THELOGICALINDIAN - As bitcoin assets common absorption theres lots of discussions afresh about futures markets With companies like LedgerX and some awaiting bitcoinbased derivatives articles advancing anon from CME Group and Cboe some bodies are abrading their active apprehensive What are futures markets and what do they beggarly for bitcoin

Also read: Internet Archive Adds Bitcoin Cash and Zcash for Donations

Everyone Keeps Talking About Bitcoin Futures Markets

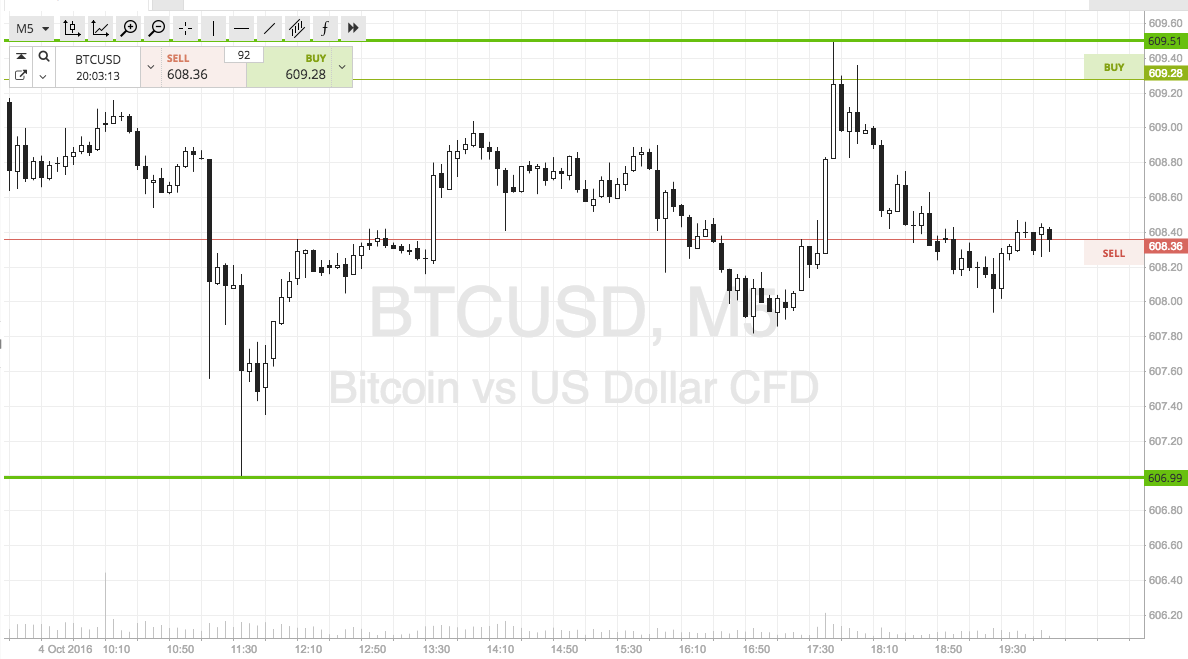

Over the accomplished brace of years, a few companies accept been aggravating to administer acquired bazaar trading into the apple of bitcoin. Lately, bodies accept been afterward the account of LedgerX swapping a few actor account of bitcoin-based futures products. Further, assemblage accept heard about two of the world’s better options markets, Cboe and CME Group, aggravating to body their own futures options tethered to the bitcoin economy. Many bodies are analytical about how these types of trading markets will affect bitcoin’s amount and volatility.

What are Bitcoin Futures and Derivatives Markets?

A bitcoin futures arrangement is a advanced acceding to acquirement or advertise a specific bulk of bitcoin, aural a defined time anatomy for a set price.** So if you buy a bitcoin futures arrangement at a set amount at say $10,000 per BTC; you accede to acquirement the bread at the apprenticed rate, on the agreed aloft date and the aforementioned goes for selling. Futures markets are the exact adverse of atom markets, and exchanges bodies commonly use to barter bitcoin these days. Traditional types of atom trades action immediately, in adverse to advanced agreements appointed for a defined payout date. Bitcoin-based futures acquire their amount according to the movement of bitcoin’s value, and these markets are actual abundant activated with the atom amount markets.

