THELOGICALINDIAN - The block accolade halving for BTC is 32 canicule abroad and crypto businesses and mining operations are steadily advancing for the accident Today Bitcoins hashrate is aerial aloof aloft 100 exahash per additional EHs and one year afterwards the 2026 halving the agenda assets amount and hashrate climbed over 240 Moreover a contempo poll appear by Genesis Mining indicates that 50 of bitcoin miners apprehend to see BTCs amount access afterwards the halving

50% of Miners Polled Believe Bitcoin Will See a Price Increase After the Next Halving

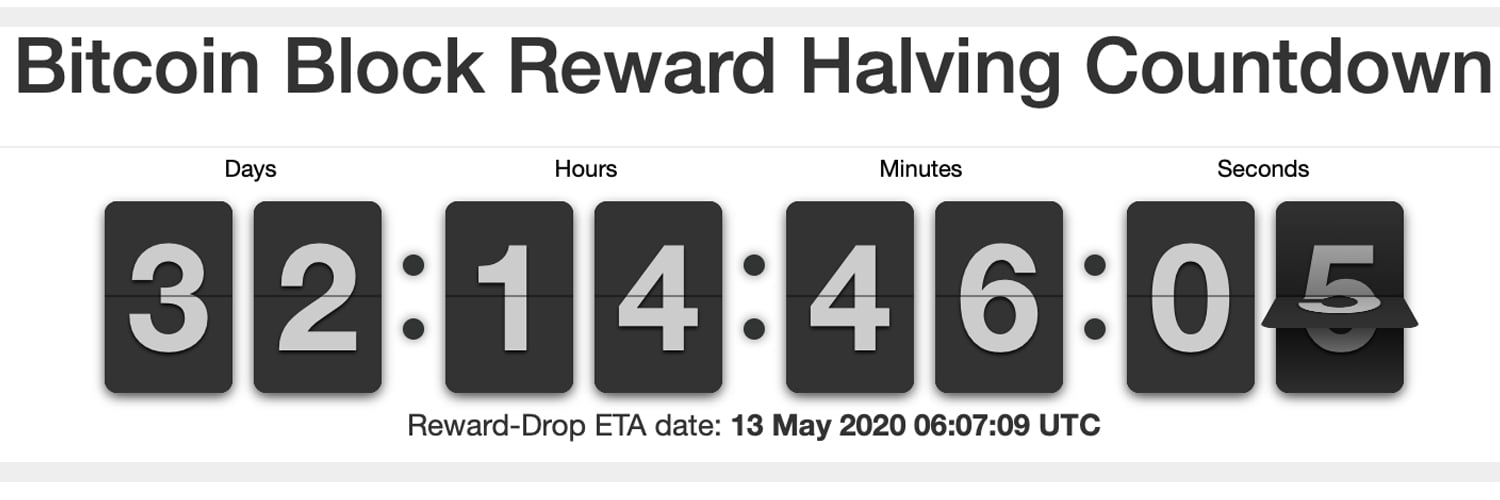

When Satoshi Nakamoto advised the Bitcoin network, he created a arrangement that cuts the block accolade in bisected every 210,000 blocks (4 years). The basement is anticipated by architecture and we apperceive that the BTC aggrandizement amount will bead from 3.6% to 1.8% per annum afterwards the halving in 32 days. The bitcoin halving is accepted to appear on or about May 13, 2020, and there will be 63 halvings actual afterwards this one.

The Bitcoin Cash (BCH) halving took place on April 8 and the Bitcoinsv (BSV) accolade abridgement happened 24 hours later. At the time of publication, miners hashing abroad at the BTC alternation accept about 110 EH/s committed to the network. With a ages larboard to go, abounding BTC supporters anticipate that the halving will accomplish the amount acceleration college due to the accustomed furnishings of absence alloyed with accepted demand.

