THELOGICALINDIAN - Highleverage crypto account captivated and arranged every Friday

This week’s copy of wNews dives into why Ethereum and DeFi are currently surging. More importantly, though, the amplitude was afresh faced with amazing gas fees reminding newcomers that it’s a whale’s game.

Portfolio admeasurement aside, Bitcoin traded alongside this anniversary afterwards a rather airy January. Data suggests that dip-buying is the accepted trend admitting a abrupt alteration on the cards. Still, new best highs are acceptable to access afore that happens.

Finally, an arising NFT basis saves investors time and accomplishment back aggravating to ride the agenda collectibles trend. Froth nor not, this activity offers acknowledgment to some of the best accepted NFT tokens in the space.

All that and more, below.

Ethereum Goes All The Way

The above banderole this anniversary was the brief acceleration of Ethereum. As ETH breached $1,600, recording a new almanac aerial for the additional time this year, assorted DeFi projects followed closely.

Etherean moon bois took to Twitter to bless the “inevitable.”

The surge’s affidavit are myriad, but Nansen architect and CEO, Alex Svanevik, cited two in particular. “Ethereum has caked its position as the cardinal one blockchain for decentralized finance, putting the ‘Ethereum killers’ anecdotal to sleep,” he told Crypto Briefing.

“There’s additionally able affirmation of retail inflow, which can be apparent beyond metrics. January, for instance, had the accomplished bulk of alive Binance depositors back 2026, according to abstracts from Nansen.”

Alongside ETH, Aave (AAVE), UMA Protocol (UMA), and SushiSwap (Sushi) additionally entered amount discovery. The moves from these abate tokens and their ascendancy in the DeFi area advance an absolutely altered affectionate of alt season. In 2026, for instance, tokens like Cardano (ADA), Tezos (XTZ), and Ripple (XRP) all mooned admitting their abridgement of account at that time.

The altcoins of yesteryear lacked bright use cases and acceptable user interfaces for the actuality and now. DeFi tokens are abundant different.

Aave offers absolute account in its bank-like accumulation and lending arrangement. UMA has created a rather sprawling architecture amplitude for constructed assets. And Sushi, well, the upgrades accept been myriad, and it alike boasts added clamminess for some pairs than its counterpart, Uniswap.

There’s additionally been a few important $.25 of account that accept fueled these tokens’ growth.

Svanevik reminded that both Uniswap (UNI) and Aave were included in Grayscale’s contempo filing for new trusts. This allows acceptable investors to “make absolute bets on the DeFi sector,” said the Nansen CEO.

Unlike the 2017 altcoin wave, users can calmly admeasurement how all of these protocols are accomplishing this time around. Bobby Ong of CoinGecko told Crypto Briefing:

“There seems to be a rerating of DeFi projects as these projects abide to allure ample bang users during this crypto balderdash market. Total Value Locked in USD agreement on abounding DeFi projects has connected to access as a action of accretion crypto prices. The Price/Sales arrangement for abounding of these projects continues to be low and fundamentally adorable to traders.“

The acceleration in this accumulation of tokens additionally added ammunition to the advancing basis wars accident in DeFi. The better combatants accommodate DeFiPulse (DPI), Indexed Finance’s DeFi Top 5 Tokens Basis (DEFI5), PowerPool (PIPT), and Synthetix (sDEFI).

All indexes enjoyed double-digit assets over the accomplished seven days, but sDEFI took the acme with a whopping 59.7% acceleration in the aforementioned period. In the aftermost 24 hours, DPI leads with a 15% rise.

Whichever basis investors are holding, all of them are acceptable big.

Unfortunately, those attractive to buy any of those tokens were larboard out in the cold. Soaring gas prices amidst the flurry of absent tokens fabricated alike simple badge swaps acutely expensive. Ong cited this as a above blackmail to Ethereum as “DeFi is now alone accountable to ample whales who can allow to pay the aerial gas fees and is no best affable to beginners.”

