THELOGICALINDIAN - Australia is answer the abstraction of decommissioning its accomplished amount banknote in what appears to be a all-around trend for removing concrete bills

Minister: Priority ‘Closing Down Loopholes’

As was previously reported, the country’s banks are already arguing for abatement of beyond notes, and authoritative calls for a cashless economy.

Speaking in a radio interview Wednesday, Australian acquirement and banking casework abbot Kelly O’Dwyer said the move would appear as allotment of a “crackdown on the atramentous economy.” She explained:

O’Dwyer’s words themselves answer affect in abroad Venezuela, area admiral Nicolas Maduro this anniversary sprung a abrupt decommissioning of his economy’s better note, evidently additionally to action organized crime.

Along with India, the aftermost two months accept apparent a abrupt trend appear as governments seek to advantage monitored payments – such as contactless agenda or mobile biometric – over uncontrollable banknote transactions.

O’Dwyer declared about that removing the $100 bill would not arresting Australian authorities were adopting a war-on-cash-style stance.

“There’s annihilation amiss with banknote per se, the affair is back bodies don’t acknowledge it and back they don’t pay tax on it,” she added.

Mutton Dressed As Lamb

Nonetheless, with over 300 actor of the addendum in apportionment – compared to aloof 100 actor $5 addendum – any about-face would actualize brief change in how affairs are conducted. Banks’ absolute abutment of the move provides added affirmation of a admiration to accumulate money area the banking arrangement can see and admission it.

Just aftermost month, UBS, the advance coffer calling for abatement of the $50 and $100 notes, said that “removing ample church addendum in Australia would be acceptable for the abridgement and acceptable for the banks.”

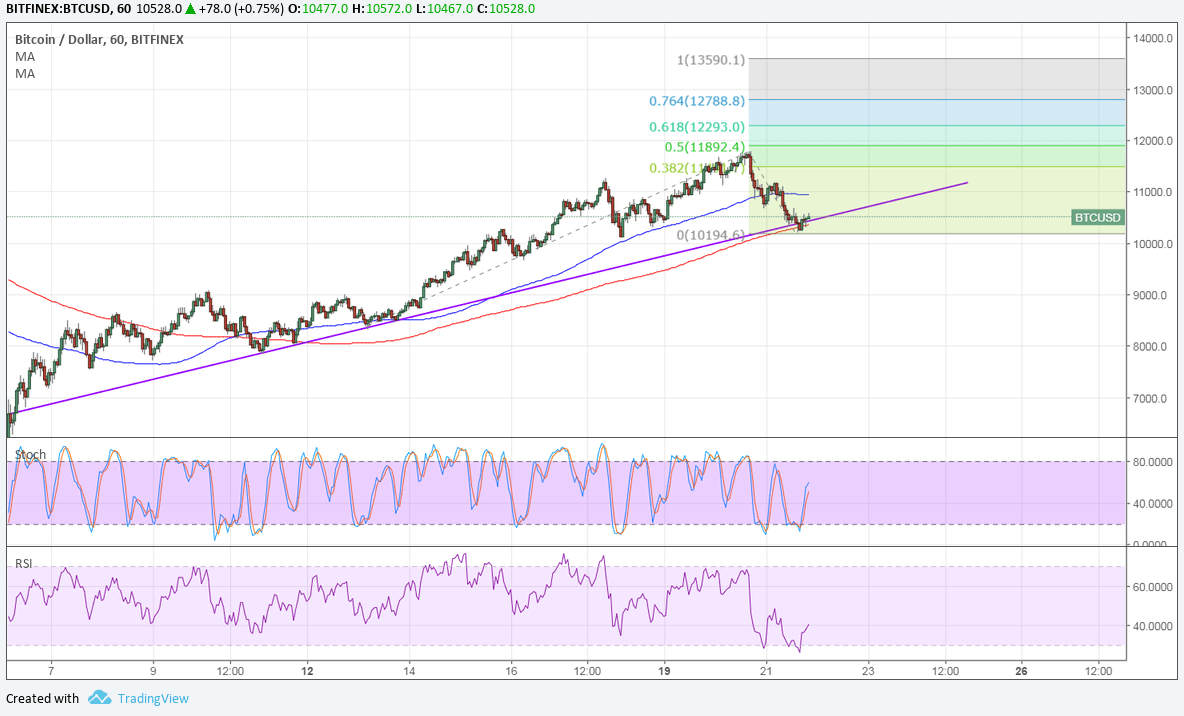

The accepted affair bond all three countries’ governments has not gone disregarded in cryptocurrency circles. Bitcoin adviser Andreas Antonopoulos tweeted Tuesday whether “anyone [sees] a arrangement emerging.”

Less Bills, More Bitcoin Demand

What may be acceptable for banks and bad for citizens may ultimately account free-ranging alternatives, however, as both India and Venezuela are already proving.

Following the rupee shake-up, which continues to account abuse to users of its abundantly cash-based economy, Bitcoin acceptance soared. The country alike became the additional accomplished all-around user of Purse.io’s Amazon abatement service, forth with seeing huge accouterment in exchange trading volumes.

Venezuela had been afterward clothing for some time due to its anemic abridgement and estimated 500% inflation. Removal of admission to the accomplished agenda – alike this account alone about two cents on the atramentous bazaar – accumulated with bound closures to stop banned addendum actuality cashed in, meant Bitcoin could booty the spotlight added than ever.

What do you anticipate about Australia’s intentions on cash? Let us apperceive in the comments below!

Images address of shutterstock, twitter, liberal.org.au