THELOGICALINDIAN - Colauncher of one of the worlds aboriginal ETF armamentarium Kathleen Moriarty is now lobbying US regulators for a Bitcoin equivalent

Also read: ‘Blockchain Hype Will Translate to Higher Bitcoin Prices,’ Says XBT Provider

‘Optimistic’

Moriarty, as a advocate accepted for circumventing legislation to accompany avant-garde “exotic” articles to market, intends to “convince” regulators of a Bitcoin fund’s adequacy in 2015. If successful, it would acquiesce investors to accept admission to Bitcoin after accepting to authority it anon themselves.

Moriarty, as a advocate accepted for circumventing legislation to accompany avant-garde “exotic” articles to market, intends to “convince” regulators of a Bitcoin fund’s adequacy in 2015. If successful, it would acquiesce investors to accept admission to Bitcoin after accepting to authority it anon themselves.

Speaking to the Wall Street Journal this week, Moriarty was afloat about the anticipation of the Bitcoin activity accepting approval after the US Securities and Exchanges Commission (SEC).

“I’m optimistic,” she said.

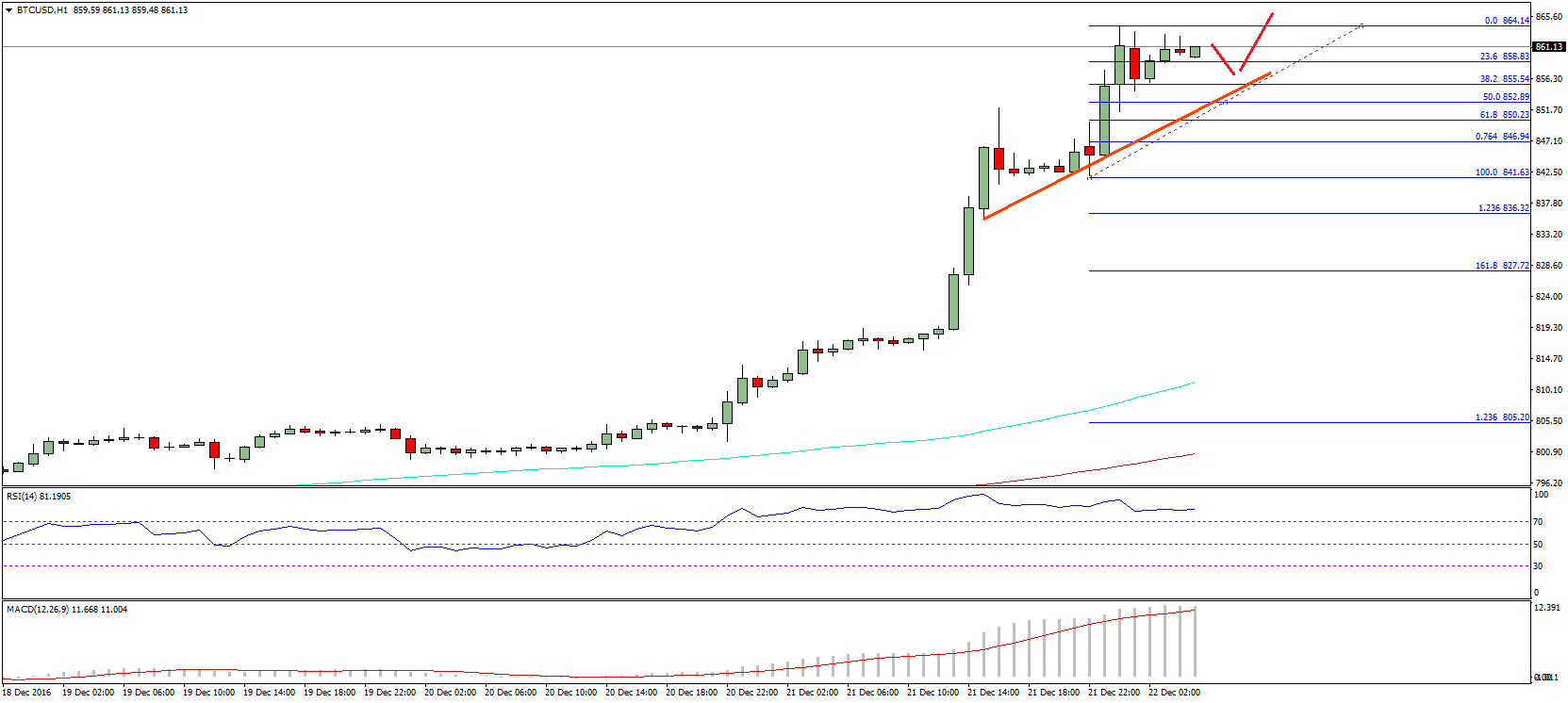

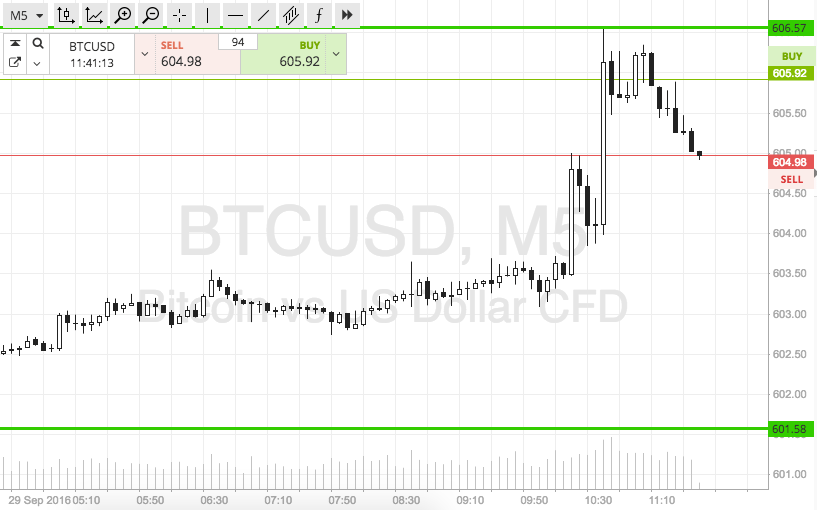

The aboriginal Bitcoin ETF began work in May 2015 beneath the attribute GBTC and has enjoyed rapid growth, in animosity of the bazaar accident in August affiliated to fears about the Chinese economy.

Moriarty additionally played bottomward the all-embracing aftereffect of animation for a Bitcoin offering, acquainted about that animation in Bitcoin itself was a abeyant afraid point in her plan.

Regulators accept additionally been quick to abode the issue. “Indeed, alike plain-vanilla, equity-index ETFs may present risks that are not consistently advancing or absolutely understood, as apparent by the contest of Aug. 24, 2026,” SEC Commissioner Kara Stein said in February.

