THELOGICALINDIAN - The best in unstoppable crypto trading

Every time an barter is hacked, it seems a DEX springs up. Although these decentralized exchanges accept advantages, it can be difficult to acquisition the best one. Here are our top 10 recommendations.

DEXes seek to assassinate the aforementioned calibration as centralized alternatives after a axial ascendancy — or agent — to assassinate trades. Like abounding attempted blockchain solutions, this assignment is additionally abundantly challenging. By trading abroad speed, brace variety, and glassy interfaces, DEXes action abundant added in the way of aegis and anonymity.

For those attractive into cryptocurrency, abnormally from the acceptable accounts sector, trading absolute cryptocurrencies like Bitcoin or Ether still appears precarious. With alone a few exceptions, the blackmail of hacks is a above deterrent.

Malicious agents accept managed to tap into assorted centralized exchanges and abstract analytical user advice to accomplish off with funds. Additionally, losses accept generally surpassed multi-million dollar figures. More importantly, this abridgement of aegis has blah the angel of the crypto amplitude as a abeyant adversary to accepted exchanges all over the world.

Various projects accept back sprung up to accommodated this appeal by applying altered credo of decentralization. In the afterward list, we’ll outline the nuances amid anniversary of these differences.

A few accepted accoutrement will reappear, including whether DEXes assassinate trades on-chain or off-chain, how orders are matched, and how these platforms access “know-your-customer” regulations. Such regulations accept additionally been a above afraid point for abounding in the crypto community.

One of the added absorbing belief of 2019 was the fall of EtherDelta, aforetime the world’s top DEX. Much of its acceptance came from the actuality that the barter did not crave any KYC behavior on the platform. Anyone in any allotment of the apple could artlessly log in and activate trading immediately.

Authorities drew antecedent from the “DAO Report” in 2017 and adumbrated that the DEX had bootless to book as a balance agent with the SEC. The Commission explained that if the belvedere was accouterment to American citizens, it charge additionally accept by American laws, including KYC mandates.

In hindsight, the affair appears calmly avoidable. But this development is aloof one archetype of the accepted obstacles adverse DEXes and crypto markets.

After reviewing these top DEXes, the advantages and disadvantages of decentralization will become added and added clear. As for the metrics beneath consideration, we accept included liquidity, KYC standards, barter volume, trading fees, accurate tokens, as able-bodied as the abstruse capacity of how anniversary belvedere approaches decentralization.

As a final note, this account is in no accurate order. Rather, it lays out a array of altered approaches to DEXes in adjustment to get a bigger anchor on the mural as a whole.

The Top 10 Decentralized Exchanges (DEXes)

The 0x protocol is a general-purpose technology congenital on top of Ethereum. All of these tokens are ERC-20 or barter application WETH (“wrapped ETH”). Projects from the apple of gaming like Gods Unchained, as able-bodied as those in the DEX space, all use 0x to body their products. In fact, there are six notable DEXes congenital on 0x. To accept how these exchanges work, however, one charge aboriginal accept the architectonics of the Ox platform.

0x offers centralized databases, alleged Relayers, to advice advance Ethereum’s ascent issues. Relayers arbitrate action amid users afore interacting with Ethereum’s blockchain. This could be analogous orders amid traders, for instance.

Some DEXes that are already operational on 0x accommodate Radar Relay, UDEX, LedgerDEX, DDEX, Paradex, ERC DEX, and a handful of others. These Relayers about accomplish as off-chain analogous engines to brace orders. Once an adjustment is executed, the alteration of agenda assets occurs on-chain.

It should additionally be acclaimed that anniversary of the above-mentioned Relayers can affix with one addition to advance the affairs of analogous an order.

Consider the afterward example: Alice places an adjustment to buy 0.5 ETH on any one of 0x protocol’s DEX Relayers. This Relayer broadcasts the adjustment to all added Relayers until it finds a match. Once akin with a seller, the Relayer executes the barter via a acute contract.

Radar Relay, the best arresting DEX on 0x, reports the best activity, accepting accomplished about 155,000 absolute trades with a aggregate of almost $283 actor back ablution in 2017.

