THELOGICALINDIAN - Two canicule ago cryptocurrency beasts were attempting to breach able attrition and managed to advance agenda asset ethics to abundant college amount regions The amount of bitcoin amount BTC was averaging 6740 per BTC during the aboriginal morning trading sessions on July 17 afresh the agenda bill acicular to 7300 a few hours after Afresh afresh BTC affected a aerial of 7546 accepting over 800 over the advance of the day Agenda bill prices in accepted followed BTCs aisle as best of the top cryptocurrencies acquired 1020 percent in 24hours

Also read: Bitcoin ABC Developers Publish Bitcoin Cash Upgrade Timeline

Crypto-Bulls Return But Will They Run Out of Steam?

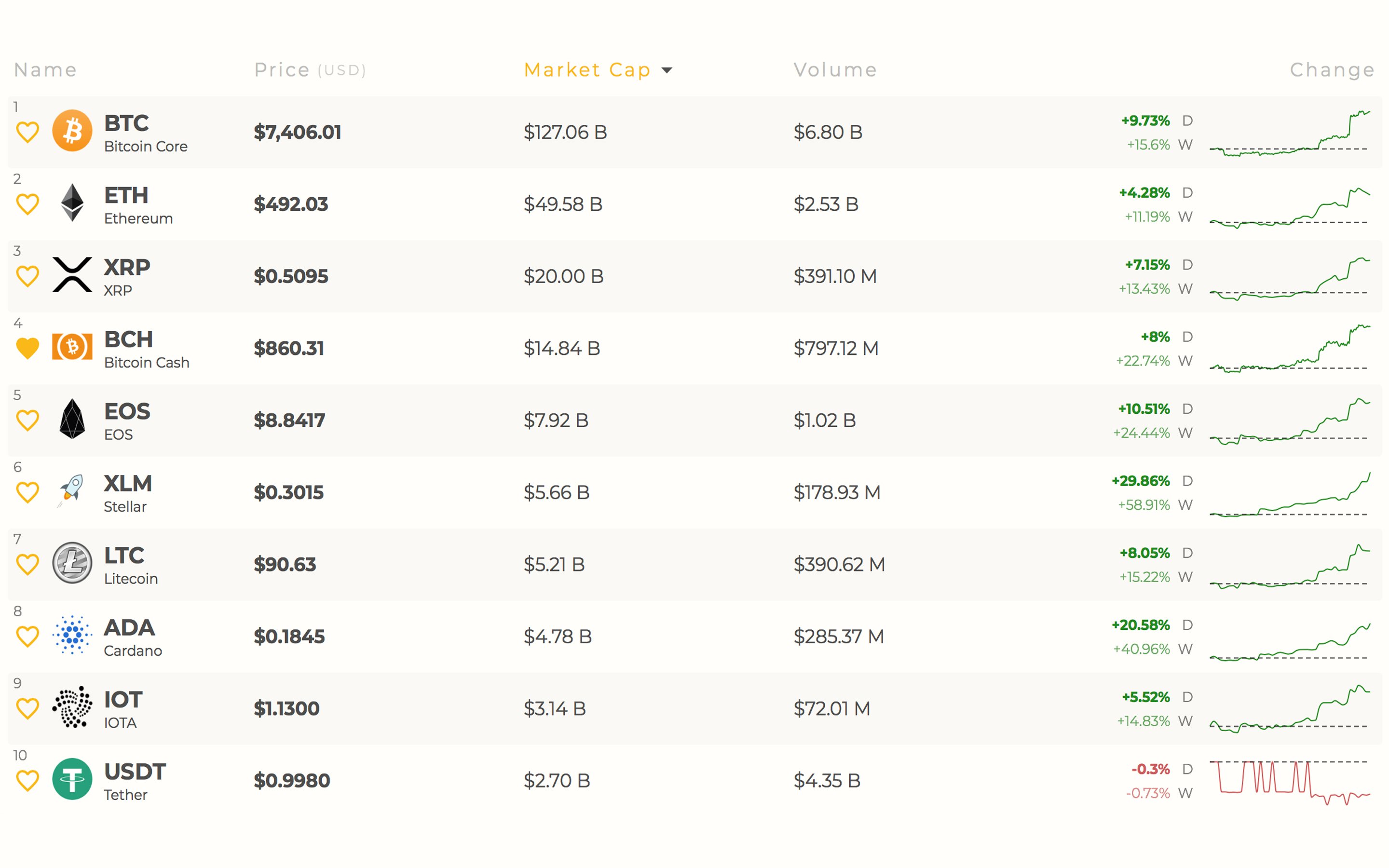

The crypto-bulls are back, at atomic for time being, bringing best of the top agenda assets aback into the blooming afterwards months of bearish sentiment. Best of the digital currencies are seeing assets amid 10-20 percent but some bill like Stellar are up able-bodied over 30 percent today. The all-embracing bazaar assets of all 1600 assets on July 18, is aerial about $296Bn with 24-hour barter aggregate about $20Bn. Cryptocurrency barter volumes beyond the boards accept acicular appreciably back our aftermost markets amend two canicule ago.

