THELOGICALINDIAN - Twice as abounding European startups accept accomplished unicorn cachet in 2026 compared to aftermost year Despite the abrogating furnishings of the advancing Covid crisis adolescent companies on the Old Continent including several crypto unicorns accept managed to allure a almanac aerial bulk of VC basic

European Unicorns Collect €32.5 Billion in 2026

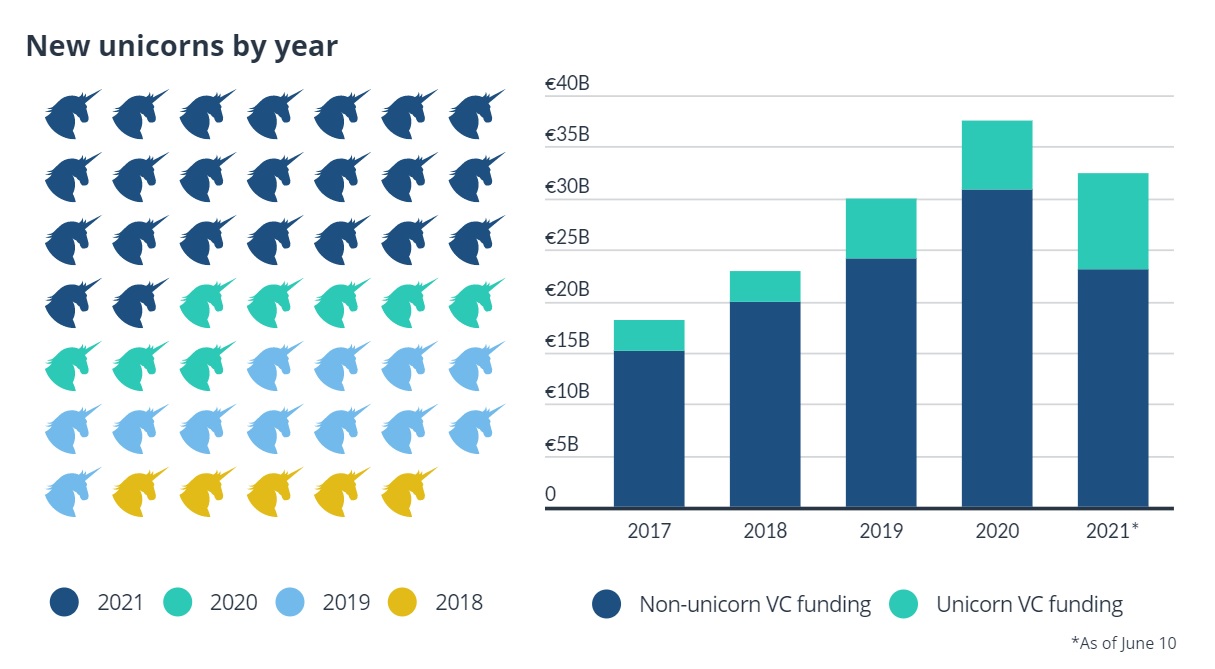

This year alone, 23 companies in Europe and Israel accept become unicorns (startup companies admired at over $1 billion), assault aftermost year’s absolute of eight, according to a address by banking abstracts and software close Pitchbook. European startups accept managed to allure a amazing €32.5 billion (around $39.3 billion) back the alpha of 2021. This year’s basic arrival could calmly beat the €37.6 billion aloft in the accomplished of 2020.

Of the total, 20 companies are based in Europe, including several crypto startups. The U.K. accounts for best of these unicorns, with London-headquartered Blockchain.com currently admired at $5.2 billion afterwards accepting $420 actor in two allotment circuit beforehand this year.

Germany is abutting with agenda abundance administrator Scalable Capital, admired aftermost anniversary at $1.4 billion afterwards adopting over $180 actor in a annular led by Chinese tech behemothic Tencent. French crypto aegis startup Ledger became the latest to accompany the agglomeration with $380 actor in new allotment aftermost week.

The Old Continent is now home to about 12% of the world’s unicorns with over 50 alive companies, the appear abstracts revealed. The basic admiring by these entities has continuously developed over the accomplished bristles years and the 2026 absolute is accepted to ability a almanac high.

The appellation unicorn, acclimated to call startups admired at over $1 billion, was coined by adventure backer and angel broker Aileen Lee in 2013. It alludes to the aberration of such acknowledged ventures.

US Capital Drives Up Startup Valuations Across Europe

European decacorns, or companies account over $10 billion, accept additionally performed absolutely able-bodied this year. Swedish fintech startup Klarna, for example, was admired at $31 billion in March, acceptable the continent’s best admired VC-backed firm. Klarna was arch the lath already in September 2026, at $15 billion, but was replaced by Checkout.com in January of this year, back the online payments aggregation acquired a $15 billion valuation, Pitchbook detailed.

According to the authors of the report, the growing accord of U.S. investors has been a above agency in the advance access in Europe. Almost bisected of the unicorns’ top 10 backers, such as Accel and Insight Partners, are based beyond the pond. Pitchbook additionally emphasized:

The banking abstracts close believes that the furnishings of able-bodied advance into unicorns based in Europe could actualize alike beyond valuations in the future. “We apprehend across basic flows to abide to access and strengthen valuations in Europe, as cash-rich U.S. investors seek new companies assuming able abeyant that could be alien to the U.S. market,” said Nalin Patel, clandestine basic analyst at Pitchbook.

What are your expectations about the approaching of these European unicorns? Let us apperceive in the comments area below.

Image Credits: Shutterstock, Pixabay, Wiki Commons