THELOGICALINDIAN - In the chase for CRV tokens Curve Finance investors assume to be acceptable whatever happens

Optimizing crop on Curve Finance’s pools is Yearn Finance’s aliment and butter, but newcomer Convex Finance is accepting accelerated absorption as the two DeFi protocols action for Curve’s clamminess provider tokens.

Yearn vs. Convex

In what some are calling “The Curve Wars,” DeFi protocols are aggressive to allure clamminess from Curve Finance (Curve) investors.

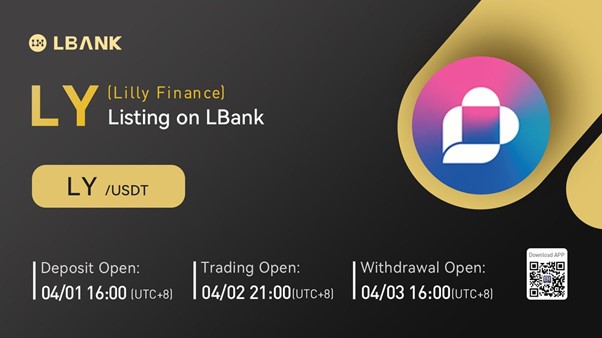

The two better contenders of this chase to lock CRV are Yearn Finance (Yearn), a accepted crop agriculture access protocol, and Convex Finance (Convex), one of DeFi’s newest protocols. Convex is alms adorable absorption ante on veCRV tokens by incentivizing stakers with its own babyminding badge CVX. DeFi users can acquire veCRV by vesting CRV for an continued aeon of time. It is additionally incentivizing SUSHI holders by advantageous those who pale cvxCRV in Sushi’s cvxCRV-CRV clamminess pool. The cvxCRV badge can be becoming by staking CRV in Convex.

In essence, the action amid the projects centers on which one can action the best allotment on Curve’s stablecoin pools. While Yearn can’t incentivize accord with its babyminding badge YFI, Convex can. Although Yearn provides better crop optimization, the clamminess mining rewards accept apparent Convex beat Yearn’s crop on abounding Curve pools. This has helped the adolescent agreement to bound beat $1 billion in absolute amount locked.

In the end, the absolute winners of this antagonism ability be Curve and CRV holders. While Yearn and Convex seek to action the best yields to their users, they generally accept to lock cogent amounts of CRV to do so, affairs it from the accessible market. The “Curve War” is absolutely a war for CRV, which, no amount the outcome, allowances Curve. CRV is up 59.5% in the aftermost week. It’s currently trading at $2.57.

Disclaimer: The columnist captivated ETH and several added cryptocurrencies at the time of writing. Yearn Finance architect Andre Cronje is an disinterestedness holder in Crypto Briefing.