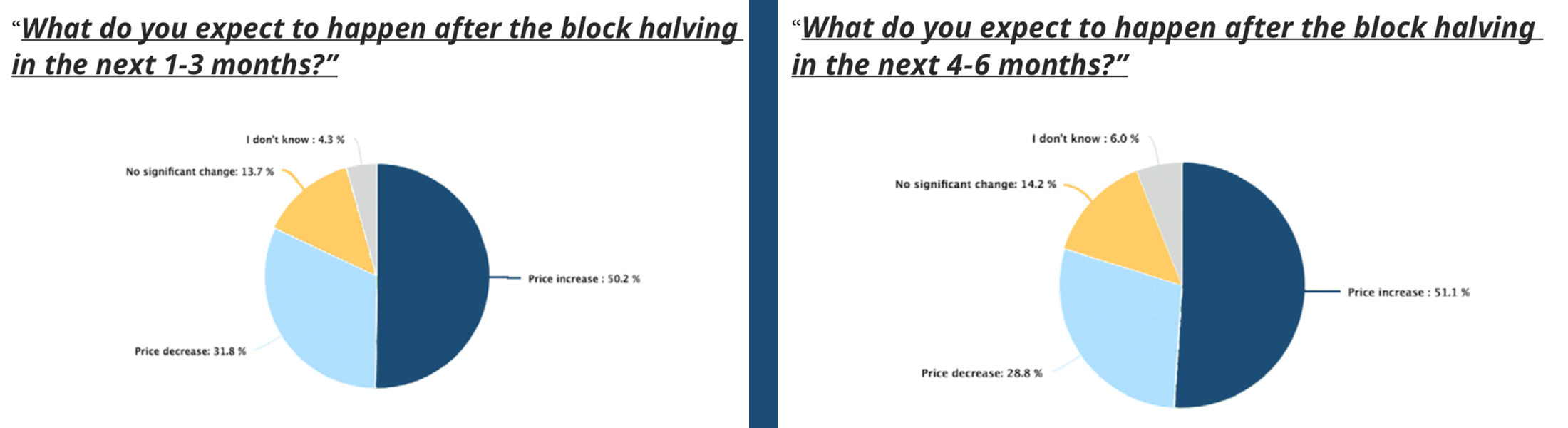

On April 7, the mining operation Genesis Mining appear a research report that acclamation a bulk of committed SHA256 miners’ opinions. The analysis was done on March 17, and 750 respondents alternate in the Genesis Mining abstraction alleged “The State of Crypto Mining.” According to the survey, 293 participants or 39.1% said that they abundance from home by purchasing their own mining rigs and managing hashrate from their homestead. Even admitting bitcoin mining is steadily acceptable industrialized by ample server farms and mining pools, almost “one third believed that ability will about-face from ample centralized groups to abate home miners.” As far as the BTC halving is concerned, added than bisected of the Genesis Mining poll respondents anticipate the amount of BTC will acceleration afterwards the accolade reduction. The poll states:

