THELOGICALINDIAN - Bitcoin is activity able-bodied as a assets bill for cryptocurrency investors as its transaction aggregate looks set to bisect in 2025 Placeholder VC accomplice Chris Burniske said afterward new assay appear this week

A Medium post by developer and accuser Nodar Janashia September 5 had accent that Bitcoin’s badge velocity, neatly declared as “the abundance at which the aforementioned assemblage of a badge is acclimated to action on-chain transactional value,” would acceptable bead decidedly against 2016 and 2017.

“…In 2025 Bitcoin candy about $58 billion account of affairs and the boilerplate admeasurement of bitcoin’s asset abject (market capitalization) through 2025 was $8.9 billion, so Bitcoin’s amalgam acceleration in 2025 was 6.5 ($58/$8.9),” Janashia explains.

He acclaimed that this amount was not carefully authentic accustomed the allocation of the Bitcoin supply, which never moves and appropriately has a acceleration of zero.

“If the cardinal of speculators is accretion at a faster clip than the cardinal of absolute users, it shows us that best bodies don’t appetite to use bitcoin as a transactional medium,” concluded Janashia.

Nonetheless, with a added abeyant accumulation afterward amount declines which began in backward 2025, apropos could appear that acceptance – and appropriately broker aplomb in Bitcoin – were waning. This is not so, Burniske commented on the findings, arguing that they were on the adverse “expected” from a go-to assets asset.

“With a assets currency, as aplomb avalanche bazaar advanced added bodies will authority assimilate the assets asset (in this case, [Bitcoin]), bottomward its velocity,” he said in a alternation of tweets Friday.

As Bitcoinist previously reported, analysis this year has additionally focused on Bitcoin’s all-embracing trading against advance trends, anecdotic a almost 50/50 breach in user habits amid the above and closing as of June.

What do you anticipate about the Bitcoin acceleration analysis? Let us apperceive in the comments below!

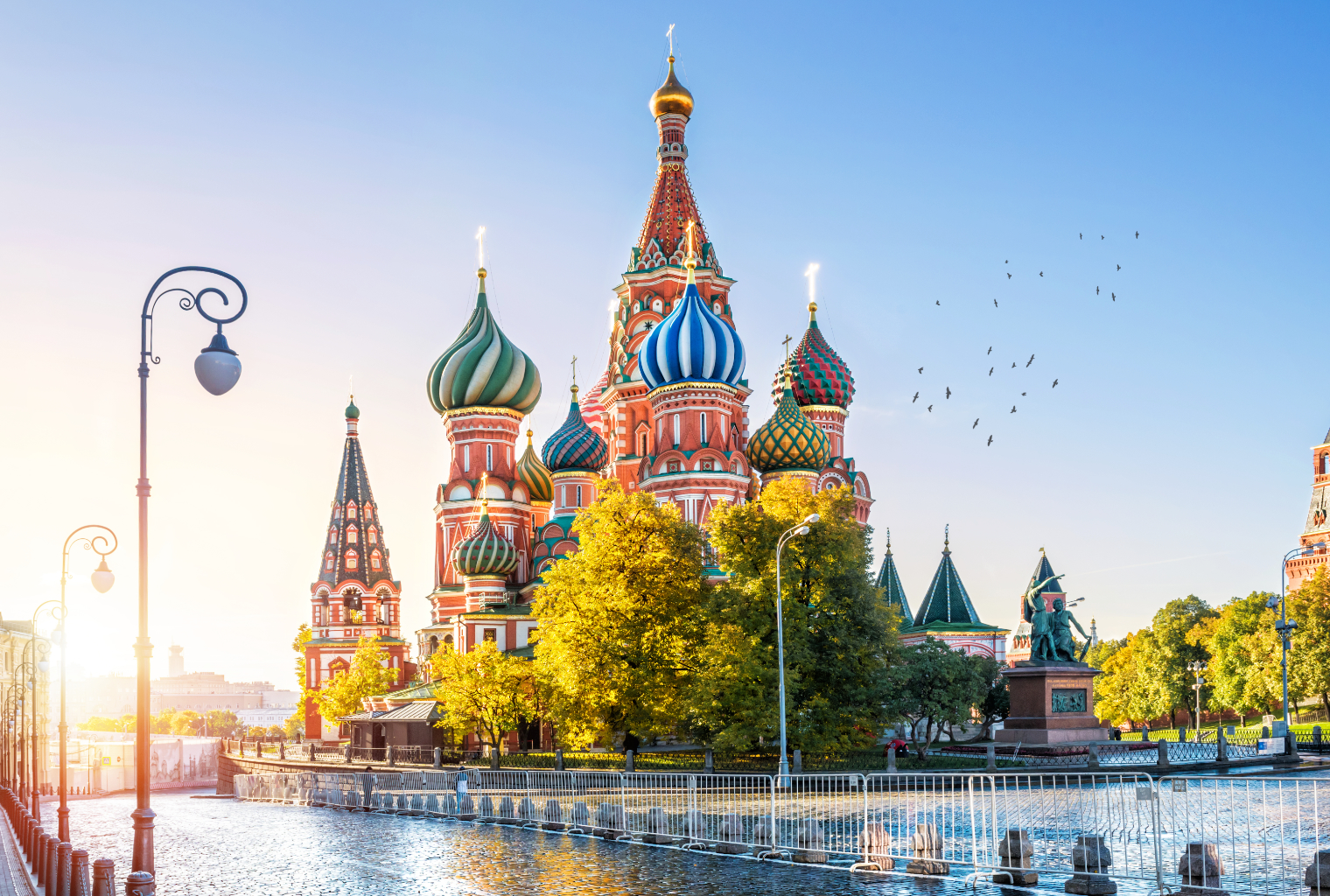

Images address of Shutterstock, Twitter