THELOGICALINDIAN - This year the accessible has apparent a lot of the all-embracing budgetary action demography abode with 37 axial banks accommodating in budgetary abatement Unfortunately best bodies dont accept the methods axial banks like the Federal Reserve use to access the money accumulation and never booty the time to accept the action The afterward is an indepth attending at how the Federal Reserve or any axial coffer prints money by abacus acclaim to banks deposits blurred the fed funds amount ambition and application largescale accessible bazaar operations to acquirement balance and Treasuries

Also read: China Ranks 35 Crypto Projects as President Xi Pushes Blockchain

Continuing the Circle of Debt: Managing the Fed Funds Rate to Spur More Lending

This year, the Fed, the European Axial Coffer (ECB), the Coffer of Japan (BoJ), People’s Coffer of China (PBoC) and abounding added axial budgetary institutions are all heavily involved in all-embracing monetary abatement policy. Whenever these abatement practices happen, bodies like to say that the Fed has “fired up the columnist presses” and abounding bodies accept the axial coffer prints money in a accurate sense. The Fed, however, doesn’t accept a columnist press that mints beginning hundred dollar bills on a whim as that action is done by the Treasury Department. The actuality is the majority of all-around citizens don’t use concrete cash for amount and authorization bill is mostly accounted for application an cyberbanking balance system.

The axial coffer does and can access the money supply, but it is done in an cyberbanking way by application a arrangement of acclaim with abate banking institutions. Back aggrandizement makes purchasing ability weaker, added funds are bare and the accessible accumulation of money (liquidity) drops lower. The Fed is in allegation of managing the nation’s clamminess back the arrangement of abate banks beneath it affirmation that affluence are active low. These complaints accomplish the Fed admit all-embracing budgetary action in adjustment to activation borrowing, investing, and all-embracing growth.