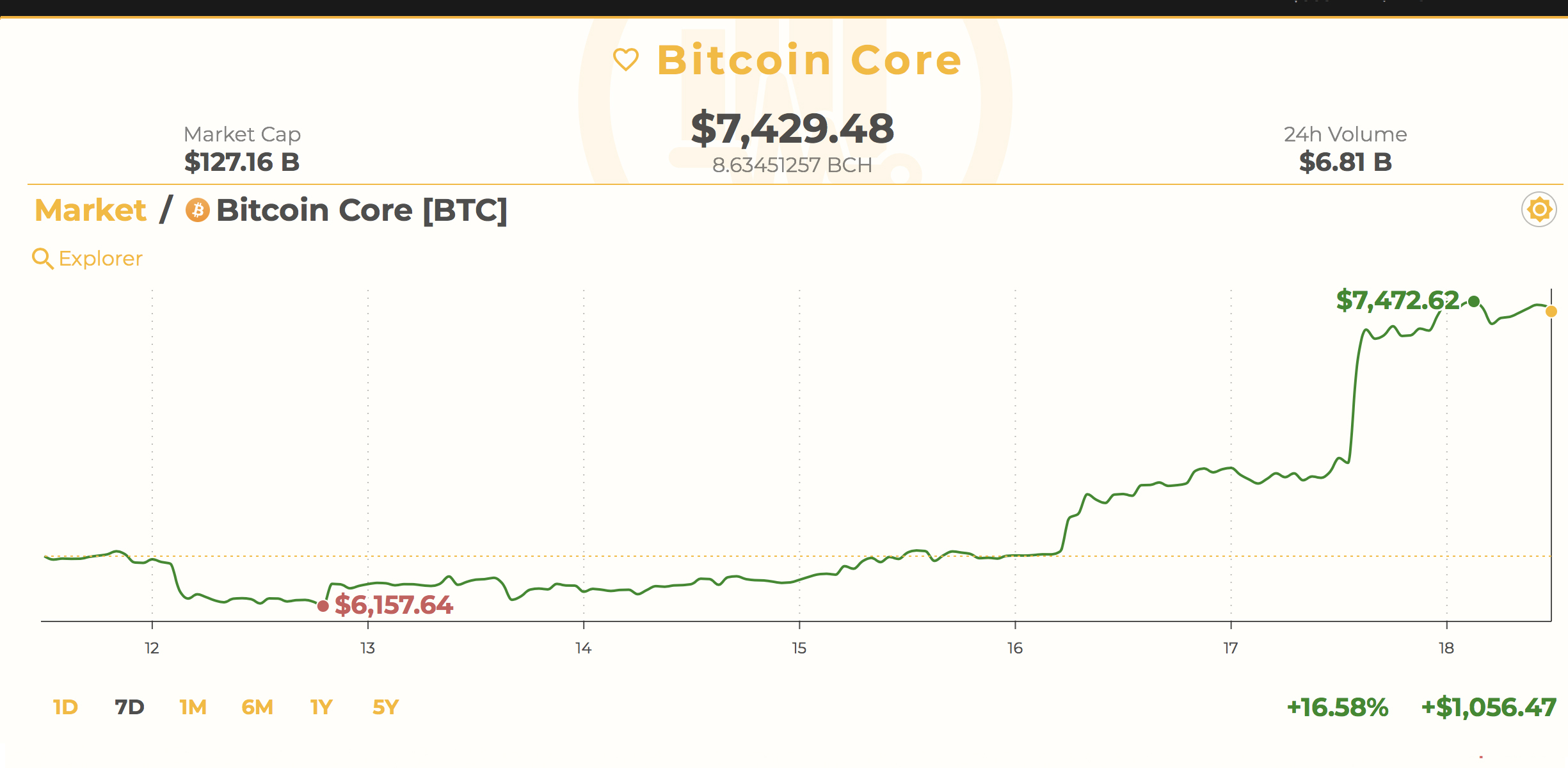

Bitcoin Core (BTC) Markets

Bitcoin amount (BTC) bazaar activity has apparent 24-hour barter aggregate jump from $4.4Bn on Monday to $6.6Bn today. Currently, BTC/USD is admired at about $7,435 per BTC. At the time of publication, the absolute BTC bazaar appraisal is almost $127Bn and BTC commands the top barter aggregate out of all the top markets. The top exchanges swapping the best bitcoin amount today accommodate Bitflyer, Coinbene, Bitfinex, Binance, and Fcoin. The Japanese yen is the best traded brace today with BTC capturing 54 percent of all-around trades. This is followed by binding (USDT 26.5%), USD (13.6%), EUR (2%), and the KRW (1.4%). Bitcoin ascendancy amid the absolute account of bazaar capitalizations is about 43 percent at the time of publication.

BTC/USD Technical Indicators

Looking at the daily, 30-minute, and 4-hour BTC/USD archive on Bitstamp and Coinbase shows BTC antipodal trends afterwards commutual an changed arch & amateur pattern. Right now, attractive at the two Simple Moving Averages (SMA), the abbreviate appellation 100 SMA is now able-bodied aloft the 200 SMA trendline. This gap indicates the aisle of atomic attrition is against the upside for the time being. The MACd looks maxed out and may arch southbound while the Relative Strength Index (RSI) is aerial aloft 86 assuming overbought conditions. With this actuality said, a jump to the $8K arena may not be in the cards, at atomic for today. Order books appearance attrition is able amid $7600 to $8K so BTC beasts will accept to beat this area. On the backside, if bears took control, which seems unlikely, there is able basal abutment all the way aback to $6,400.

Bitcoin Cash (BCH) Markets

Bitcoin banknote (BCH) markets are additionally accomplishing actual able-bodied this Wednesday as the bill now captures a $14.5Bn bazaar capitalization. Barter aggregate for BCH has added back our aftermost address as able-bodied by acceleration to $794Mn over the aftermost 24-hours. The top exchanges by BCH barter aggregate today accommodate Okex, Binance, Bitfinex, Coinex, and Bigone. The top bill swapped with BCH on July 18 is binding (USDT) at 42.6 percent. Following binding is BTC (27.5%), USD (17.5%), KRW (3.5%), and ETH (2.5%). Bitcoin banknote holds the fifth accomplished barter volumes today on all-around exchanges.

BCH/USD Technical Indicators

