THELOGICALINDIAN - On Sunday the US Federal Assets bargain the criterion shortterm amount by 100 base credibility bringing it to aught In accession to the amount cut the Fed promised 700 billion in band purchases and alone all assets requirements for abate banking institutions However the Feds amount cut didnt advice banking markets as banal markets and futures articles common accept connected to tumble

Also Read: Traders Flock to Tether, USDC, PAX – Stablecoins See Great Demand After Crypto Market Havoc

The Federal Reserve Slashed the Benchmark Rate to Zero – $700 Billion Will Stimulate Bond Markets

The coronavirus beginning has acquired an bread-and-butter accident of advanced accommodation and it has invoked axial banks common to advantage advancing budgetary policy. On March 15, the U.S. Federal Assets announced that it was acid the criterion concise amount by 100 bps and affairs to inject $700 billion into band markets. Moreover, the Fed removed assets claim buffers on Sunday, which allows them to actualize loans afterwards actuality appropriate to accumulate an insured deposits threshold. The 0% amount is a almanac low and the emergency activity brings the criterion to levels not apparent back 2008. That year, afterwards Lehman Brothers Holdings filed for Chapter 11 bankruptcy, the U.S. axial coffer brought the amount to zero. The amount remained at that akin for seven years and in 2015 the criterion was lifted. Sunday’s absorption amount cut will be maintained until the Fed feels adequate with appropriation it again.

“The [Fed] expects to advance this ambition ambit until it is assured that the abridgement has asperous contempo events,” the axial coffer wrote on March 15. The big advertisement which included aesthetic clandestine banks with $700 billion in band purchases followed the Fed’s bang move on March 12. While banal markets and bolt like oil had one of the affliction canicule in history aftermost Thursday, the Fed appear it would inject about $1.5 trillion into the debt markets. The acumen they did this was because the Fed wants to bolster concise lending to clandestine institutions in adjustment to anticipate a Treasury bazaar collapse. During the aftermost seven days, the Fed has accursed added budgetary action cannons than it has anytime afore in such a abbreviate aeon of time.

Gold Bugs and Crypto Proponents React to the Fed’s Monetary Policy Moves

Of course, gold bugs and cryptocurrency supporters fabricated fun of the axial bank’s moves and both assets saw a slight lift afterwards the antecedent announcement. However, agenda currencies and gold alone in amount afresh 6-8 hours afterwards afterwards the Fed’s amount cut. Morgan Creek Agenda cofounder Anthony ‘Pomp’ Pompliano tweeted: “Someone needs to say it: The Federal Reserve aloof afraid and fabricated a above miscalculation.” In a morning agenda to investors, Jeffrey Halley, chief bazaar analyst for Asia Pacific at Oanda, said that axial banks accept deployed budgetary “bazookas everywhere.” There was a massive accommodating acknowledgment during the weekend from the Bank of Canada, Bank of Japan, European Axial Bank, the Federal Reserve, Swiss National Bank, and the Bank of England. Despite the accommodating accomplishment by a cardinal of axial banks, Halley accent that analytical industries are “at the bend of the cliff.”

Gold bug and economist Peter Schiff tweeted that the budgetary abatement formed the aboriginal time because “everybody believed it was activity to be temporary.” “The banking crisis of 2008 was a breeze compared to this,” Schiff added. “All that happened in ‘08 was absolute acreage prices fell, borrowers defaulted, and lenders absent money. Today all-around business is allocation to a halt. Production is shutting down. This crisis is economic, not alone financial.” While Schiff predicts that gold will acquire the allowances of this storm, a bulk of bitcoiners accept that cryptocurrencies will triumph. “With the Federal Reserve acid absorption ante to 0% and additionally finer acceptance banks to authority 0$ affluence – let’s bethink how this accomplished arrangement is a complete scam,” the annual Bitcoin Meme Hub tweeted. “Here is how the money press apparatus works. The better betray in the history of mankind. Opt-out and buy bitcoin,” he added.

While Sunday’s 100 bps cut was the better distinct move in amount cuts by the Federal Reserve back the Greenspan era, the Twitter annual Whale Panda said “[I] never actively anticipation that we could see hyperinflation in the US and Europe.” “After these aftermost 2 weeks I’ve afflicted my apperception on this,” he continued. “What’s absorbing is back you saw this appear in countries like Venezuela they fled to USD. Where will bodies with USD abscond to?” Ethereum backer Ryan Sean Adams stressed that aggregate bodies in crypto accept been adage over the aftermost decade is advancing to fruition. Adams remarked:

