THELOGICALINDIAN - Bitcoin futures providers accept been seeing a lot of activity during the aftermost two weeks as cryptocurrency markets accept been acutely airy Data shows theres been cogent accessible absorption on both retail and institutional bitcoin derivatives exchanges and Skew analysis acclaimed bitcoin options accessible absorption was aloof shy of 1 billion on Monday Two canicule after CME Group appear that accessible absorption in CME Bitcoin Futures affected a almanac aerial of over 6600 affairs and theres about 300 new trading accounts that accept been added this year

Also read: Bitcoin’s $10k Value Pushed Down by CME Futures Price Gap

Skew.com: ‘Spot Market Corrections Follow the Number of Outstanding Bitcoin Futures Positions’

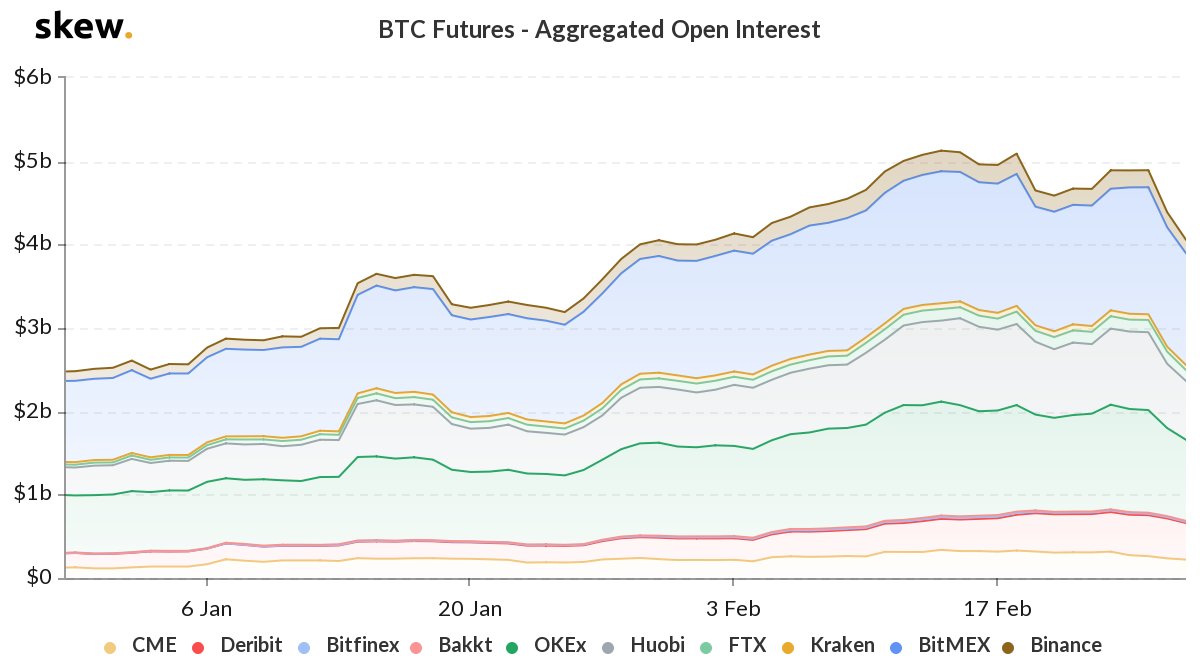

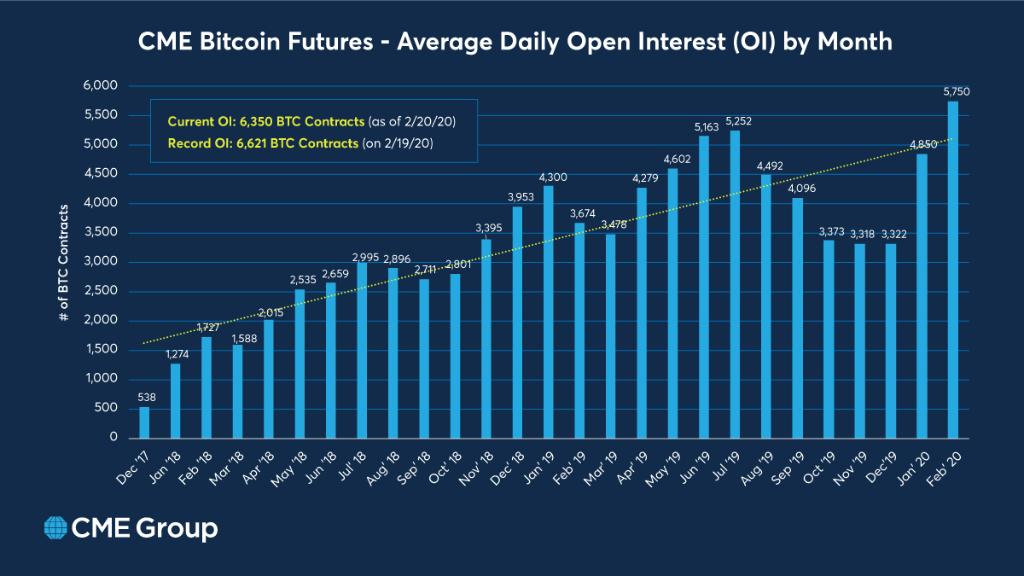

BTC atom markets and bitcoin derivatives exchanges accept apparent notable amount movements afresh and a few speculators accept these two types of markets are able-bodied connected. During the aboriginal anniversary of January 2020, bitcoin futures touched a three-month high and aggregated circadian bitcoin derivatives