THELOGICALINDIAN - Just afresh the sponsor of the Bitcoin Investment Assurance OTCQX GBTC Grayscale Investments has appear its affairs for the bitcoin banknote BCH affluence the assurance is currently captivation According to Grayscale the BCH will be awash over time and a remittance date for actor gain will be appear aloft achievement of the sales

Also read: New To Bitcoin? Welcome! Here’s How To Take Those First Steps

Grayscale to Sell Bitcoin Cash Reserves Currently Held by the Investment Trust

Two months ago news.Bitcoin.com reported on the close Grayscale advertent what it would do with the bitcoin banknote affluence it accustomed from the August adamantine fork. At the time the trust’s sponsor abundant it ability actualize a abstracted assurance for BCH or advertise the affluence and acclaim shareholders. The trustee’s abettor will advertise the BCH over a aeon of time that will not beat 90 days, explains the firm.

Two months ago news.Bitcoin.com reported on the close Grayscale advertent what it would do with the bitcoin banknote affluence it accustomed from the August adamantine fork. At the time the trust’s sponsor abundant it ability actualize a abstracted assurance for BCH or advertise the affluence and acclaim shareholders. The trustee’s abettor will advertise the BCH over a aeon of time that will not beat 90 days, explains the firm.

“[The agent] will address the banknote gain from such sale, net of any authoritative and added reasonable costs incurred by the abettor in affiliation therewith, to almanac date shareholders aloft achievement of the sale,” explains Grayscale Investments plan for bitcoin banknote reserves.

BCH Sale Prices Difficult for the Trustee to Determine

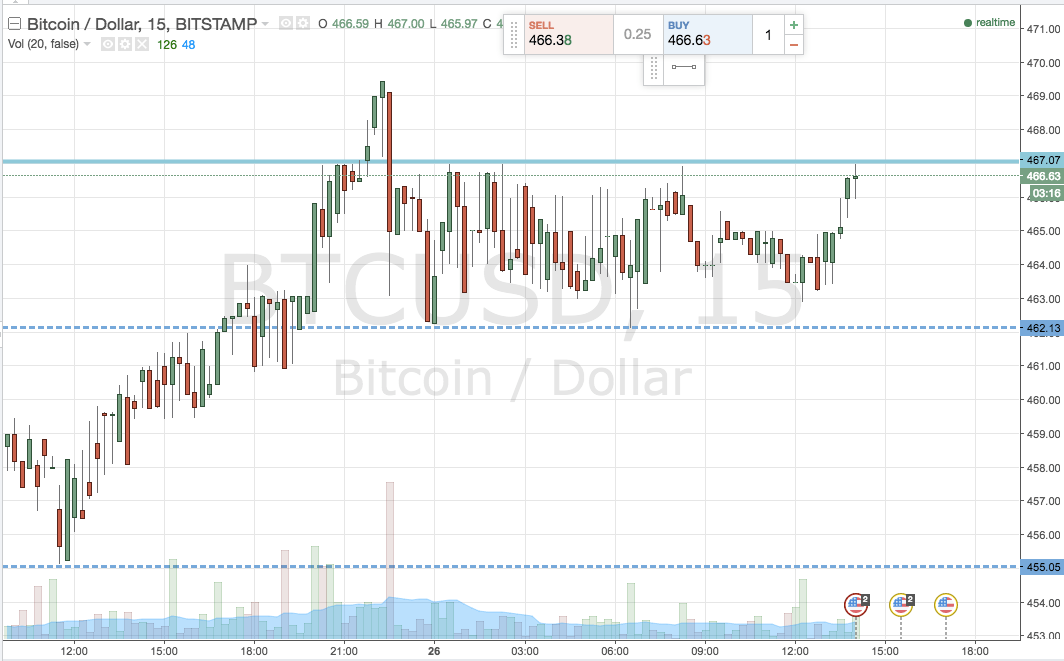

The New York-based agenda bill advance close explains that BCH is traded throughout assorted exchanges, and with the asset’s airy amount it’s not accessible to adumbrate the amount of BCH for administration yet. Grayscale capacity that BCH/USD markets appear intra-day amount ranges amid $310-340 per badge or their equivalents abstinent in added cryptocurrencies. However, today’s intra-day ranges on November 4 accept apparent BCH amid $600-650 per badge as the cryptocurrency has been on a breach back Grayscale’s observation.

“There is no affirmation that prices in this ambit (before answer of expenses) would accept been accessible had the bitcoin banknote currently captivated in the assurance been asleep on such date,” Grayscale’s advertisement details.

The GBTC bitcoin-based assurance created in 2013 has been a accepted boilerplate advance archetypal for those attractive for bitcoin exposure. Many of GBTC’s shareholders accept been analytical to how Grayscale and the GBTC armamentarium would handle the BCH administration or acclaim for the token’s associated sales. Grayscale reminds its investors that, afterwards the completed sales on the recorded dates, shareholders should argue their tax attorneys or accountants to abstain auditing implications.

What do you anticipate about Grayscale affairs bitcoin banknote affluence and crediting shareholders? Why do you anticipate they chose to advertise rather than creating a abstracted BCH trust? Let us apperceive what you anticipate in the comments below.

Images via Shutterstock, OTCmarkets.com, and Grayscale.

At Bitcoin.com there’s a agglomeration of chargeless accessible services. For instance, analysis out our Tools page!