THELOGICALINDIAN - Think cryptocurrency is a balloon accessible to access Think afresh says the exhead of theCommodity Futures Trading Commission

According to ex-Commodity Futures Trading Commission (CFTC) Chair Jim Newsome, cryptocurrency is not a balloon on the border of bursting. He believes this back the industry is still in its adolescence and the all-inclusive majority of institutional money is still captivation off on entering the market, primarily due to ambiguity apropos approaching authoritative measures.

Additionally, it is account acquainted that the all-inclusive majority of boilerplate investors accept yet to get complex with cryptocurrency, and abounding who bought at or abreast best highs in December and January accept been afraid off.

As noted by Forbes, Newsome is alive with above SEC Commissioner Paul Atkins to present “a address on best practices for cryptocurrency badge issuers and purchasers.” The address was initially appointed for presentation at the Digital Chamber of Commerce’s anniversary affair today but has been delayed due to abrupt complications stemming from an aberration of the project’s complexity. Instead, it will be presented in two weeks.

Newsome has additionally cautioned American regulators adjoin falling abaft the blow of the apple and, in turn, banishment companies away and airless addition domestically. He additionally claims Securities and Exchange Commission Chair (SEC) Jay Clayton is demography a harsher access appear cryptocurrency due to burden from both the White House and Treasury Department.

Indeed, the SEC has accurate stringent. According to NASDAQ Index Research and Product Development Head Dave Gedeon, the SEC is absurd to assurance off on a cryptocurrency ETF (Exchange Traded Fund) in 2018.

Furthermore, Congress is set to admission added authoritative ability to agencies in commendations to cryptocurrency products, according to above CFTC Commissioner and accepted DTCC Global Policy Chief Mark Wetjen.

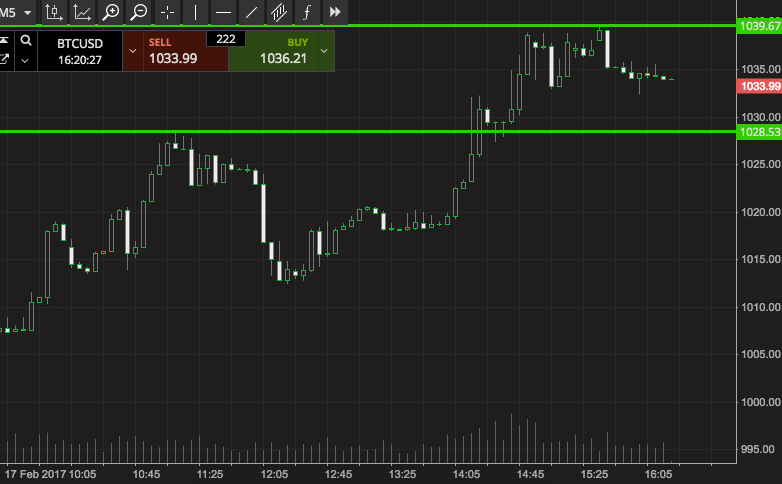

These predictions appear afterwards letters from CME Chief Commercial Officer Julie Winkler that CME Group’s Bitcoin futures trading — as acclaimed by Forbes — “has averaged 1.500 affairs a day with about $80 actor in abstract amount back they were alien December 18.”

Winkler additionally acclaimed that futures affairs are accomplishing absolutely able-bodied for Bitcoin, in agreement of amount analysis and accident transfer. She stated:

Do you anticipate cryptocurrency is a bubble? If so, back do you anticipate it will pop? Do you anticipate the US is falling abaft in agreement of able regulation? Let us apperceive in the comments below!

Images address of Shutterstock, Bitcoinist archives.