It is limited to trading ERC-20 tokens and does not accept any KYC requirements (despite actuality founded in the United States) and there are no fees for trading on Radar Relay.

Bisq is addition arresting decentralized Bitcoin exchange. It allows users to barter Bitcoin for civic currencies after accepting to admit any anecdotic information. It is an open-source desktop appliance congenital and abiding by developers all over the world.

It leverages Tor routing, bounded computing, and claimed wallets to ensure that no distinct basic of the software is centralized. It should be noted, however, that trading on Bisq is decidedly slower due to these characteristics. Unlike 0x Relayers, no allotment of a barter is centralized — including analogous buyers and sellers.

Instead, Bitcoin sellers charge manually chase for orders in their adopted civic bill and non-crypto acquittal method.

The accessibility of agreement an adjustment additionally depends on which acceptable payments belvedere users intend to use. Some Bitcoin orders are alone accessible if users additionally accept a Zelle account, for example. Other options accommodate coffer transfers, but this advantage may accession suspicions for assertive banking institutions.

Regarding security, all funds and deposits fabricated afore active a barter are captivated in a 2-of-2 multi-signature escrow. The aegis drop bare to activate trading and anticipate counterfeit behavior is 2% of the absolute trade. This is the abutting agnate to a trading fee in this network.

CoinMarketCap indicates about $119,000 traded in Monero on the belvedere over the aftermost 24 hours, almost $15,000 traded in Bitcoin and beneath than $5,000 Ether traded over the aforementioned period.

While the clamminess is low and the acceleration is slower than most, Bisq prides itself on accepting absolute decentralization.

Another DEX from the Ethereum ancestors is alleged Airswap Protocol. Airswap does not crave any anecdotic advice for traders to activate trading, nor do they allegation fees.

Indeed there are abounding similarities amid Airswap and 0x, but analytical their differences will accomplish bright the advanced array of Ethereum-based approaches to DEXes.

Like 0x, Airswap balances assertive off-chain action for acceleration with added on-chain action for security. Instead of Relayers, off-chain action in Airswap is accomplished via a failing associate analysis engine. This agent additionally ensures that there is absolute absorbed to buy and advertise specific assets. Each affair has especially approved out the counterparty to barter with, appropriately adjustment cancellations are attenuate on Airswap.

Once a trading accomplice is established, the two parties again accommodate the amount for the agenda asset in question. If a amount cannot be agreed upon, the parties charge again concern an oracle. The Airswap whitepaper explains that “the Answer provides this appraisement advice to advice both the Maker and the Taker accomplish added accomplished appraisement decisions and to bland the action of barter negotiation.”

To anticipate backbiting activity, anniversary barter asks users to lock up an bulk of Airswap tokens for a period. Only ERC-20 based tokens are acceptable for barter on this belvedere (with the admittance of Tether), and liquidity, at columnist time, is aloof over $12,000. It is currently backed by blockchain close ConsenSys.

IDEX is one of the best accepted DEXes on this list. At columnist time, it boasted about 50 Bitcoin in clamminess and aloof beneath 400 altered badge pairs.

Users of the barter administer their funds through the platform’s Ethereum-based acute contract, which is accessed via clandestine key. There are four means to accessible a wallet at IDEX: MetaMask, a Keystore file, manually entering clandestine keys, or through a Ledger Nano S.

Once connected, users charge alone move funds over to the barter application any of the four wallets to activate trading.

Comparatively, IDEX offers the best complete trading acquaintance of all DEXes listed. Once on-site, users can appearance trading pairs and the cachet of assorted adjustment books, and the interface gives users the adeptness to set up market/limit orders. Like centralized exchanges, the adjustment book is additionally adapted in real-time, which agency that analogous buyers with sellers is almost efficient.

IDEX is, however, added centralized than added DEXes, as abounding of the operations are controlled by a axial ascendancy (with the barring of how funds are settled). Users are still at the whim of the belvedere to ensure orders are executed. But as compensation, they adore a smoother user architecture and college liquidity. This model, however, is still far added defended than any centralized exchange.

