THELOGICALINDIAN - Cryptos contempo bane woes assume to appear as no abruptness for the banking institution

A new BIS address has criticized crypto for its structural flaws, arguing that a abridgement of abiding nominal anchor, scalability issues, fragmentation, and able intermediaries all affectation risks to the space.

Central Bank Institution Prefers Central Banks

The Bank for International Settlements (BIS) is still analytical of crypto.

In a abundant 41-page pre-released excerpt of its Annual Economic Report, the banking academy declared that “structural flaws accomplish the crypto cosmos clashing as the base for a budgetary system,” arguing instead that systems congenital about axial banks action added abiding and interoperable services.

BIS along declared its absorption in accumulation crypto’s innovations in the fields of programmability, composability and tokenization into the programming of approaching Central Bank Digital Currencies (CBDCs).

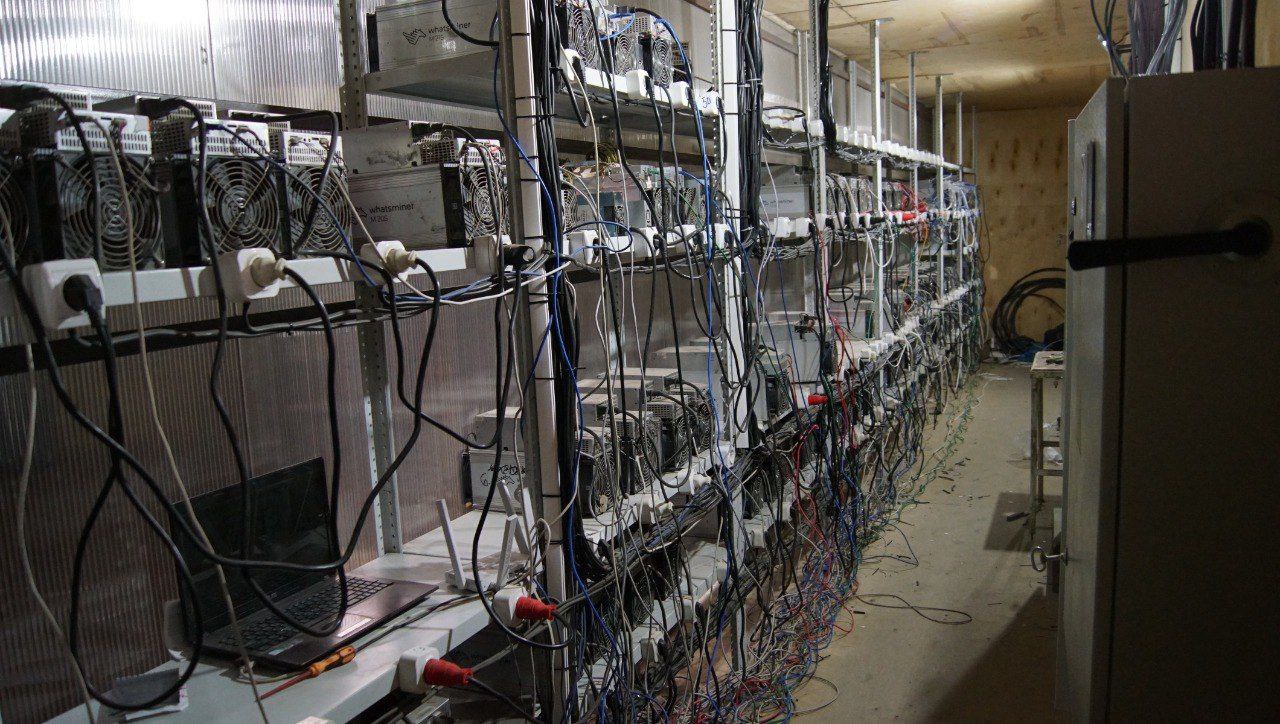

Chief amid the BIS’ criticisms of the crypto ecosystem were its abridgement of a abiding nominal ballast (which axial banks use to advance amount stability), its scalability issues, its fragmentation, and its addiction to await on able intermediaries.

BIS General Manager Agustín Carstens told Reuters that “all these weaknesses that were acicular out afore accept appealing abundant materialized,” alluding to the contempo stablecoin collapses, crypto lender insolvencies, barrier armamentarium wipeouts, and institutional bailouts which came in the deathwatch of Bitcoin’s barbarous bead in price.

“Based on what we know, it should be absolutely manageable,” Carstens said about the crypto meltdown, advertence he wasn’t assured the amplitude to activate a all-around banking crisis. “But there are a lot of things that we don’t know.”

Carstens had ahead stated his appearance that “the body of money” was assurance and that arguable acquittal networks would be clumsy to attempt with the casework provided by axial banks. He expects all-embracing standards for CBDC interoperability to cycle out aural the abutting 24 months.

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.