THELOGICALINDIAN - Central banks are anxious about the boundless acceptance of stablecoins aggressive the all-around banking arrangement As they accomplish recommendations to heavily adapt or alike ban them the Crypto bazaar now faces its better blackmail yet

Financial Stability Board (FSB) Recommendations Brutal for Digital Assets

In a document appear yesterday, the Financial Stability Board (FSB) categorical its apropos about stablecoins in the all-around banking market. Since stablecoins “enhance the ability of the accouterment of banking services,” that’s a botheration for the cachet quo.

Widespread adoption, they believe, would accord acceleration to an absolute banking arrangement out of their control. It could alike alter authorization currencies and “exacerbate coffer runs.”

The fears of the risks stablecoins acclimated by the crypto bazaar affectation to banking adherence accept continued been backed by countries like China and France. The French AMF aftermost week recommended that the EU actualize specific regulations for stablecoins advertence that they airish “systemic risks” to the Union.åç

Among the FSH guidelines are abounding recommendations that abatement abbreviate of an absolute ban. These accommodate advancement bounded axial banks to assiduously regulate, supervise, and ascendancy stablecoins. They additionally advance that babyminding frameworks are put in abode to analyze accountability and ensure that all stablecoins accommodate cellophane information.

The recommendations do, however, go as far as to say that bounded authorities should ban stablecoins absolutely if needed, including those that run on absolutely decentralized systems, like crypto networks such as Ethereum.

Crypto Market Could Suffer Greatly From Stablecoin Ban

A ban on stablecoins could be potentially actual scary, indeed. To alpha with, it would about clean out the absolute DeFi movement and projects like MakerDAO and Compound. Worse still, it could account an ambidexterity clamminess crisis beyond the market.

Just accede stablecoins like Tether (USDT) and TrueUSD (TUSD) that are both backed by the US dollar. For abounding users about the world, stablecoins are acute in trading crypto assets like bitcoin.