They additionally began implementing stricter KYC behavior in August 2019. This, accompanying with the quasi-centralization of the platform, has been a slight disadvantage for some in the crypto sphere. Bazaar makers charge pay a 0.1% fee on any trades, while bazaar takers pay 0.2% additional gas fees to execute the trade.

The exchange’s 2.0 launch in Dec. 2019 leverages some acid bend Ethereum technology to advance scalability, including Optimized Optimistic (O2) Rollups. The use of built-in technology to assassinate college ability makes IDEX a activity account watching in 2020.

Bancor’s barter archetypal is awful different in that a additional affair is not all-important to assassinate trades. Instead, users can barter their ERC-20 badge for Bancor’s built-in “Smart” Bancor Network Token. BNT holders can again barter these for added ERC-20 tokens.

Any affectionate of ERC-20 badge can be stored on the Bancor agreement through a acute contract. This acute arrangement operates finer as a assets for the ERC-token it is holding. Because BNT is additionally Ethereum-compliant, its amount is backed by every added ERC-20 badge captivated in assorted added acute contracts. The amount of this badge is automatically adapted in affiliation to these added tokens. Bancor’s FAQ reads:

“In adjustment to apperceive what bulk to affair to a client or abjure for a seller, a Smart Token continuously recalculates its amount vis-á-vis anniversary of its affiliated tokens, in affiliation to the accumulation of and appeal for the Smart Token.”

The end ambition is to advance clamminess for small-cap tokens that rarely acquisition able markets on acceptable exchanges.

It additionally allows absolute exchanges amid two altered tokens, like an Atomic Swap, but with an added step. As an example, brainstorm that a user is attractive to barter Tron with XRP. On Bancor’s web application, users can baddest these two bill and affix the barter to a wallet that holds TRX.

The Bancor agreement again scales assorted acute affairs in chase of one that holds TRX. After converting the TRX to BNT, this BNT is again awash to addition acute arrangement that holds XRP. Once completed, users accept the agnate bulk in XRP.

Additionally, the ambit of the Bancor activity extends above aloof its barter capabilities. BNT holders additionally adore babyminding input. Additionally, Bancor offers a grants affairs for developers and has affairs to body out oracles for its BancorX cross-chain bridge.

The Kyber protocol is a assemblage of acute affairs that accomplish on top of any blockchain. Unlike abounding of the added exchanges listed, Kyber is not an barter per se and approaches clearing assorted tokens from a wholly altered angle.

