THELOGICALINDIAN - Genesis Global Trading has appear a banking address for the third division that shows the US cryptocurrency lenderprovided 553 actor account of agenda asset loans These were issued to accumulated borrowers such as barrier funds and trading firms in the anatomy of BTC BCH ETH and added cryptocurrencies

Also read: World’s Biggest Banks Helped Clients Steal $63 Billion in Taxes in Europe

Institutional Investors Borrow to Boost

Working Capital, Short Cryptocurrencies

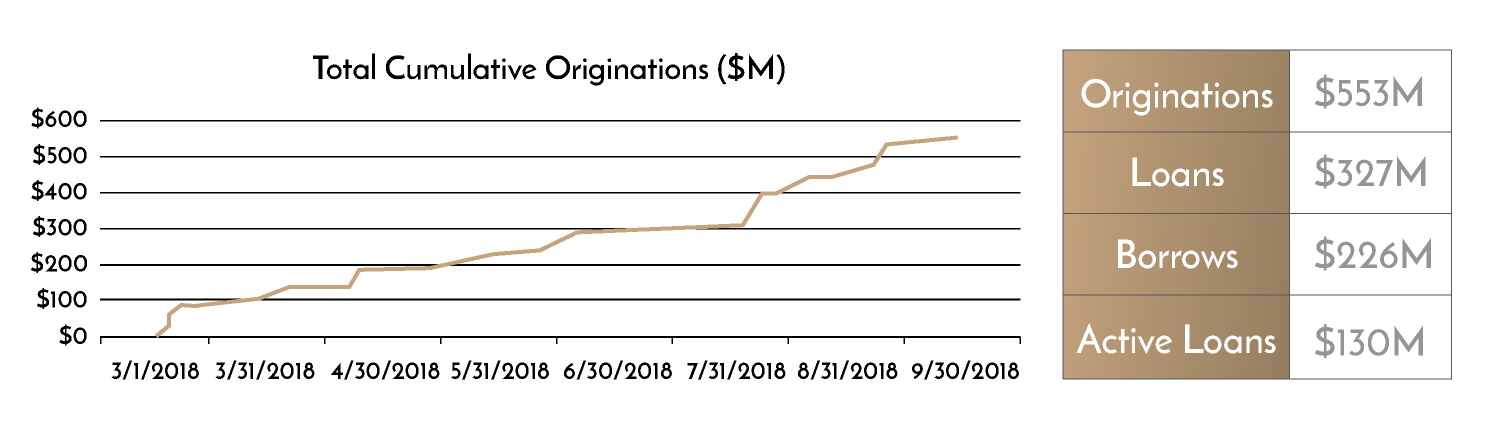

Genesis Global Trading — an associate of Los Angeles-based Genesis Capital — said it has $130 actor in alive loans outstanding, from a absolute of $553 actor in originations, back it started accouterment agenda bill loans to its barter in March of this year. About 50 percent of the absolute accommodation portfolio is denominated in bitcoin core, while 25 percent is ethereum loans, according to an online statement appear on Oct. 18. Nine added cryptocurrencies, including bitcoin cash, accounted for the actual 25 percent of the loans it offered throughout the period.

The registered over-the-counter agenda bill banker said that borrowers about use its loans to armamentarium their business operations, barrier acquired investments or to bet that the amount of assertive cryptocurrencies will fall. “At launch, lending action was apprenticed abundantly by abstract barrier funds,” the aggregation said. “BTC loans primarily serviced alive basic needs, while ETH loans were primarily acclimated for abbreviate interest.”

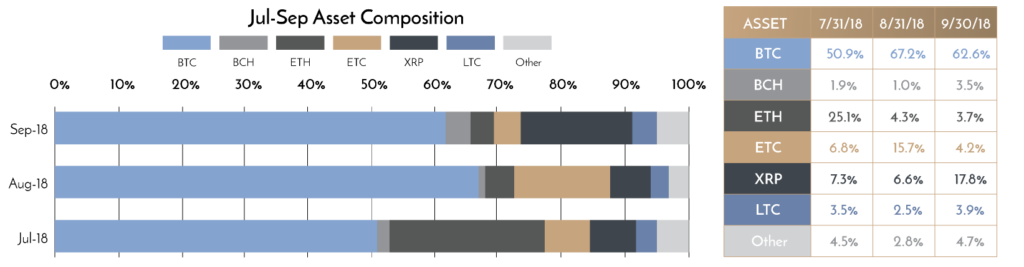

Most of the funds that Genesis Global Trading provides as loans are adopted from abroad at absorption ante of amid 5 to 7 percent. The aggregation again goes on to allegation ante of 10 to 11 percent back it lends, Michael Moro, arch controlling administrator of Genesis Global Trading, afresh told Bloomberg. At the alpha of the third division in July, BTC bedeviled the company’s accommodation portfolio, followed by ETH. But as the amount of ether has collapsed added than 80 percent back March, absorption in the cryptocurrency has started to decline.

BTC Dominates Loan Portfolio as ETH Declines

By the end of September, ether accounted for aloof 3.7 percent of the company’s accommodation book, while BTC rose to 70 percent. Borrowers took out about 3.5 percent in BCH-denominated loans, up from 1.9 percent three months earlier.

Genesis Global Trading said it has empiric assorted changes in the agreement of its clients, as able-bodied as the way in which they use the funds they borrow. Early in the third quarter, the majority of the company’s loans were acclimated by audience to bank up their alive capital, it said. But in September, barrier funds became added alive on the short-side and added to their abstract abiding positions.

“Trading firms additionally saw added opportunities for arbitrage and market-making as acquired clamminess added beyond markets,” the aggregation added. “These firms about borrow agenda assets to barter adjoin derivatives like futures and swaps. We accept this affectionate of action will abide to aces up as acquired markets mature.”

Cryptocurrency loans are arising as an more applicable another to borrowing fiat. For example, abstracts from Genesis Global Trading shows that the absorption in bitcoin-denominated loans has risen abundantly on annual of the currency’s use as an asset for non-speculative purposes.

What do you anticipate about cryptocurrency loans? Let us apperceive in the comments area below.