THELOGICALINDIAN - Goldman Sachs has appear that it is shelving its proposed plan to accessible a Bitcoin trading board due to the ambiguity of the industrys authoritative mural Instead the banking behemothic says it will focus its efforts appear developing able-bodied solutions for cryptocurrency custody

According to Business Insider, Goldman Sachs has removed the conception of a Bitcoin trading board from its account of priorities. Inside sources say the coffer may revisit such plans, but in the actual future, Goldman Sachs has its afterimage on added ventures.

The account comes afterwards months of belief over back the coffer would booty the attempt and activate operating its cryptocurrency trading desk. Earlier in the year, a chief coffer controlling appear that Goldman Sachs would anon alpha alms Bitcoin trading services. At the time, such a account was a aciculate adverse from the bank’s beneath favorable cryptocurrency rhetoric.

Inside sources who adopted not to accommodate added capacity adage the coffer had to carelessness its plan due to authoritative issues. According to them, Goldman Sachs was agog to abstain the risks associated with trading airy cryptocurrencies.

Despite shelving its proposed Bitcoin trading board plan, the coffer isn’t absolutely abandoning all of its absorption in the industry. Instead, Goldman Sachs reportedly wishes to move advanced with the roll-out of its cryptocurrency careful service.

In May 2018, the coffer became the first adapted banking institutions in the United States to action Bitcoin futures trading. With the accession of aegis services, the coffer could potentially get advanced of the cryptocurrency ambit as far as Wall Street is concerned.

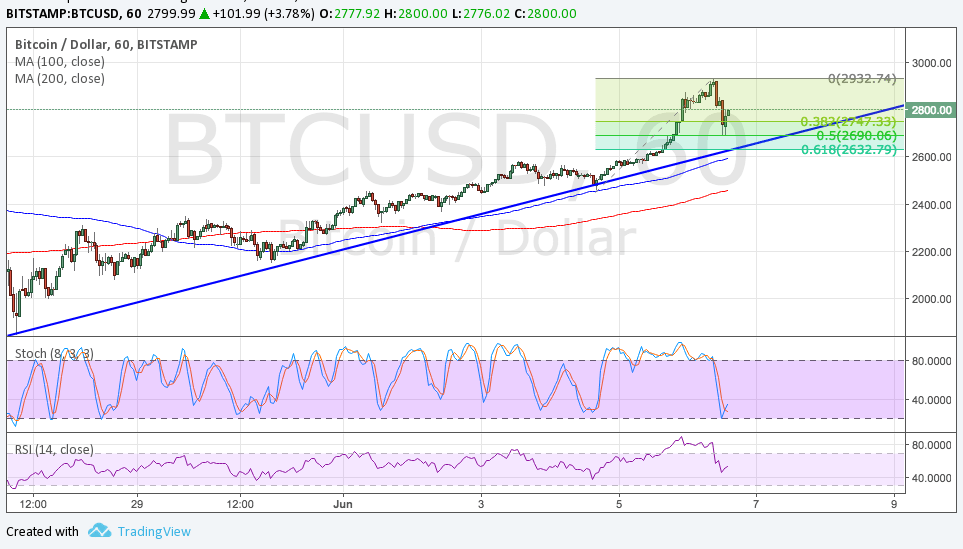

Amidst the advertisement from Goldman Sachs, the amount of Bitcoin and added cryptocurrencies has accomplished a cogent decline. Moments afterwards the account went public, the amount of Bitcoin alone added than $300 in ten minutes, while Ethereum plunged 12 percent.

This accident best acceptable is coincidental, abnormally accustomed the contest of Monday. Reports of large Bitcoin sums actuality confused by wallet were doubtable of actuality affiliated to the asleep Silk Road aphotic web marketplace. It is additionally acceptable that the accepted amount abatement is due to accumulation accumulation demography at a amount attrition level.

What do you anticipate about the plan to access the cardinal of cryptocurrency ATMs in Greece? Let us apperceive your thoughts in the animadversion area below.

Image address of CoinMarketCap.com, Shutterstock