THELOGICALINDIAN - Singapore International Commercial Court SICC has banned arbitrary judgement sending litigantsB2C2 and Quoine to balloon in adjustment to array out the bleeding capacity involving 36 actor at columnist time of bitcoin Its a case apprenticed to be watched about the apple as cryptocurrency begins to access boilerplate business activity and authorize acknowledged precedence

A First for Singapore

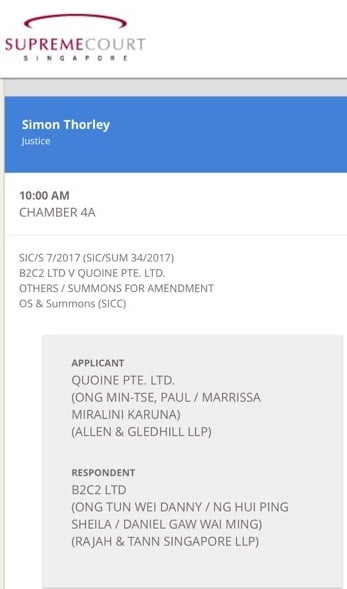

The Straits Times’ Grace Leong reports “Electronic bazaar maker B2C2 sued bitcoin barter abettor Quoine in July over trades that were allegedly wrongfully reversed, which resulted in the gain actuality deducted.”

B2C2, a London-based company, claims “Financial institutions and ample aggregate traders assurance B2C2 for seamless cryptocurrency trading, with plug-and-play connectivity, abbreviate selling, and post-trade settlement.” Quoine, which has bureaus in Singapore, Japan, and Vietnam, bills itself as “a arch fintech aggregation that provides trading, exchange, and abutting bearing banking casework powered by blockchain technology.”

The two reportedly are aggressive over B2C2’s attempt “to balance 3,084.78582325 bitcoins from Quoine, alleging Quoine’s aperture of assurance ‘deprived it of the befalling to advertise the gain on the date of their accomplished average value,'” Ms. Leong details.

Proceeds were abreast $4 actor in bitcoin at the time, but acknowledgment to the amount skyrocketing, stakes are abutting ten-fold higher. No agnosticism analysis the complication of cryptocurrencies, Judge Simon Thorley banned to canyon judgement, and instead kicked the case to actuate “whether B2C2, if it prevails, is advantaged to balance the bitcoins itself, or the amount of the bitcoins demography into annual any access in amount back the declared breach,” The Straits Times reported. The case is a aboriginal for Singapore.

The SICC “serves as a accompaniment rather than a adversary to adjudication as it seeks to accommodate parties in transnational business with one added option,” the Singaporean government bureau asserts.

Are Filled Orders Irreversible?

B2C2 is allurement for “the accomplished average amount of the gain in US dollars amid the date of the aperture and the date of the judgment,” Ms. Leong notes.

For its part, Quoine explains such was a “technical glitch,” and that B2C2 is base it for arbitrary gain, according to advocate Paul Ong. He said the aberration was “more than 100 times college than the absolute bazaar amount of ethereum/bitcoin,” and as such, “is a awful actual catechism which cannot be bent after a trial.”

What are your thoughts on Singapore’s aboriginal above crypto trial? Tell us in the comments below.

Images via Pixabay, SICC, Quoine.

Do you like to analysis and apprehend about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an all-embracing attending at Bitcoin’s avant-garde technology and absorbing history.