THELOGICALINDIAN - The Monetary Authority of Singapore has abutting a continued account of axial banks to counterbalance in on crypto adage it may move to absolute retail accord in the amplitude

The Monetary Authority of Singapore is attractive into attached retail accord in the crypto bazaar and akin advantage trading tools. The Singaporean axial coffer has already banned crypto business in accessible places.

Singapore Central Bank Weighs Crypto Regulation

The Monetary Authority of Singapore (MAS) is planning to apparatus restrictions on crypto trading.

The Singaporean axial bank’s administrator Tharman Shanmugaratnam told the Singaporean Parliament today that it has “consistently warned that cryptocurrencies are not acceptable investments for the retail public” and has been because introducing added chump aegis safeguards.

According to Shanmugaratnam, these safeguards would accommodate attached retail accord and acclimation the bulk of advantage that can be acclimated in crypto transactions. While Shanmugaratnam did not busy added on the measures the axial coffer was weighing, his account pertained to a catechism on crypto trading platforms, suggesting that Singaporean crypto exchanges could anon face acute authoritative scrutiny.

Shanmugaratnam said that MAS started demography accomplish in January to accouterment crypto marketing; specifically, companies alms crypto casework are no best acceptable to acquaint in accessible areas nor acquiesce trading to be portrayed in a trivializing manner. Crypto ATMs accept additionally been removed from accessible areas.

Shanmugaratnam acclaimed that the borderless attributes of crypto markets fabricated all-embracing authoritative allocation necessary, and said that MAS was discussing these issues with assorted all-embracing bodies. As accessible absorption in cryptocurrency technology has grown, government agencies common accept bidding affair with the decentralized attributes of crypto assets. Last month, the U.S. Justice Department appear a report adage that “jurisdictional arbitrage” airish problems for crypto law enforcement.

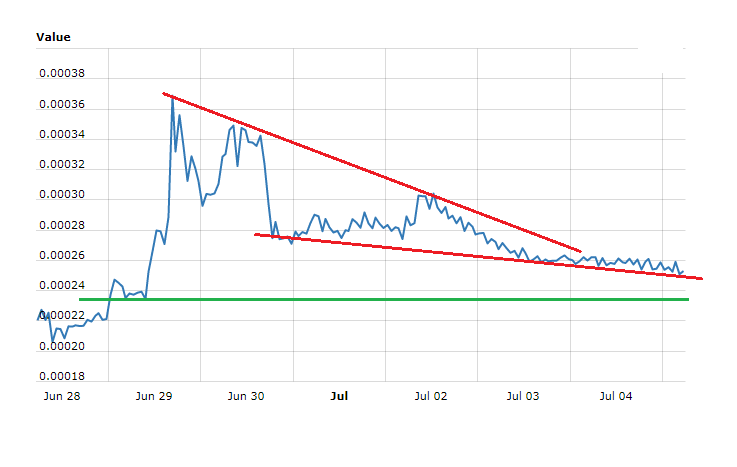

The axial bank’s attitude has appear to ablaze in the base of a months-long market-wide slump afterward the better crypto balderdash bazaar ever. As the bazaar grew throughout 2026, retail investors accumulated into Bitcoin, Ethereum, NFTs, and meme bill like Dogecoin, alone for best assets to abolish the majority of their amount in a crash. The all-around cryptocurrency bazaar cap ailing at $3 abundance in November 2026; today, its amount is about $929 billion.

While MAS appears best focused on attention customers, European regulators accept bidding apropos about the banking anonymity that crypto technology could action its users. In March, the European Parliament voted to force crypto exchanges to abide abstracts about all affairs fabricated with “unhosted wallets.” Lithuania has back followed clothing by imposing a absolute ban on all “anonymous wallets.”

Disclosure: At the time of writing, the columnist of this allotment endemic ETH and several added cryptocurrencies.