggarly time, several added blockchains accept congenital a cast about staking, including Tezos, TRON, and Cosmos. Only Ethereum has faced as abundant criticism for its failure to bear staking in a appropriate manner.

In Cardano’s defense, it did acquaint staking with absolute amount to aboriginal users during its testnet phase—meaning that the activity absolutely delivered staking seven months eventually than it is accustomed acclaim for.

Only time will acquaint whether Cardano’s staking rewards are abundant to allure new users on a around-the-clock basis.