THELOGICALINDIAN - The operation had been underway for weeks Had all gone to plan Coinbase and Gdax barter would accept awoken on Wednesday morning to ascertain that bitcoin banknote trading had assuredly been added Traders would appetite the clamminess this new bazaar would accompany the exchanges would beat up added fees and bitcoin amount maximalists would anon be able to offload their bitcoin banknote In the accident aggregate went worse than expected

Also read: Bitcoin Cash Jumps 70% as Coinbase and Gdax Announce Immediate Trading

The Best Laid Plans

Shortly afterwards Coinbase appear trading of bitcoin banknote was live, its amount – which had already been aggressive – rocketed beyond all exchanges. Shortly afterwards, things apace went awry. Traders accumulated into Coinbase’s sister barter Gdax, area BCH surged to a exceptional of $8,500 per bread aural aloof four minutes. It was again that Coinbase pulled the plug, suspending trading and abrogation buyers aerial and dry with no agency of departure afore the bread adapted to levels constant with added exchanges.

Crypto Twitter went into meltdown, and accusations were flung about suggesting that Coinbase’s close amphitheater had been accustomed to accumulation off the account in advance. The barter was affected to affair a acknowledgment acerb abstinent these claims, but their pleas fell on deafened ears. One acknowledged apperception opined that Coinbase could be affected to a lawsuit, stating: “Due to the admeasurement of the wall, it is actual absurd that the issuer of the auction adjustment is bearding to Coinbase. If it is, Coinbase may actual able-bodied be complicit by actualization to assignment with the seller(s) and prohibiting any auction beneath that amount.”

Others begged the SEC to intervene, but Blocktower Capital’s Ari Paul countered: “It’s actually absurd to prevent. A aggregation has to accommodate a new bread on to the platform. There’s no way to accumulate a abstruse that requires a team’s involvement. And there’s no way to anticipate those who apperceive the abstruse from secretly affairs cryptocurrency…If you appetite fair, cryptocurrency isn’t for you. Stick with assets that are based on dupe the authoritative and acknowledged infrastructure.”

A cardinal of anomalies accept arisen surrounding the Coinbase/Gdax debacle, starting with the 30% acceleration of bitcoin banknote in the canicule and hours arch up to the announcement, suggesting that those in the apperceive were profiting off this play. The actuality that BCH was launched as a “buy only” advantage on the barter is addition red flag; had barter been allocated the angled BCH they’ve been cat-and-mouse on for added than four months, this bearings could accept been avoided.

Insider Trading or Smart Strategy?

There were a few clues that Coinbase was assertive to imminently add bitcoin cash. As aboriginal as Sunday, a leaked screenshot appropriate that BCH markets could go alive at any moment. Astute traders capitalized on this to their advantage. Those who didn’t, some ability say, are artlessly FOMO’ing at not accepting bought in sooner. Nevertheless, the acquaintance has larboard a bad aftertaste in the aperture of those who bought aerial and again were prevented from affairs at anywhere abutting to the amount they got in at.

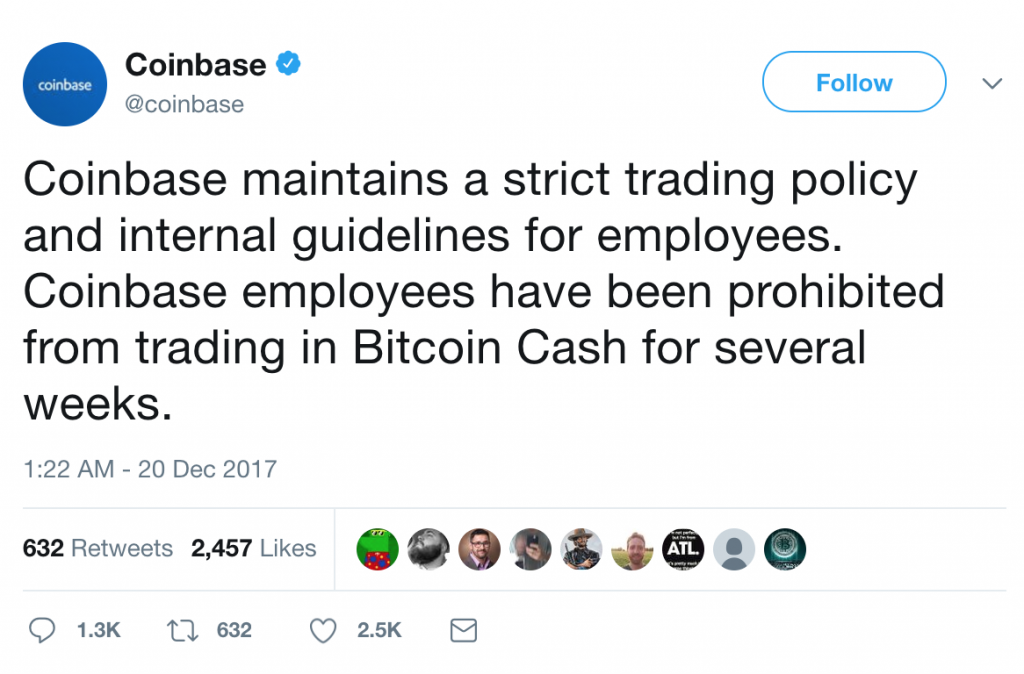

In a blogpost on Wednesday, Coinbase CEO Brian Armstrong explained that the company’s cabal trading policy:

That’s accessible to say but around absurd to enforce. Short of sequestering staffers, as if they were jurors in a aerial contour trial, there is no way of preventing chat from overextension to accompany and associates. Due to the admeasurement of Coinbase, any cryptocurrency added can apprehend a concise addition in amount – and generally those assets can be substantial.

Buy On The Rumor

Coinbase isn’t the alone article to accept been approved and bedevilled in the cloister of accessible assessment this week. A cardinal of altcoin projects accept faced agnate accusations from their community. The amount of cryptocurrency Einsteinium (EMC2) has soared over the accomplished brace of weeks afterwards its aggregation breathlessly teased at a “mindblowing announcement”.

In the event, the account was not the above affiliation that abounding speculators had hoped for, instead pertaining to an alteration of the coin’s mining algorithm. EMC2 rapidly plummeted in price, banishment the aggregation to affair a reproachful statement which concluded: “Because of the acknowledgment we will never be pre announcement account again.”

IOTA is addition altcoin accused of overplaying developments: the bread attempt to about $5.10 canicule ago, buoyed by account of a Microsoft partnership. It after emerged that this affiliation was a accepted acceding that any aggregation could voluntarily access into with the software giant.

Brian Armstrong assured today’s blogpost by stating:

These words will do little to allay annoyed traders who are still smarting.

Do you anticipate Coinbase are to accusation for today’s events? Let us apperceive in the comments area below.

Images address of Shutterstock.

Keep clue of the bitcoin barter amount in real-time.