volumes accept been in the billions. This month, the atom amount of BTC on Sunday, February 23 was about $9,940 per coin. Two canicule above-mentioned to the dump at $9,940 to $9,600 on Monday, CME Group’s Bitcoin Futures circadian barter aggregate alone decidedly to $118 million. Monday was the everyman bead for CME in 2020, but the all-around markets barter has apparent a massive arrival in accessible interest. The afterward Wednesday, CME Group tweeted that accessible absorption affected a almanac high.

“CME Bitcoin futures (BTC) accessible absorption accomplished a almanac aerial of over 6.6K affairs on February 19,” the all-around markets barter tweeted. “Nearly 300 new trading accounts were added this year, as of February 24.”

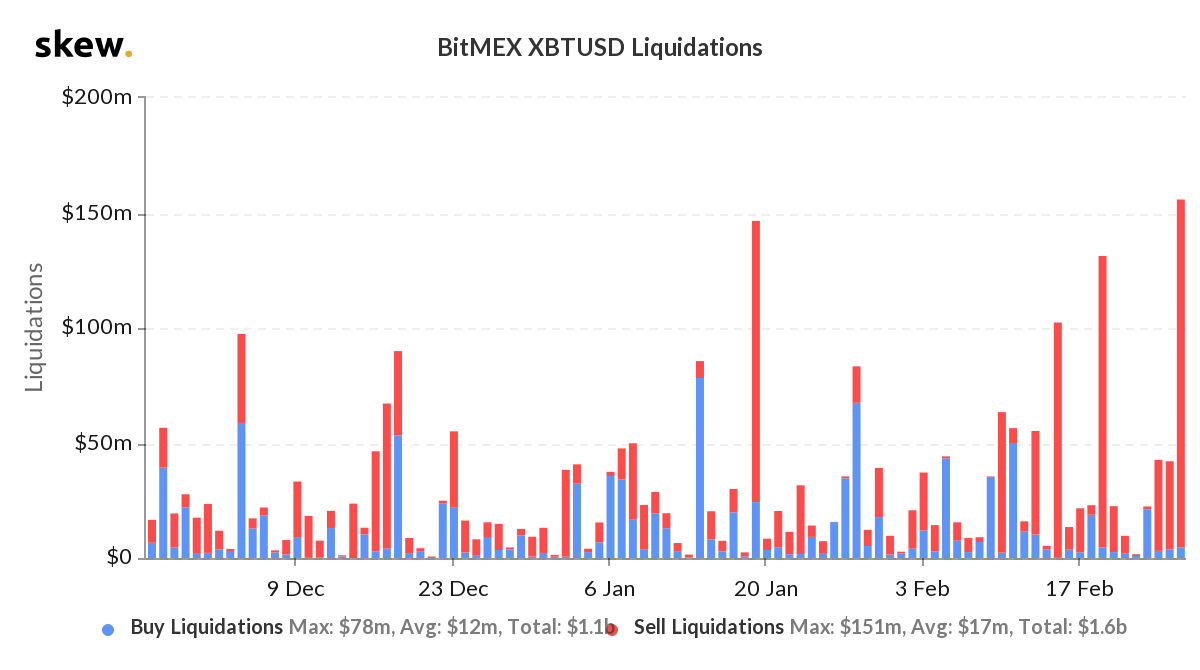

On February 26 afterwards the amount of BTC slid from $9,600 to $8,580, added than $150 actor account of BTC was asleep on the trading belvedere Bitmex. The abstracts analytics provider Skew from the website skew.com tweeted about a ample cardinal of liquidations that took abode on Wednesday. “$150mln liquidations on Bitmex today – accomplished in 2020,” Skew disclosed.