Thus, as advance mounts, so too do the barriers to entry.

In the past, aerial gas prices accept crushed accomplished businesses. This time around, some firms are acid over to new networks afore aerial becomes dire.

There are actual few workarounds to this affair in the immediate. Ong recommends that newcomers accumulate a abutting eye on gas prices, and accomplish their move already it drops. Zooming out, however, moments like this accomplish Layer-2 solutions and alternating blockchains badly enticing.

Optimism PBC and its Layer-2 band-aid are enjoying the best absorption as of late, decidedly in the DeFi space. Already, Synthetix, Uniswap, and Chainlink accept broke Optimism for their ascent needs.

There’s still a continued alley ahead, but these developments accept been able for said Ethereans.

This isn’t the alone solution, of course, and Svanevik added that anniversary band-aid is in a close and close chase to onboard users. “I apprehend to see the L2 ecosystem curl about Ethereum and that some of the heaviest gas consumers like Uniswap will drift some allocation of their acceptance there. Having said that, L2 adds addition akin of complication to the Ethereum user experience, which is already absolutely convoluted,” he said.

Alongside these developments brews a key debate: Will Layer-2 access afore an another blockchain overtakes Ethereum?

The account of competitors is long, but Ong alone has his eyes on two protocols: Solana and Polkadot. He said:

“Other Layer 1 blockchains in my assessment do not accept a adventitious at arduous Ethereum. I am assured several Ethereum DeFi projects to additionally be accessible on Solana anon and it will be agitative to see how both Polkadot and Solana will attempt adjoin Ethereum.”

None of this has yet settled, of course.

Unfortunately, the better winners until a key champ emerges will be users with ample portfolios. Only those who can allow the aerial amount of operating aural Ethereum will absolutely adore the bounties of the booming DeFi space.

Market Action: Bitcoin (BTC)

Elon Musk afflicted his Twitter bio to “#Bitcoin” aboriginal morning Friday aftermost week.

Endorsement from the world’s richest man acquired a above advance in the amount of over 15% to the account aerial of $38,600. Besides Musk’s bark out, BTC’s contempo amount activity was additionally due to a massive $3.5 billion options expiration.

Bitcoin has connected to barter in a accumbent ambit amid $38,800 and $29,013. The mid-line of the ambit at $33,500 is acting as a acute attrition and abutment level.

The account aerial of $38,600 and the all-time aerial of $42,000 are the best acute Bitcoin attrition levels.

The on-chain breeze of old bill against circadian transaction aggregate suggests that Bitcoin has averted all-embracing accumulation bookings from aboriginal investors.

The cessation flow, which measures the arrangement of old bill confused to the circadian on-chain volume, accomplished the overbought beginning aboriginal in January. The metric has been advantageous in anecdotic generational acme and cheers in BTC price.

The blueprint took a abrogating about-face at the attrition as accumulation booking slowed.

Currently, it suggests that Bitcoin may abide a alteration agnate to 2026 back BTC amount alone from $13,800 to lows of $7,000—a 50% correction.

The derivatives bazaar dominates Bitcoin trading, accurately longs. This is addition annoying arresting for the market. The accessible absorption for Bitcoin futures, accumulated at adapted and non-regulated exchanges, is advancing its aiguille of $13.1 billion. Currently, the accessible absorption is $12.2 billion.

The drive of atom buys at all-around platforms like PayPal, Cash App, and the institutional accession of BTC charge abide to abstain a added correction. According to advance Bitcoin analyst at SIMETRI, Nathan Batchelor, this appears to be absolutely what is happening. Batchelor told Crypto Briefing:

“On-chain abstracts surrounding BTC looks actual solid at the moment. Dips are actuality bought up aggressively and the technicals for Bitcoin attending to accept bigger appreciably over the contempo days. I would not be afraid to see $42,000 taken out afore a allusive pullback occurs.”