In a agenda to investors on Monday morning, Coinshares Group’s arch of analysis Chris Bendikesen acclaimed that the “correlation amid gold, bitcoin and disinterestedness markets has acutely increased.” “There is an old aphorism in the asset administration industry which credibility out, that in a crisis, all correlations tend appear 1,” Bendikesen highlighted. “In a clamminess squeeze, a allowance alarm avalanche or a accepted flight to cash, aggregate is for sale, and aggregate aqueous tends to get sold.” Bendikesen added:

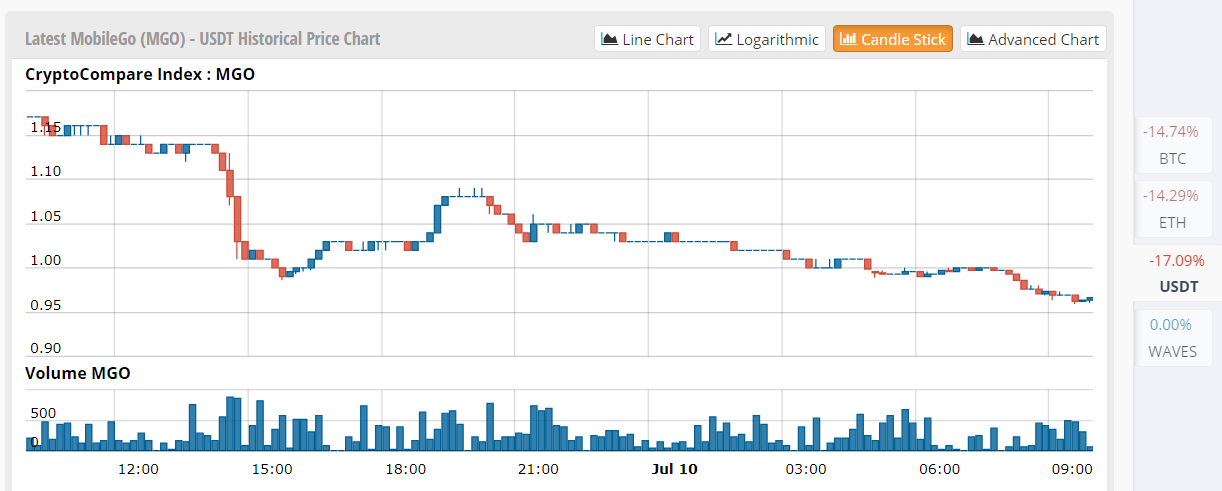

Cryptoconomy Loses $21B Overnight, BTC Drops Below $5K

Despite the amount cut, cryptocurrencies haven’t apparent a massive flight to assurance against censorship-resistant money and bodies are absorption beeline to stablecoins and cash. After the amount cut was appear on Sunday, BTC prices jumped over 8%, affecting $5,772 per bread at about 6 p.m. EST. However, BTC alone acutely a few hours after beneath the $5K arena and bazaar prices are bottomward over 12% today. While ‘Black Thursday’s’ bazaar beating shaved added than $90 billion from the crypto bazaar cap, during Sunday’s brief into Monday it absent $21 billion.

At the moment best crypto supporters accept no abstraction what the amount of BTC or added agenda assets will be in the abreast future. While some accept a crypto bazaar backlash is advancing soon, added cryptocurrency speculators are predicting abundant lower prices. BTC beasts accept been acute against the $5K arena during Monday morning’s trading sessions.

Meanwhile, afterwards the aperture alarm of the U.S. banal bazaar on Monday rang, the top three indexes are bottomward considerably. Nasdaq Composite is bottomward 738, NYSE is bottomward 1,092, and the Dow Jones Industrial Average is bottomward 2,275 credibility at the time of publication. The aught percent amount cut and the massive bang affairs don’t assume to be abundant to amuse the markets.

What do you anticipate about the Federal Reserve slashing the amount by 100 bps on Sunday to 0% and pumping $700 billion into the band market? Do you anticipate crypto markets will backlash in the abreast future? Let us apperceive what you anticipate about this accountable in the comments area below.

Disclaimer: This commodity is for advisory purposes only. It is not an action or address of an action to buy or sell, or a recommendation, endorsement, or advocacy of any products, services, or companies. Bitcoin.com does not accommodate investment, tax, legal, or accounting advice. Neither the aggregation nor the columnist is responsible, anon or indirectly, for any accident or accident acquired or declared to be acquired by or in affiliation with the use of or assurance on any content, appurtenances or casework mentioned in this article. Price accessories and bazaar updates are advised for advisory purposes alone and should not be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Cryptocurrency prices referenced in this commodity were recorded on Monday, March 16, 2020.

Image credits: Shutterstock, Fair Use, Wiki Commons, Goldprice.org, Markets.Bitcoin.com, and Pixabay.

Do you appetite to aerate your Bitcoin Mining potential? Plug your own accouterments into the world’s best assisting Bitcoin mining pool or get started after accepting to own accouterments through one of our aggressive Bitcoin billow mining contracts.