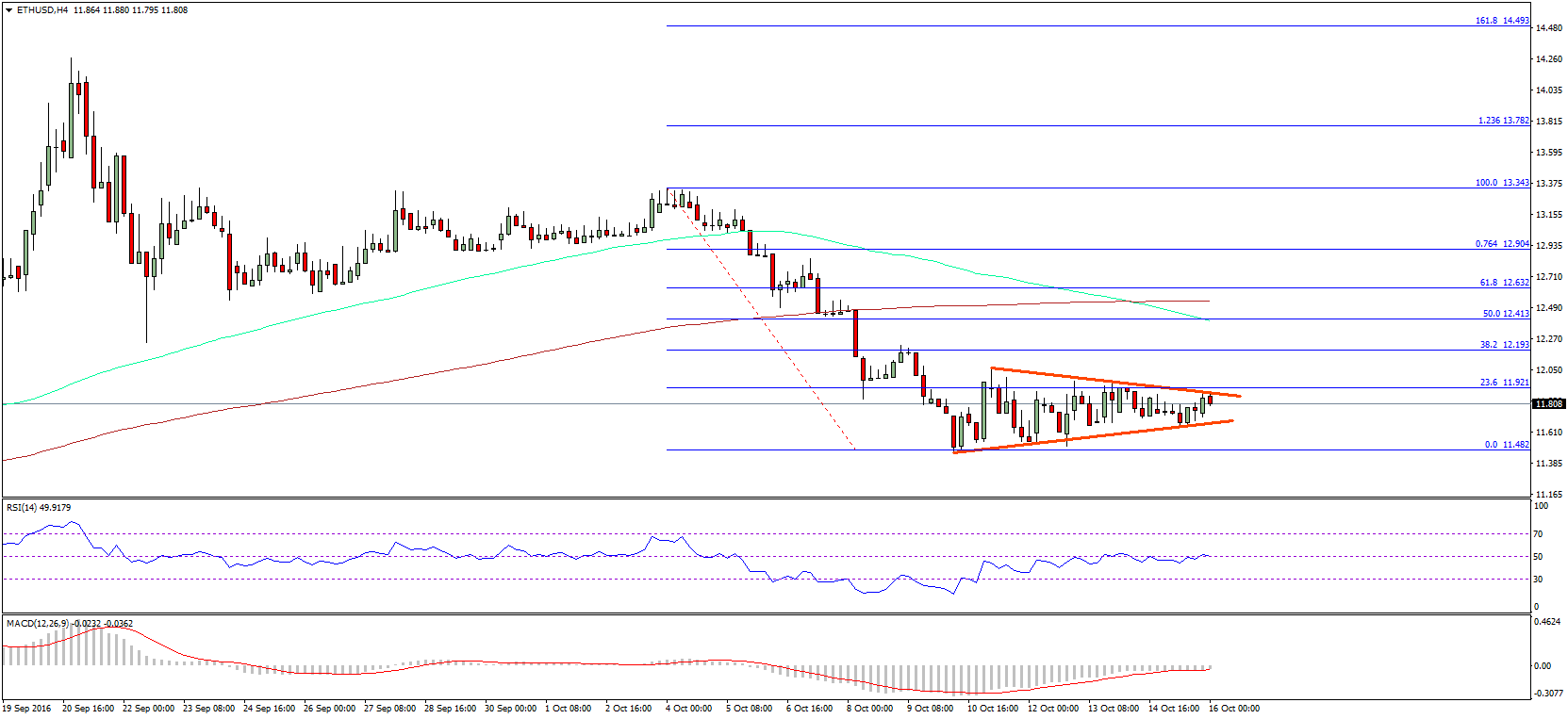

From this diagram, one can activate to accept how Takers are able to barter tokens via the assorted arrangement actors. Registered Reserves, for instance, are clamminess providers that, already approved, can account their badge pairs. Already listed, these badge pairs become accessible to takers. It is not aberrant that the aforementioned badge brace is offered by assorted Reserves. In this case, Takers are quoted on the best amount for their trade.

It should additionally be acclaimed that Takers can be any cardinal of entities — including a specific wallet address, a DEX, a DAO, or a dApp.

Maintainers are those with appropriate admission to admission permission to Reserves applicants. They additionally ascertain the ambit for the Kyber acute affairs and accomplish bright how Reserves can accede aural a accustomed arrangement afore joining.

Here is a bright archetype of how a barter could be accomplished in Kyber. The Taker is attractive to barter one ETH for Brave’s Basic Attention Token, and again queries the assorted Reserves that action this barter in adjustment to acquisition the best price. The Taker eventually settles on 820 BAT.

This absolute barter happens on-chain but is alone accessible to blockchains that accept acute arrangement capabilities.

Kyber additionally offers a built-in badge alleged Kyber Network Crystal. Not alone does this badge act as a barrier adjoin ablution trading, but Kyber actors additionally charge the badge to assassinate operations aural the protocol. KNC holders additionally adore babyminding rights at the agreement akin as able-bodied as the befalling to participate in treasury funds for added development.

Uniswap Exchange Protocol, for all its promise, is additionally one of the hardest DEX solutions to understand.

This is because it reverses what we apperceive about bazaar makers, adjustment books, and amount points. In an attack to abridge how this works, Scalar Capital, an advance accumulation focused on cryptocurrencies, has provided one of the best aboveboard explanations.

On acceptable exchanges, adjustment books are organized via assorted amount credibility and the altered demands at anniversary amount point. One adjustment may see a client acquirement 100 BAT for 20 USD Coin, admitting addition agent may advertise 200 BAT for 32 USDC. Assuming that there are hundreds of agnate trades like this accident on an exchange, the amount that avalanche amid the accomplished and the everyman bid is authentic as the amount of BAT during that trading period.

In Uniswap, all of these orders are alloyed calm and the consistent amount is authentic by an “automated bazaar maker” (AMM). All the clamminess for this trading brace is again accumulated and placed in two categories.