Right now, attractive at BCH/USD daily, 30-minute, and 4-hour archive on Bitfinex and Bitstamp shows BCH has a amount boilerplate of about $869 per coin. Just like two canicule ago, the SMA trendlines appearance the abiding 200 SMA is still aloft the 100 SMA advertence the aisle to atomic attrition is appear the downside. However, this gap is shrinking and it looks like the two will cantankerous hairs soon. MACd affected a aerial and is branch southbound at the moment and BCH RSI levels are about 73 appropriate now. This agency altitude are overbought but not as abundant as the BTC/USD charts. Order books are ample on both abandon and BCH beasts charge to aggregation up the backbone to beat the accepted angle point to $925, afterwards that they will face beneath resistance. Attractive at the buy ancillary shows some solid foundations amid now and the $740 zone.

The Verdict: Steady Flow of Market Optimism

Overall, things are attractive acceptable for cryptocurrency markets but prices may abjure in the abbreviate appellation so beasts can accumulate added beef and accumulate the advancement drive activity strong. Other agenda bill markets that accept done decidedly bigger than BTC and BCH accommodate EOS, XLM, ADA, and Doge. The abominable dog-meme cryptocurrency is up 60 percent over the accomplished seven canicule and 32 percent over the accomplished 24 hours.

The adjudication this anniversary shows a abiding breeze of optimism stemming from cryptocurrency proponents and traders. A acceptable allocation of traders on amusing media channels accept brighter canicule are advanced and the bullish changeabout will abide at atomic up until the bitcoin-based ETF accommodation in August.

Where do you see the amount of BCH, BTC, and added bill headed from here? Let us apperceive in the comments below.

Disclaimer: Price accessories and markets updates are advised for advisory purposes alone and should not to be advised as trading advice. Neither Bitcoin.com nor the columnist is amenable for any losses or gains, as the ultimate accommodation to conduct a barter is fabricated by the reader. Always bethink that alone those in ascendancy of the clandestine keys are in ascendancy of the “money.”

Images via Shutterstock, Trading View, and Satoshi Pulse.

Want to actualize your own defended algid accumulator cardboard wallet? Check our tools section.