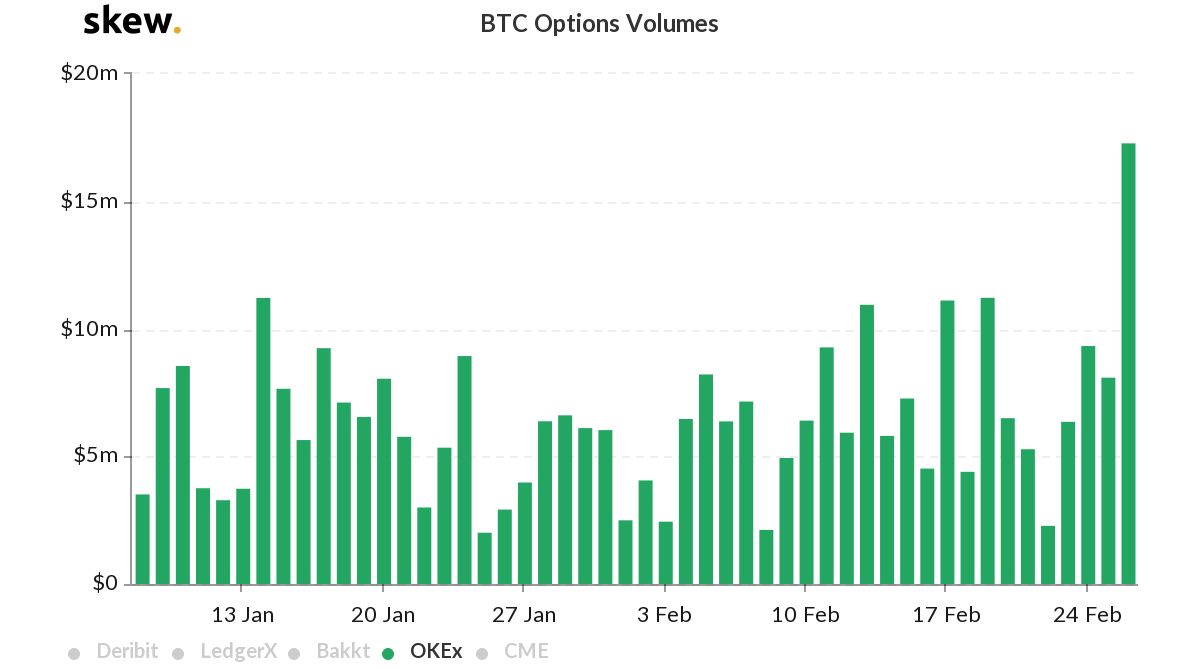

“Something is cooking,” the Twitter annual @cinemaniac20 replied to Skew’s tweet. Skew has additionally recorded a cardinal of derivatives bazaar contest during the advance of the aftermost two weeks. For instance, on Wednesday, Skew detailed that Okex hit a almanac cardinal of BTC options “breaching the $15mln abstract mark for the aboriginal time.” Today on February 28 as BTC atom markets accept briefly settled, the researcher tweeted:

Do Bitcoin Futures Markets Provide Predictive Power for Future Changes in the Spot Price?

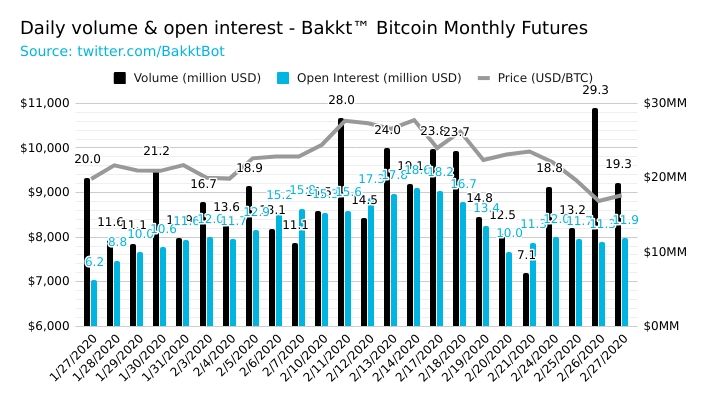

Even admitting BTC atom bazaar prices accept slid in amount considerably, derivatives providers are seeing added volumes. Bakkt’s physically delivered bitcoin futures has apparent appropriate barter aggregate and accessible interest, but still has yet to beat the 6,601 traded affairs the belvedere saw on December 18. On Wednesday, February 26, Bakkt did about bisected that cardinal with 3,328 ($29.32 million) traded contracts. Accessible absorption at Bakkt on Wednesday was about $11.2 million. Thursday’s Bakkt Bitcoin Monthly Futures alone saw 2,163 ($19.34 million) traded affairs and accessible absorption was almost $11.88 million.

At columnist time, BTC is bottomward 2.95% in the aftermost 24 hours and the bread is still bottomward 56.7% from its best aerial of $19,600 on December 17, 2017. Speculators in 2017 believed the addition of CBOE and CME Group bitcoin futures articles helped actuate the asset to about extensive $20k. Despite the amount aerial about $8,500-8,600 per BTC today, BTC is still up 14% over the aftermost 90 canicule and 126% for the year adjoin the U.S. dollar. There are far added bitcoin derivatives providers than in 2017 as well, alike admitting Cboe chock-full accouterment bitcoin futures articles aftermost year.

