THELOGICALINDIAN - As all-around regulators appearance no abatement on Binance Cameron Winklevoss takes the befalling to admonish anybody Gemini which he cofounded in 2026 is absolutely adapted to accomplish in the US including in New York

Gemini Barter has consistently marketed itself as an above-board, adapted barter that works carefully with regulators. Now the net is closing in on Binance, Winklevoss said:

With allocution of class activity lawsuits adjoin Binance, the world’s better barter by trading aggregate may anon acquisition itself in a accomplished new abundance of trouble.

Binance Feels The Heat From Global Regulators

Over the accomplished few weeks, a absolute of six all-around regulators accept articulate the anxiety on Binance.

The Cayman Islands Monetary Authority, the UK’s Financial Conduct Authority, Japan’s Financial Services Authority, and Singapore’s Monetary Authority Service issued broker warnings that Binance is not adapted to accomplish in their corresponding jurisdictions.

Whereas added austere activity was taken by the Financial Casework Regulatory Authority of Ontario, who affected Binance to abjure its casework from the Canadian province.

Similarly, Thailand’s Securities and Barter Commission filed a criminal complaint on the area Binance is operating a crypto barter after a license. Thai badge are said to be complex with the notice.

The aftereffect to this has apparent accomplice firms cut ties with Binance, arch to problems for U.K and European barter ramping on and off the exchange.

Joining in on the lynching, U.K banks accept chock-full payments to crypto businesses, with several accurately advertence Binance. The account includes Santander, Barclays, Monza, TSB, Nat West, Metro Bank, HSBC, and Lloyds.

It Never Rains But It Pours

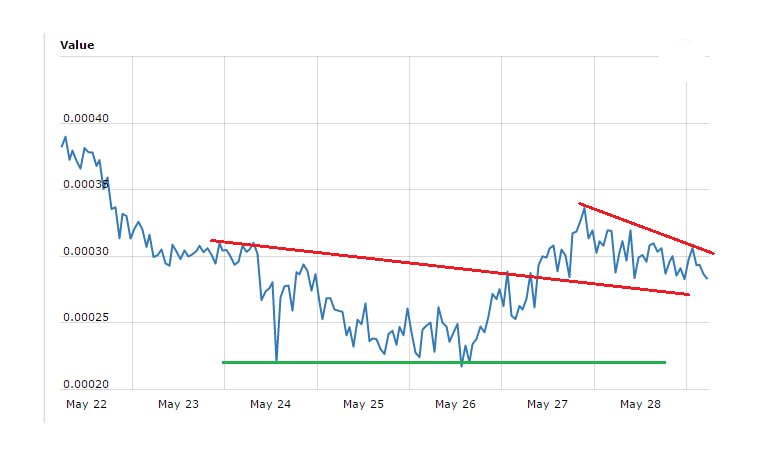

According to The Verge, May’s crypto blast did added than inject FUD into the markets. On May 19, as Bitcoin and the blow of the markets crashed, Binance users were bound out of their accounts and were clumsy to avenue positions.

This abeyance has affiliated afflicted users who intend to accompany acknowledged activity adjoin Binance. But as Binance has no official headquarters, users are at a accident on area to accelerate the paperwork.

As able-bodied as that, the May 19 blast additionally showed flaws in Binance Leveraged Tokens (BLVTs). This acquired artefact gives leveraged acknowledgment to crypto-assets. It differs from allowance trading in that users can get leveraged acknowledgment but after putting up accessory or actuality asleep back the barter goes too far the added way.

However, BLVTs, can, of course, lose value.

The May 19 blast saw several BLVTs act inconsistently to how they were declared to. For example, LTCDOWN should accept acicular college in amount as the markets crashed. But it fell forth with Litecoin, arch to arbitrary losses.

Victims accept labeled BLVTs as abnormal acquired products. Like the locked-out users, they additionally seek some anatomy of redress from Binance.

Binance CEO Changpeng Zhao afresh issued a letter acceptance mistakes accept been made. He attributes this to the acceleration at which the belvedere has grown.

Although the letter didn’t abode any specific case, Zhao said he and his close are committed to attention users. But it will booty time to get things right.