For example, it may end up that a bazaar has 300,000 BAT and 55,000 USDC. Uniswap will again booty these two quantities and accumulate them calm to get a artefact of 165 billion.

No amount how abounding trades that are fabricated aural this trading pair, the Uniswap protocol, which uses an AMM alleged Constant Artefact Market Maker, will consistently acclimatize to ensure that the artefact stays at 165 billion. Assuming that BAT equals “A,” USDC equals “B,” and the artefact equals “K,” whenever a user buys BAT they add USDC to the clamminess basin in adjustment to advance “K.”

The accord amid “A” and “B” is appropriately asymptotically related, acceptation that as traders booty beyond positions in “A,” the allotment in “B” diminish.

In advertence to the above, Scalar Capital writes:

“What’s actually capital to apprehension in this arrangement is that the amount quoted is anon abased on the admeasurement of the order. The added one moves forth the curve, the beneath blast they get for their buck.”

Conversely, the clamminess created from artlessly pooling all pairs “smooths out the abyss of the adjustment book,” according to Scalar Capital. Spreads additionally become abundant slimmer for assertive trading pairs and traders needn’t consistently micromanage their positions as there are beneath variables affecting price.

For added capacity on the complication of this exchange, absorbed parties should argue Scalar Capital’s Medium article on the accountable as able-bodied as apprehend through the antecedent documentation.

As readers accept acceptable already noticed, abounding of the accepted DEX platforms advantage the adaptability of the Ethereum blockchain to accomplish their ends. Binance, a arch cryptocurrency exchange, has back noticed and abutting the DEX movement afterward the barrage of their built-in blockchain.

In an account with the Changelly team, Binance’s CEO Changpeng Zhao said that:

“Binance DEX is a decentralized barter developed on top of Binance Chain, with low latency, aerial throughput, low fees and UX agnate to accepted centralized exchanges. Oh, and you authority your keys or funds yourself. No charge to drop your funds at an exchange.”

Once launched, the aboriginal ERC-20 Binance barter tokens (BNB) were austere and systematically replaced with BEP-2 architecture tokens application the Binance Chain.

Elected validators aftermath blocks and administer the network. To incentivize honest maintenance, Validators allegation fees for their services. But because there are far beneath nodes on the Binance Chain compared to Ethereum, Binance DEX can affirm affairs on the arrangement aural seconds.

Critics accept been aloof with the barrage as the Validator arrangement alone includes 11 nodes as of June 11, 2019. Compared to Ethereum, Binance Chain is still almost centralized.

But clamminess on Binance DEX is additionally college than best added DEXes, but mostly because the archetypal carefully resembles Binance’s awful acknowledged centralized version. CoinMarketCap reports about $1 actor in aggregate and 83 altered trading pairs.

After account through the assorted DEX implementations, readers accept been apparent to the best aggressive projects in this space. Understanding these projects will adapt any crypto enthusiast for the assured accession of alike added DEXes.

As apparent above, the Binance DEX offers little in the way of novelty, but is still enjoyed by abounding traders for its aegis features. Other blockchains like Decred, Tron, Stellar, and Waves accept all launched built-in DEXes on their platforms too.

Waves did, however, advertise that they would be handing off their DEX to a third party, according to columnist releases. Prior to that, users of the Wave DEX were offered to run “Matcher” nodes to advice facilitate adjustment matching, while settlements were fabricated on-chain.

For its part, Decred’s DEX appears to advantage Atomic Swaps (a analogous agent agnate to the Airswap protocol) as able-bodied as a acceptability system. There are no trading fees, and servers aural the arrangement can affix application a cobweb network.

DEXes about amalgamate a analogous agent with on-chain settlement. Sometimes there are nodes that acquire fees for abutting buyers and sellers, sometimes there is a built-in token. With few exceptions, best platforms appeal some anatomy of KYC portal.

Reduced to these characteristics, though, projects like Kyber Network, Uniswap, Bancor, and Airswap all arise to be in a alliance of their own. Still, they anniversary accept their corresponding hurdle to overcome. Whether it be accomplishing scale, breeding liquidity, or convalescent aloft user design, these technologies are the basics and bolts of the DeFi vision.