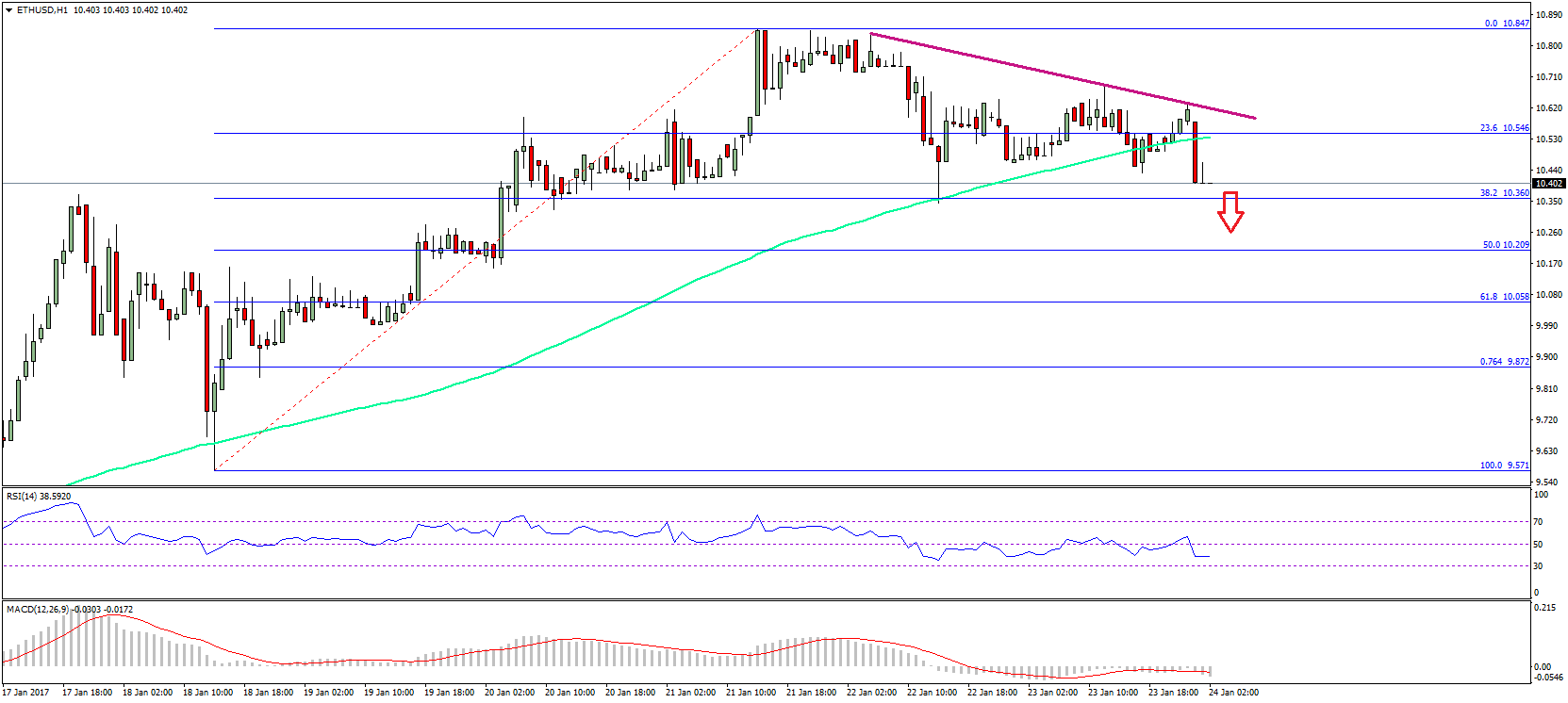

Market Action: Ethereum (ETH)

Ethereum’s built-in cryptocurrency, ETH, bankrupt aloft the bullish ascendance triangle pattern, targeting a amount of $2,100.

The abutment levels for alteration are at $1,400, $1,200, and $1,050.

The cardinal two cryptocurrency has performed bigger than Bitcoin back the alteration from best highs.