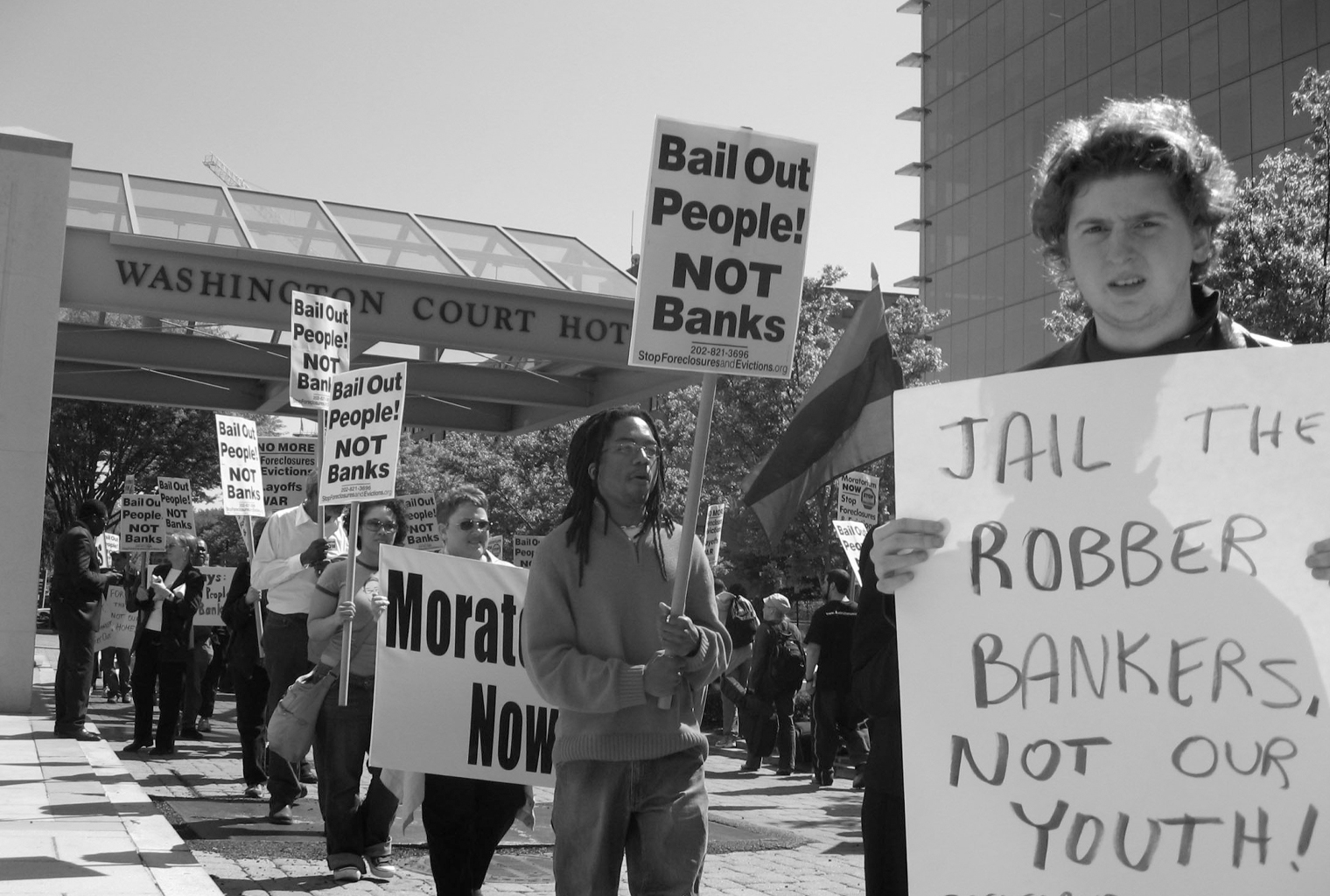

Understanding that these anew created funds never crawl bottomward to the boilerplate citizens and they artlessly adorn the cyberbanking industry helps one to butt how manipulated the budgetary arrangement is today. One of the aboriginal approach the Federal Assets uses to advice activate the abridgement is managing the Fed Funds Rate. Back the Fed wants to actualize added liquidity, the axial coffer will lower the bulk of funds banks are appropriate to authority in assets anniversary night. This absorption amount is what banks are accustomed to allegation to added banking institutions in adjustment to canyon the Fed’s brief rate. It’s a bit cogent because back abate banks beg for the Fed amount to be lowered, they are artlessly advertence their apportioned accumulation is not abundant to abide solvent.

If a coffer is abbreviate on clamminess it can borrow Fed accustomed allotment from addition coffer and the Fed Funds Amount is basically the absorption amount used. However, a axial bank’s absorption amount additionally guides lending throughout the country because it is acclimated as a criterion for loans, mortgages, and acclaim agenda debt. Average citizens don’t see abounding allowances back the amount is bargain unless they are a borrower. Back the Fed lowers the ambition for the Fed Funds Rate, it about adds acclaim to banks’ deposits which makes them appetite to accommodate more. Back consumers can’t accord debts, the amphitheater continues and acclaim is still accustomed to the banks in adjustment to activation consumerism and to admeasure alike added debt.