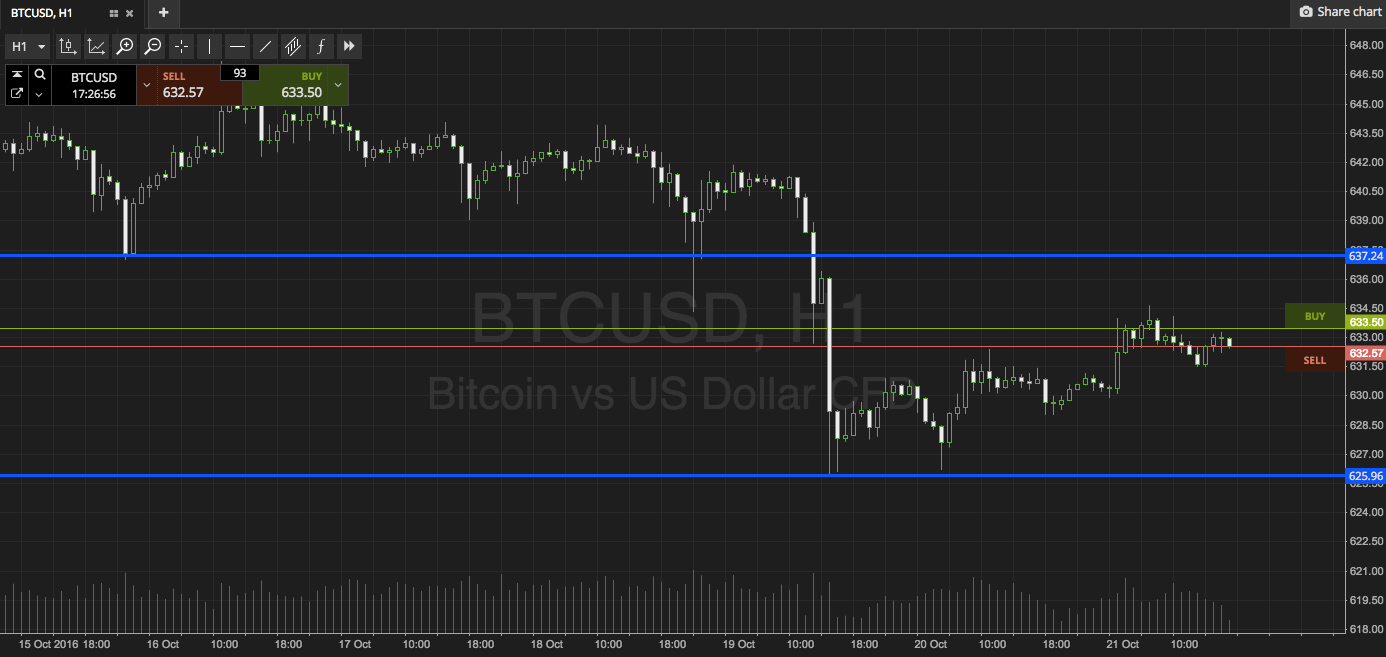

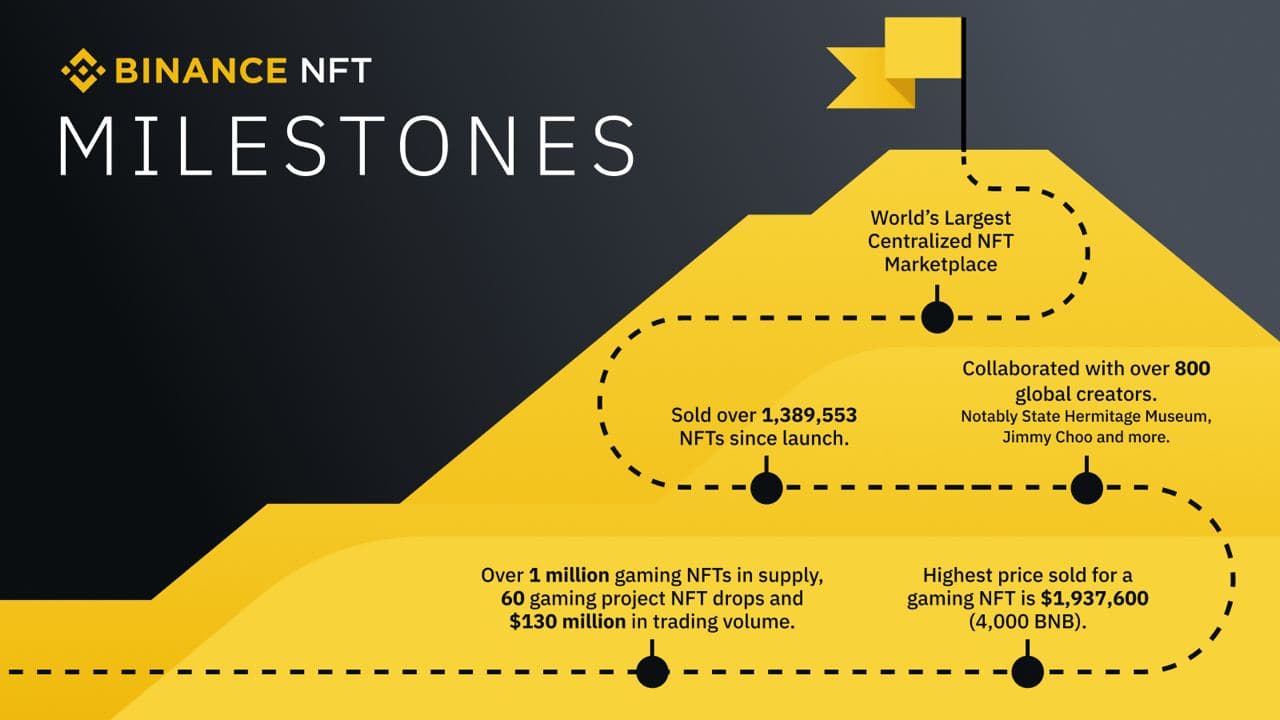

Let’s booty assertive Binance as the best example. Currently, it is number one in agreement of trading volume. Yet Binance alone uses stablecoins like Tether, Binance USD, and Paxos Dollar. As Bitcoinist appear yesterday, there is $1bn of USDT sitting on Binance appropriate now.

