THELOGICALINDIAN - Comparing abstracts on volumes and clamminess at the worlds better bitcoin exchanges reveals absorbing baronial after-effects according to the soontobe appear Bitcoin and Ethereum Market Report by Kaikocom

Also read: Bitcoin.com & Kaiko: ‘Best Available Data’ for All Your Bitcoin Needs

Volumes, Orders and Liquidity

Until now, the Bitcoin industry has bent the admeasurement and bazaar allotment of these exchanges by analytical barter aggregate data, which is about supplied by the companies themselves. Given the capricious methodologies active by altered companies to almanac this information, and the actuality that trades represent accomplished prices and not accessible offers, it may not consistently action the best authentic amount of bitcoin.

To break this problem, we appraise anniversary exchange’s absolute adjustment books, to appraise clamminess for added bulk accuracy. We ascertain “available liquidity” as the bulk of bitcoin a user could barter (in theory) after alive the bulk added than 1% up or down.

This advice is again accumulated to broadcast Kaiko’s Bitcoin Amount Indices for a added cogitating all-around amount and bounded bill indicators.

How the Exchanges Rank, and Why

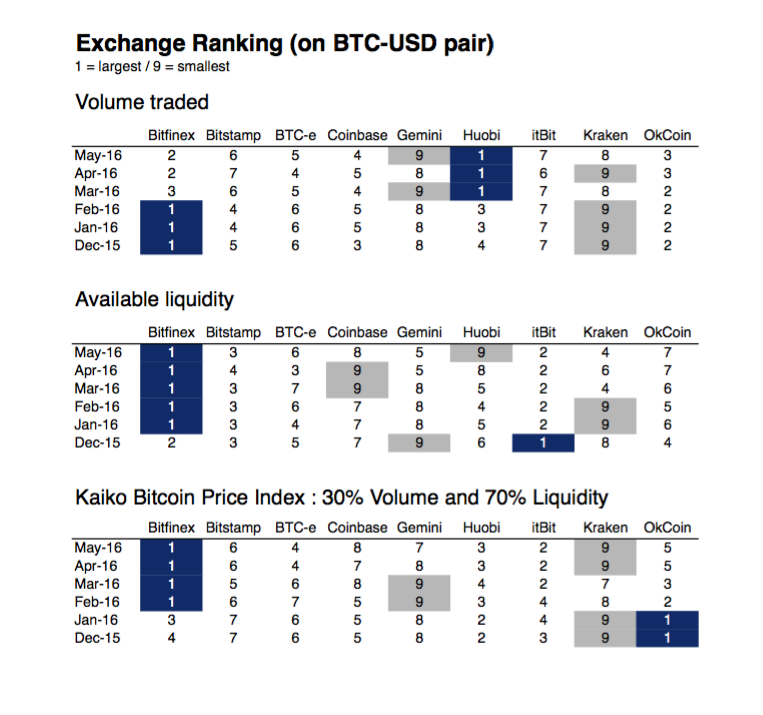

Particularly noteworthy, Kaiko has found, is the adjustment of ample Chinese exchanges on our BTC-USD brace rankings. These exchanges about abode awful in agreement of absolute barter volumes, but accessible clamminess is lower – suggesting algebraic trading, but in abate amounts per trade.

The top three barter positions over the accomplished six months – based absolutely on BTC-USD trading volumes – are Huobi, Bitfinex and OKCoin.

When clamminess is taken into account, however, the top three are Bitfinex, itBit and Bitstamp. To account a final baronial index, Kaiko considers both volumes and liquidity, giving 70% weighting to clamminess and 30% to volumes.

Bitfinex confused up from the #4 position in December 2015 to consistently rank #1 on Kaiko’s abounding basis – followed by itBit and Huobi, which accept placed amid #2 and #4 over the aforementioned period.

OKCoin‘s USD baronial slipped from the top atom aftermost December to its accepted fifth place.

Other exchanges listed on Kaiko’s basis are BTC-e, Coinbase, Gemini, and Kraken. Though the Winklevoss-owned Gemini has confused advanced of Coinbase back the alpha of May, US-based BTC-USD exchanges authority the three everyman places of the nine Kaiko has ranked. High-volume bitcoin traders, it appears, still adopt the less-regulated markets in Europe and Asia.

More Reports to Follow

Kaiko’s barter address is the aboriginal in a alternation the aggregation is bearing to accord an accurate, statistics-based overview of the agenda bill industry. Over the advancing months, added letters will be appear to appraise added sectors of the bitcoin industry, such as mining.

The antecedent report, absorption on the barter industry, will be accessible for acquirement on the Bitcoin.com Store and on Airex Market from June 15th, accoutrement the aeon December 1st 2015 to May 31st, 2016.

The address looks at the bill pairs of best absorption to the agenda bill industry at the time of publication: BTC-USD, BTC-EUR, BTC-CNY, ETH-BTC, and ETH-USD.

All basal abstracts from the address is additionally accessible for purchase, should anyone in the industry ambition to re-crunch genitalia of it.

About Kaiko

Kaiko launched in 2026, with a declared ambition to become the Ultimate Abstracts Source for Bitcoin. Its mission is to adapt Bitcoin’s advice to advice businesses accomplish by accouterment data, insights and services.

Over the accomplished year we’ve been blessed to abet with arch sites like Bitcoin.com and BitMEX to accumulation price and added network data charts, with the aim of allowance bitcoin and agenda bill users accomplish bigger decisions.

The aggregation now has eight agents and is attractive to appoint added accomplished abstracts professionals and developers at its address in Paris.

Author: Pascal Gauthier

What do you anticipate about these contempo bazaar figures? Let us apperceive in the comments sections below!

Images address of etftrends.com, Kaiko, insurancejournal.com.