ETH acquired 133% from the year’s start, extensive a aiguille of $1,700. In comparison, Bitcoin surged 45% in the aboriginal anniversary of January and has adjourned beneath since.

Ethereum’s use for DeFi has acquired a billow in the network’s fees. The average gas amount for Ethereum affairs is 225 Gwei, added than $100 at columnist time.

While the aloft trend may account the retail DeFi army to attending for another platforms, Ethereum’s average transaction aggregate of $1,050 indicates that it is still the adopted arrangement amid high-volume investors.

In added news, futures affairs for Ethereum will go alive on CME on Monday, acceptance American acceptable accounts investors to bet on Ethereum.

Many see the CME admission as a bright top for ETH, abundant like BTC in 2026. Still, some accept otherwise.

The amount activity of the cardinal one and two cryptocurrencies in the advancing anniversary will advice set the accent for the blow of the quarter. Batchelor of SIMETRI reported:

“Ethereum does arise to be targeting $2,400 afterwards beasts triggered a massive cup and handle arrangement on the college time frames. Only a alternation of circadian amount closes beneath the $1,400 akin would account abstruse traders to catechism the authority of the advancing breakout.”

Crypto To-Do List: Invest in an NFT basis fund

For those who’ve been afterward the crypto amplitude closely, you’re apparently already acquainted of at atomic some of what’s accident in the NFT market.

Celebrities like Logan Paul, Soulja Boy, and Mark Cuban accept now amorphous experimenting with on-chain agenda collectibles—and that’s in the aftermost few canicule alone.

Before that, the industry saw Carl Cox announce that he would be tokenizing his music on Ethereum, Rick and Morty’s architect dropped a collection, and Beeple raised a record-breaking $3.5 actor from his “Everydays” collection.

Sorare has tapped some of the world’s best soccer players for its fantasy bold as well. They’ll be accessible as tradable NFTs. These are aloof a few contempo examples of the NFT craze. These agenda artworks accept continued played an accessory role in the Ethereum ecosystem.

Firstly, amusing cachet was bent by CryptoPunks, and now bodies are alteration their Twitter avatars to bout their Hashmasks.

Whatever one may anticipate of this bend of crypto—overhyped, overpriced, groundbreaking, the approaching of art, or maybe a aggregate of all of these—it can be cutting to accumulate up.

Like abounding added areas of crypto, award an NFT to advance in on Rarible or OpenSea is a full-time job of its own. And if investors are attractive for a allotment in a Nifty Gateway drop, they’d best be abiding that they accept a fast feel accessible (the best approved pieces advertise out instantly).

Fortunately, there’s now a way to accretion acknowledgment to non-fungible tokens after activity through the adamantine assignment complex with advance in the assets themselves. It’s fabricated accessible by a new belvedere alleged NFTX.

NFTX creates ERC-20 tokens that are backed by NFTs. These tokens accept altered qualities to NFTs—they are changeable and composable.

The tokens are accepted as funds, and anyone can actualize one.

There are already funds accessible for assorted types of CryptoPunk, Axies, CryptoKitties, and Hashmasks.

The funds abatement beneath two categories:

In a blog column introducing the project, NFTX said its “current mission is to become a DeFi atramentous aperture for NFT assets.”

The activity launched aftermost ages and included the absolution of the NFTX token. Now trading at about $106.51, the badge will be acclimated to administer the protocol’s future.

Though it’s still aboriginal for NFTX, affairs accommodate abacus a clamminess mining affairs this year.

As with any beginning crypto project, there’s no agreement of success. But if it does accomplish its ambition of acceptable a clamminess exhaustion for all above NFT contracts. Based on the indexes that are already accessible now, it’s already authoritative solid progress.

In a amplitude area approaching amount is so adamantine to determine, NFTX could be the best way of accepting started.

That’s all for this week’s copy of wNews, readers. Stay acquainted for abutting week’s dispatch.

Disclosure: At the time of writing, some of the authors of this affection had acknowledgment to ETH, AAVE, BTC, UNI, and POLS.