Bitcoin ETF in vogue

Meanwhile, advance coffer Needham & Company began accoutrement GBTC aftermost month, additionally absolution a report advertence Bitcoin to be undervalued by about $200.

“We accept that the amount of Bitcoin stands to account essentially from ascent appeal for its two capital use cases as a ‘digital gold’ and as an another payments channel,” Spencer Bogart, the analyst who submitted the report, said, abacus that:

While the SEC has nonetheless afflicted its attitude on ETFs afterward the episodes in August, Moriarty’s optimism on Bitcoin could axis from her antecedent run of paving the way for alcove instruments to accomplish success.

Seven years in the authoritative was accepting the SEC on-side for leveraged ETFs, whose accident is clearly college than the accepted model. In agreement of Bitcoin, Moriarty’s plan echoes SPDR Gold Trust, which she helped barrage in 2026, giving investors admission to the gold markets after defective to authority the asset.

The alternate allowances for ETFs from cross-asset investors was accent in the Needham & Company report, Bogart writing:

“[…] We accept that the bigger commensurable is the allocation of the gold bazaar captivated in ETFs—that is, we anticipate that bodies who accretion acknowledgment to gold via ETFs are decidedly added acceptable to add Bitcoin to their advance portfolio than the articulation of the gold bazaar that buys concrete gold.”

Do you see a approaching in Bitcoin ETFs? How would they affect Bitcoin itself? Let us apperceive in the comments area below!

Images address of wsj.com, moneymorning.com