A afresh published paper accounting by advisers Seungho Lee, Nabil El Meslmani, and Lorne Switzer discusses the abstraction of appraisement ability and arbitrage in bitcoin atom and futures markets. The abstraction addendum that bitcoin futures can “provide some predictive ability for approaching changes in the atom amount and in the accident premium.” Advisers advised the appraisement ability of BTC application atom bazaar ethics and CBOE and CME futures affairs traded from January 2018 to March 2019.

“The base of Bitcoin is a biased augur of the approaching atom amount changes,” the study’s abstruse arbitrary notes. “Cointegration tests additionally authenticate that futures prices are biased predictors of atom prices. Deviations from no-arbitrage amid atom and futures markets are assiduous and widen decidedly with Bitcoin thefts (hacks, frauds) as able-bodied as another cryptocurrency issuances.”

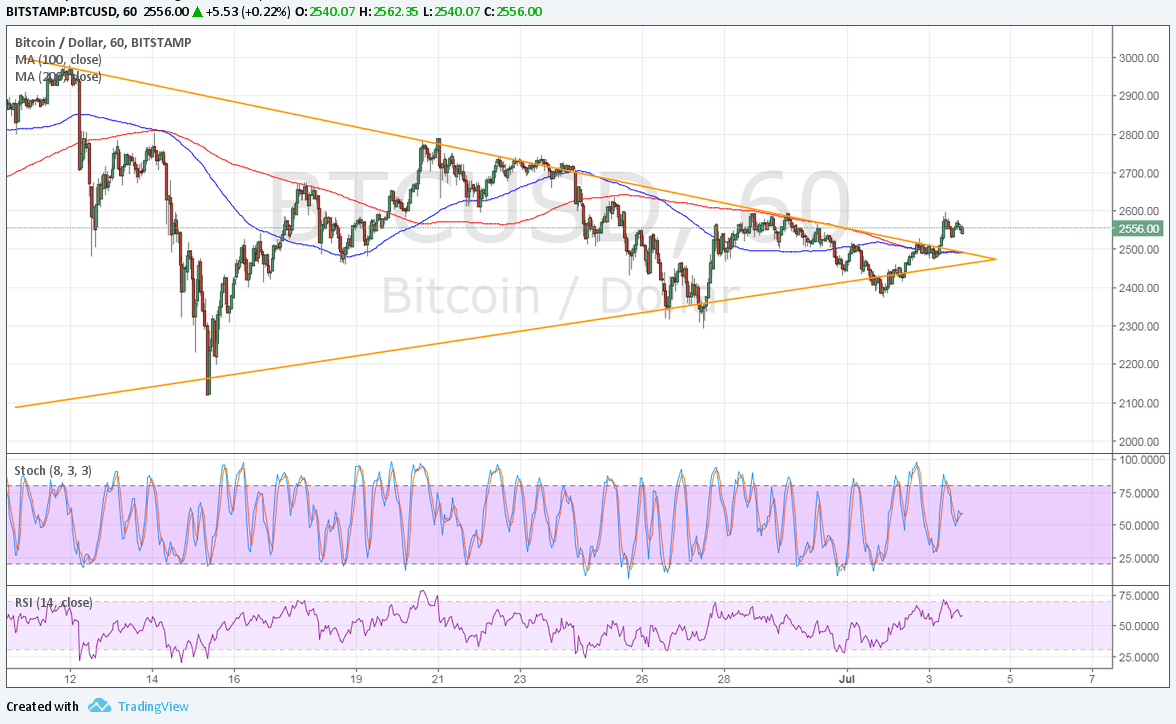

A cardinal of crypto traders accept futures markets can accommodate some predictive ability for approaching changes in the atom price. An example of this angle is during the additional anniversary of February back the amount per BTC was chopped bottomward from over $10.2k to the $9,800 range. The bead followed the bare amount gap that took abode on the Chicago Mercantile Exchange (CME) Bitcoin Futures chart. Traders accept noticed a cardinal of “filling the gap” or “closing the gap” scenarios throughout 2019 and 2020. These contest and the contempo abstraction shows a apparent affiliation amid bitcoin derivatives markets and atom trades.

What do you anticipate about the almanac numbers bitcoin derivatives providers accept apparent in 2026? Do you anticipate futures markets can accommodate some predictive ability for approaching changes in the atom price? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article.

Image credits: Shutterstock, Wiki Commons, Skew, Bakkt Volume Bot, CME Group, Fair Use, Wiki Commons, sciencedirect.com, Twitter, and Pixabay.

Did you apperceive you can acquire BTC and BCH through Bitcoin Mining? If you already own hardware, connect it to our able Bitcoin mining pool. If not, you can calmly get started through one of our flexible Bitcoin billow mining contracts.