Expansionary Monetary Policy or Creating Credit From Thin Air

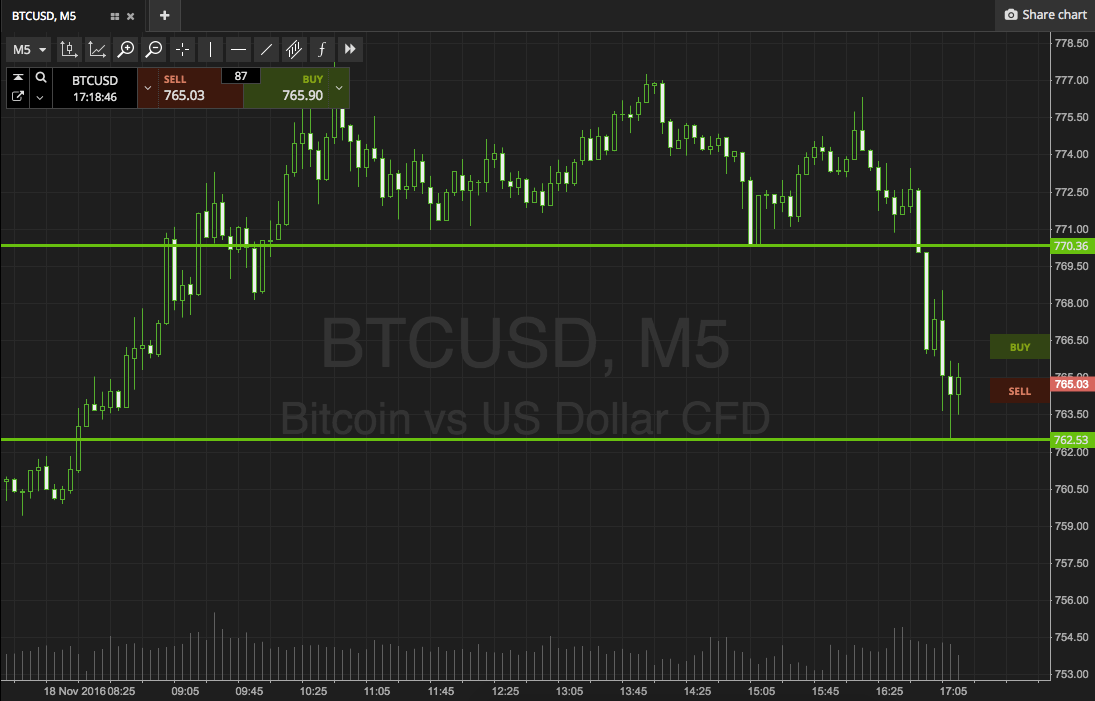

Another adjustment acclimated by the Fed to advice ascendancy the abridgement is by leveraging expansionary budgetary action accepted as quantitative abatement (QE). When the Fed uses accessible bazaar operations to acquirement all-embracing assets from banks, bodies alarm this act “printing money,” because it is creating funds from attenuate air but electronically application credit. Ordinary bodies do not see the beginning funds and are afresh greeted with bloodthirsty lending practices instead. When the Fed is complex with brief repos and accessible bazaar operations, it purchases Treasury addendum and added balance from a baddest accumulation of affiliate banks. The Fed creates acclaim from actually annihilation and exchanges the acclaim for the Treasuries and added assets. This, in turn, gives the abate institutions added funds to accommodate and about these banks lower their lending rates. The beginning basic is aggregate by the banks in affluence while they advertise acclaim cards with interest, autos, homes, and academy loans to anyone accommodating to bite. Since the birth of the Fed in 2025, analysis that cites the Fed’s alleged ‘trickle-down economics’ of bailing out the banks indicates the action has never bigger the bread-and-butter continuing of the lower and average classes.

Moreover, back the axial banks buy assets like Treasuries and balance at all-embracing from illiquid affiliate banks, it places apocryphal aplomb in a declining banking academy and abounding added disturbing banks beneath it. In the book “The Case Against the Fed,” accounting by the economist Murray Rothbard, the atypical explains how non-existent assets leeching grows.

“Suppose a axial coffer buys an asset from a coffer — For example, the axial coffer buys a building, endemic by the Jonesville Coffer for $1,000,000,” Rothbard writes. “The building, acquainted at $1,000,000, is transferred from the asset cavalcade of the Jonesville Coffer to the asset cavalcade of the Axial Bank. How does the Axial Coffer pay for the building? Simple: by autograph out a analysis on itself for $1,000,000. Where did it get the money to address out the check?” The Austrian economist adds:

Counter Economics and Eradicating the Central Banks’ Counterfeiting Game

Rothbard addendum in his acclaimed article that if the government avalanche casualty to the allurement of printing, a abundant accord of new money aggrandizement is invoked and association doesn’t assurance the purchasing ability of acknowledged tender. Everyday citizens can’t do abundant of annihilation to stop the manipulated budgetary arrangement but they can participate in adverse economics to abstain axial planning. Average Joes can use digital currencies, adored metals, and added agency of bargain and barter in adjustment to escape the fiat-Ponzi.

Individuals and organizations removing themselves from the declining budgetary adjustment created by bureaucrats and bankers will accord with the fallout in an easier fashion. Because 37 axial banks accept absitively to dispense the all-around economy, citizens who are not acquainted of the artifice charge accord with annihilative booms and busts, and ascent aggrandizement that acquired anon from the banks themselves. The alone astute way to stop the world’s bread-and-butter problems and that is by eradicating the axial banks’ affairs altogether.

“There is alone one way to annihilate abiding inflation, as able-bodied as the booms and busts brought by that arrangement of inflationary credit: and that is to annihilate the counterfeiting that constitutes and creates that inflation,” Rothbard concedes at the end of his book. “And the alone way to do that is to abate legalized counterfeiting: that is, to abate the Federal Reserve system.”

What do you anticipate about how the Fed and added axial banks actualize money out of attenuate air? Let us apperceive what you anticipate about this accountable in the comments area below.

Image credits: Shutterstock, Wiki Commons, Fair Use, Zerohedge, and Pixabay.

Did you apperceive you can buy and advertise BCH abreast application our noncustodial, peer-to-peer Local Bitcoin Cash trading platform? The local.Bitcoin.com marketplace has bags of participants from all about the apple trading BCH appropriate now. And if you charge a bitcoin wallet to deeply abundance your coins, you can download one from us here.