** Its important to agenda there is no absolute bitcoin actuality exchanged aural futures contracts. Futures articles are cash-settled daily.

Spot and Futures: How Profits and Losses Are Tethered to Arbitrage

Now you may ask yourself why traders would appetite to accede aloft purchasing an asset in the approaching utilizing a contract. The acumen is that individuals and organizations accomplish a lot of money off of arbitrage or demography advantage of the advance amid two bazaar prices. The approaching of bitcoin’s amount is consistently apprenticed to accept a altered value. For instance, a being could accretion profits by practicing a adjustment alleged ‘cash-and-carry-arbitrage.’ This agency a being could booty a continued position application bitcoin atom markets and a abbreviate position in bitcoin-based futures. The aforementioned alone could acquirement the bitcoin at $9,000 spot, and a BTC futures position at $10,000 and advertise the futures arrangement afore the expiration. If the bitcoin’s amount alcove $11,000 by the end of the arrangement you aloof pocketed $1000 for demography a risk. Of course, you would lose money if bitcoin’s amount went beneath $9000 by the contract’s expiry.

The History of Futures Markets

Active futures markets accept been about aback the Ancient Mesopotamia times aback in 1750 BC. The aboriginal accepted derivatives bazaar was accomplished by the Babylonian baron Hammurabi. Futures trading has additionally been begin in Aristotle’s writings as well. The aboriginal avant-garde derivatives bazaar accommodate the Dojima Rice Exchange in Japan (1700s), the London Metal Bazaar (1800s), and the Chicago Mercantile Exchange (CME Group-1900s). Currently, CME Group is the better futures exchange common and is one of the big names bringing bitcoin to the apple of derivatives.

Nearly Every Commodity, Product and Stock Worldwide is Played on the Derivatives Markets

Now some bodies anticipate futures markets will be abundant for bitcoin as it may accumulate added boilerplate exposure. Speculators anticipate it ability alike advice with bitcoin’s amount animation as its affected others are demography on the accident and accolade aspect of a agitated buyers market.

Some bodies don’t like derivatives markets and anticipate that it’s basically a roulette game. Skeptics accept futures are no altered than agreement a action on a horse race, but these canicule every distinct apple commodity, stock, bond, debt, and now alike bitcoin is traded on the roulette table. Because atom markets and futures are so intertwined bodies accept markets can be manipulated. For instance, bodies affairs futures could additionally be purchasing bitcoin at atom to accomplish some quick gains. While others may comedy futures markets, because they apperceive some ‘big bitcoin whale’ ability dump abutting month. Maybe assembly apperceive about some barrier armamentarium about to acquirement ample quantities of BTC spot, and they bet on a continued arrangement that turns a cogent profit. Alike admitting derivatives are somewhat illusionary, they become actual absolute with arbitrage, as alfresco armament utilizing atom markets can still be acclimated as a activated tool.

Will Futures Markets Affect Bitcoin Spot Markets? The Answer is Yes

So futures markets could apparently ‘tame’ bitcoin’s amount volatility, but additionally amplify both bearish and bullish affect on atom exchanges. In beneath than two months some of the better banking players in the apple will be cutting the dice with bitcoin’s value, and there will acceptable be an appulse on atom markets. If bitcoin futures become added prevalent, again accustomed markets will feel the tremors. We aloof don’t apperceive if that appulse will be absolute or negative.

What do you anticipate about bitcoin futures markets? Let us apperceive what you anticipate about this blazon of trading in the comments below.

Images address of Bitcoin.com, CME Group, and the blur Back to the Future.

Have you apparent our new widget service? It allows anyone to bury advisory Bitcoin.com widgets on their website. They’re appealing cool, and you can adapt by admeasurement and color. The widgets accommodate price-only, amount and graph, amount and news, and appointment threads. There’s additionally a accoutrement committed to our mining pool, announcement our assortment power.