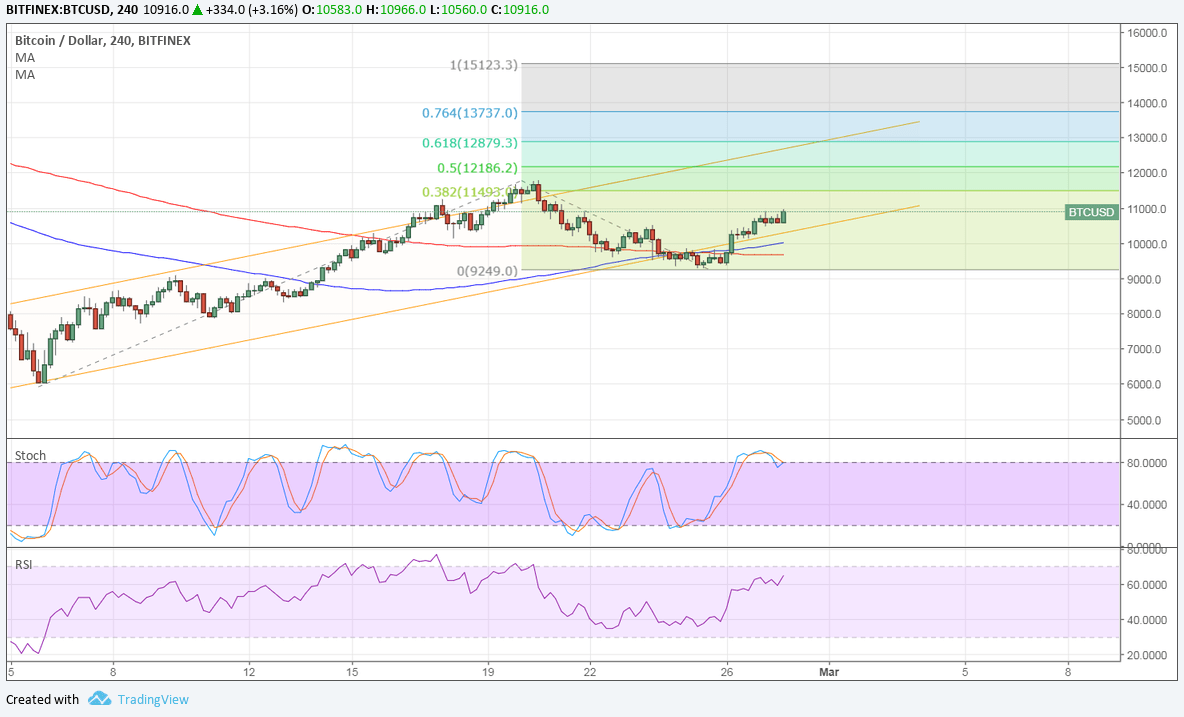

This is a absolute assurance for crypto as it suggests that traders are steadily sending their stablecoins to the barter in adjustment to beat up crypto assets. It appears that abounding investors are cat-and-mouse for the appropriate time to catechumen their backing to BTC and potentially sparking a new rally. Yet all that could be apoplectic if the FSB recommendations are adopted.

In practice, they may not aftereffect in an absolute ban. However, they could accountable cryptocurrency exchanges and account providers to the aforementioned scrutinous regulations as banks and added FSIs. This could advance abounding projects and companies out of business.

And an absolute ban that sees behemoth stablecoins like Tether leave the bazaar could additionally see a accumulation departure of traders and a clamminess crisis like annihilation the crypto bazaar has ahead faced.