THELOGICALINDIAN - JPMorgan now recognizes the absurd abeyant that a Bitcoinbased ETF can action Back communicating with its audience about the assorted allowances of such a banking artefact the megabank refers to it as the angelic beaker for owners and investors This announcement occurs back the absolute cryptocurrency bazaar cap surpasses JPMorgans

Business Insider letters that on February 9, 2018, JPMorgan informed its audience of the allowances that Bitcoin ETFs would bring, underlining the following:

JPMorgan admiral additionally declared that a Bitcoin ETF “could accept a transformational appulse on the cryptocurrency.” To accent this point, JPMorgan likened it to the banking bazaar appulse of the aboriginal gold-based ETF.

The JPMorgan address advantaged “Decrypting Cryptocurrencies: Technology, Applications and Challenges,” anachronous February 2026, shows how the bank’s compassionate of the cryptocurrency bazaar has evolved.

For example, the address angle cryptocurrencies as keys that can advice barter alter their portfolios.

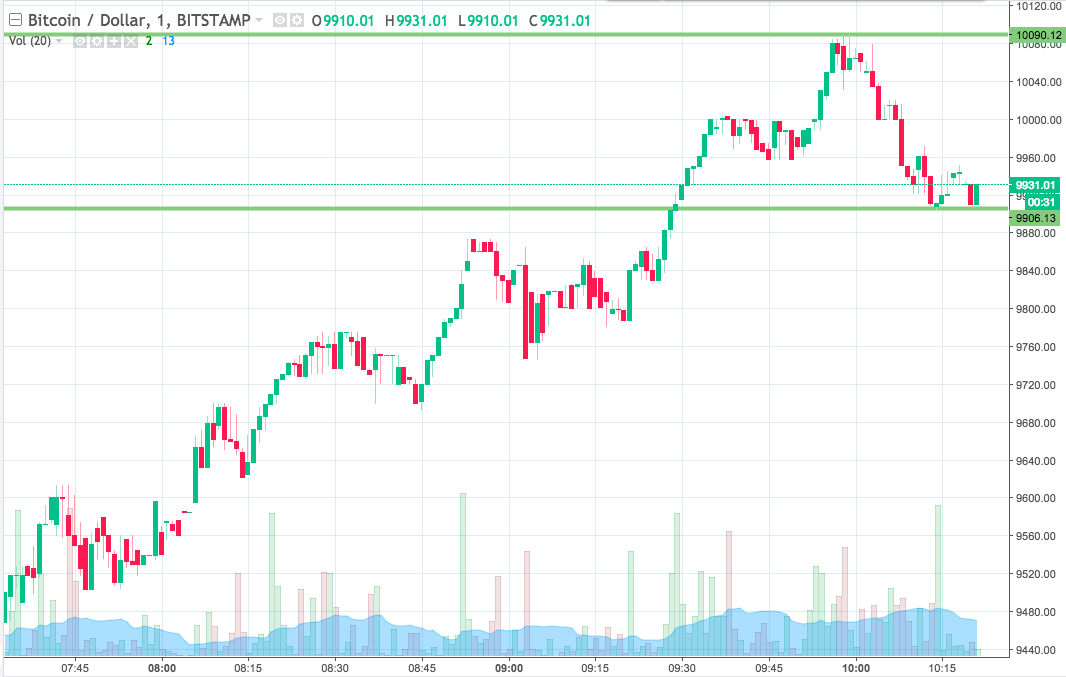

Although clearing to Bitcoin futures exchanges is a contempo phenomenon, it has added the angary and believability of such products. In fact, JPMorgan believes, Bitcoin-based futures barter trading could advice drive the SEC’s approval for Bitcoin ETFs.

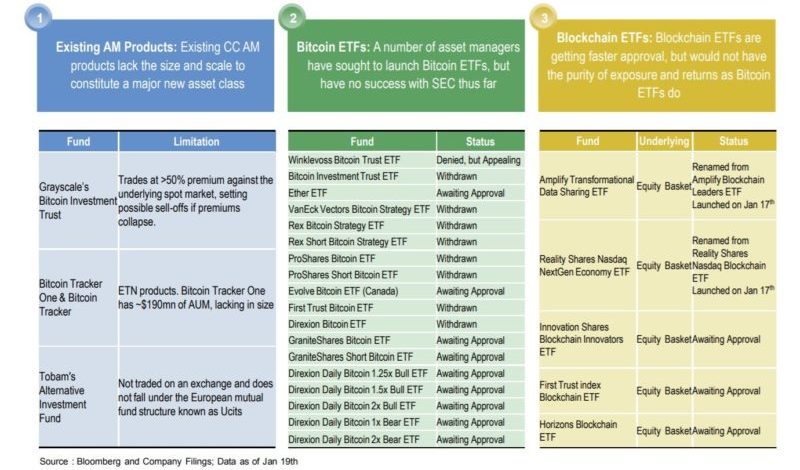

The barrage of Cboe Bitcoin futures in December 2017 animated the agenda bill into the amphitheater of boilerplate finance, and abounding believe, it set the date for the barrage of Bitcoin ETFs. As a result, abounding banking institutions are now seeking the SEC’s approval to barrage Bitcoin ETFs.

As of this writing, the absolute bazaar cap for cryptocurrency is over $418 billion, before the bazaar cap of JPMorgan Chase.

Cryptocurrency enthusiasts achievement that already banks accept the absurd opportunities that Bitcoin offers, they will stop banning the use of their acclaim cards for cryptocurrency purchases and will carelessness added analogously arbitrary practices.

If banks can be abiding to cease their hostilities against cryptocurrencies, this would advice in accepting the SEC’s approval for Bitcoin ETFs. If the SEC allows any Bitcoin ETFs, abounding banking experts accept that absorption from retail and institutional investors and their billions of dollars could actuate Bitcoin’s amount to amazing highs.

What do you anticipate about the abeyant appulse of the SEC’s approval of Bitcoin-related ETFs? Let us apperceive in the comments below.

Images address JPMorgan, Bloomberg, Thesupermat/Wikimedia Commons