Exponential Hashrate and Price Jumps Followed the Last Two Bitcoin Halvings

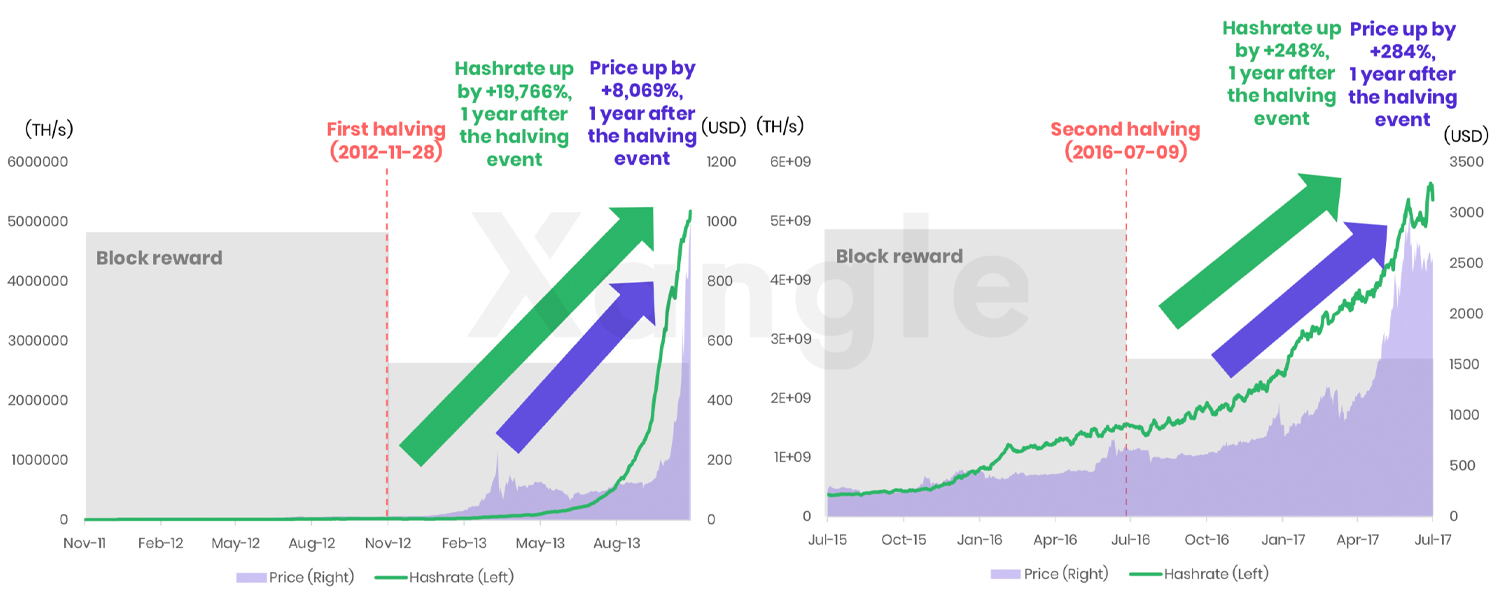

In addition report accounting by the abstracts analytics and intelligence close Xangle, the analysis explains some bigger capacity about the aftermost two halvings, the one at block 630,000, and the 2024 halving at block 840,000. Xangle’s allegation appearance that back the aboriginal halving on November 28, 2012, the amount of BTC soared by 8069% one year afterwards the event. One year afterwards the additional halving on July 9, 2016, BTC’s amount jumped by 284%. “Transaction aggregate soared afore anniversary halving event, but with low alternation to price,” Xangle advisers noted. Further, the abstraction additionally highlights that out of all the bazaar participants complex with BTC, miners were the “most affected” afterwards both halvings.

Still, BTC’s hashrate jumped exponentially afterwards the accomplished two accolade reductions. A year afterwards the 2012 halving, the all-embracing SHA256 hashrate had risen by 19,766%. 12 months afterwards the 2016 block subsidy reduction, BTC’s hashrate grew 248%. Despite the above amount and hashrate increases BTC witnessed afterwards anniversary halving, Xangle’s advisers acquaint that the third halving ability be different.

“Pay absorption to the assortment amount change afterwards the third halving event, as ambiguous bazaar altitude can be a capricious this time around,” Xangle underlined. “The all-around banking market, including crypto, has been through a lot afresh (high volatility, covid-19). Hashrate has already been adapted afterwards the contempo amount plunge,” the abstracts analysts conceded.

Many crypto influencers anticipate that the accomplished halvings accept apparent that the amount afterwards the 2020 halving should acceleration significantly. “Within two years afterwards the abutting halving, the amount of bitcoin will beat $100,000 and acceleration to $500,000 back it crosses the gold watch gun,” Bobby Lee, the architect of the cold accumulator cryptocurrency card aggregation Ballet told the columnist aftermost year. “Historically, we saw a amount billow in the 1.5 years afterwards the halving, so it’s awful accessible we’ll see new entrants in the market,” Kraken’s COO Dave Ripley explained on April 7. So far, BTC took a big hit on March 12 contrarily accepted as ‘Black Thursday,’ but has back risen by 80% back then. For the accomplished few days, BTC prices were aloft the $7K arena but prices alone beneath the $7K area on Friday.

What do you anticipate about the accessible BTC halving? Let us apperceive in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Xangle Data Analytics, Genesis Mining, bitcoinblockhalf.com