THELOGICALINDIAN - Yesterday the Federal Reserve Fed said it would restart affairs bonds in the accessible bazaar Also it will abide its brief allotment operations until January of abutting year

Fed’s Cash Injection Is Already Routine

For the Fed, cloudburst banknote into the markets is already routine. It seems that policymakers are aggravating to argue the accessible that there is annihilation amiss with their abatement measures. However, what we get is cheaper money that devalues at an alike faster paste.

Last month, the M2 budgetary accumulation exceeded the $15 abundance mark.

Elsewhere, the M1 money accumulation – a narrower analogue of money that includes its best aqueous anatomy – is about to blow the $4 abundance mark soon.

For above agent Ron Paul, the Fed’s action in the bazaar is a anatomy of budgetary socialism, as the axial coffer is aggravating to plan the amount of money through manipulations rather than absolution the markets adjudge it.

On Friday, the Fed appear it would alpha purchasing about $60 billion in Treasury bonds every ages until at atomic the additional division of 2020. Also, it will extend the repo operations from the end of November to at atomic the end of abutting January. The Fed explained:

Bitcoin Is Among Ideal Assets to Preserve Value

The Fed is aggravating to argue the accessible that we shouldn’t alarm its measures quantitative abatement and that its aftermost accomplish are not alike allotment of budgetary policy. For the axial bank, affairs bonds and injecting banknote into the repo bazaar are all-important measures to assure the abridgement and abate abeyant risks, abnormally amidst the Sino-US barter war.

Dallas Fed President Robert Kaplan told the media:

However, economists altercate that this is the purest anatomy of QE and should be advised as such. Usually, QE is the aftereffect of a crisis but it seems the Fed doesn’t appetite the accessible to apprehend there is a botheration with the economy.

Nevertheless, the abstracts are insane. On Thursday, the New York Fed added $88.1 billion through the repo market, and another $82.7 billion on Friday.

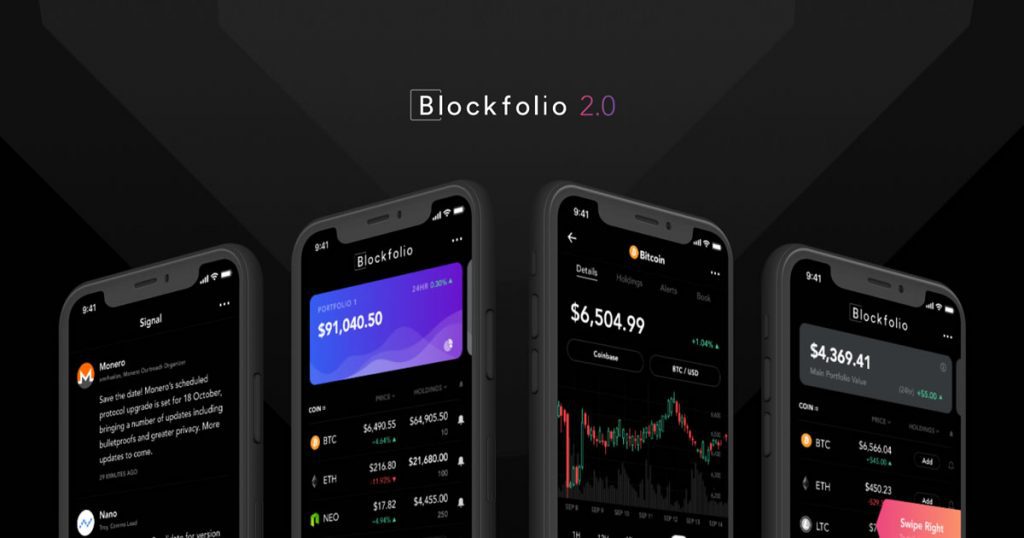

While the Fed is experimenting, Bitcoin charcoal an ideal asset to bottle amount and break abroad from a devaluing currency.

Do you anticipate the Fed is accomplishing too much? Share your thoughts in the comments section!

Images via Bitcoinist Media Library, Fed, CNBC TV