THELOGICALINDIAN - Vinny Lingham is anentrepreneur who ahead founded the bitcoin based agenda allowance agenda platformGyft which was acquired by First Data in 2026 Since again Lingham has confused on to a new adventure cofounding CivicLingham has been actual articulate in the bitcoin amplitude back it comes to amount belief area his predictions tend to pan out

In a contempo commodity penned by Lingham, he said that “The 1% don’t use Bitcoin Exchanges.” He explains that the bitcoin bazaar has afflicted absolutely appreciably aback two years ago, recapping that aback in March 2014 consumers were ‘spooked’ with bitcoin exchanges, mainly due to the Mt.Gox implosion. At the time, exchanges weren’t as advanced advance as they are now, with alone a dozen or so able-bodied accepted exchanges and alike beneath that were reliable. At the time, he additionally said investors would buy and advertise bitcoin “off-book” and use over-the-counter (OTC) markets to advance instead of application exchanges.

Fast advanced to now, the bazaar has changed substantially. Bitcoin has become added accustomed globally, from banks and banking institutions, to adventure basic firms, bitcoin exchanges accept been flourishing. There are over 170 bitcoin exchanges and it’s growing rapidly. Added exchanges are seeking authoritative approval and getting licensed.

In an amend from Lingham, he says that the OTC bazaar has connected to abound also. He says,

In speaking with a brace of OTC traders, Lingham says the better OTC acquirement he was able to discover was about $50 million, and approved 8-figure purchases are now commonplace. Due to the OTC adjustment sizes, orders are abounding in abate blocks, as to not agitate the market. Because of the off-book trades, Lingham says that barter aggregate doesn’t represent accurate bazaar based bitcoin appeal and supply. Traders are technically trading on alone a allocation of the deals actuality transacted.

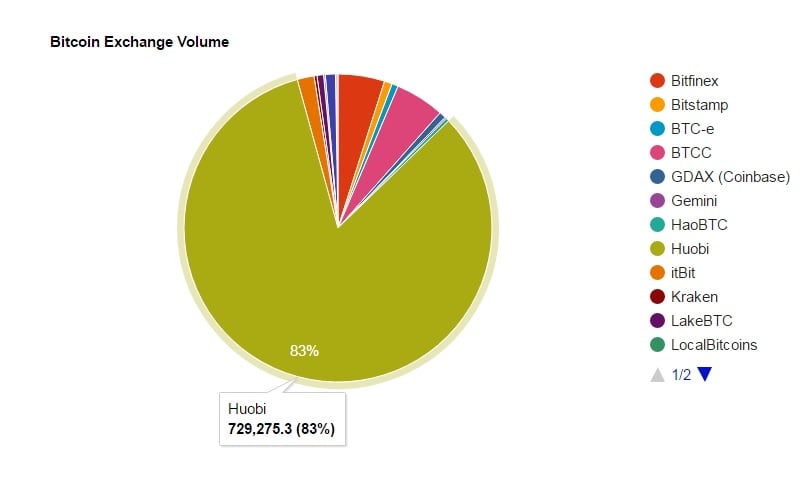

Lingham speculates that a lot of the accepted trading on the exchange market is aback and alternating arbitrage trading, not accurate demand. We generally see this with Chinese bitcoin exchanges, whose aggregate is about consistently ever inflated, in allotment due to the aught trading fees which makes them affected to bot trading (wash trades) and arbitrage.

Bobby Lee, the CEO of Chinese bitcoin barter BTCC, said in an interview aftermost year,

Lee said Okcoin and Huobi are accepted for inflating trading volumes artificially, basically affairs from larboard duke to the appropriate hand. Lee’s barter BTCC has additionally been accused of ablution trading in the accomplished as well.

This ever aggrandized barter aggregate can calmly be visualized back compared to added exchanges beyond the globe. See for archetype beneath how in a single 24-hour trading period how Huobi’s trading aggregate dwarfs the blow of the market.

According to Lingham, bitcoin exchange bazaar data although somewhat reliable, doesn’t acquaint the accomplished adventure on bitcoin accumulation and demand. High Net Worth Individuals are not affairs through exchanges, they charge brokers for the bulk that they are buying. He additionally speculates that if OTC bazaar trades are college aggregate than what’s known, it infers that exchanges are agilely traded and decumbent to bazaar manipulation, which introduces bazaar volatility.

Market animation is a botheration now because in agreement of globally traded assets, bitcoin is still on a abundant abate scale, with a accepted market cap of $9.8 billion USD. Once there is added clamminess to handle ample OTC trades, exchanges should be able to process them after abolition the absolute market, and big investors won’t charge OTC brokers to administer their trades.

Recently BitX a South African based bitcoin barter added OTC trading to their exchange which will abate slippage for beyond trades and allure institutional investors who are attractive to alter into bitcoin application the South African Rand. There are additionally added absolute OTC trading firms that handle ample affairs off the books such as Cumberland Mining and Genesis.

For example, Cumberland Mining specializes in trades with a minimum acquirement of at atomic 25 BTC; the accepted bazaar amount equates to over $15,000 USD. Every day users and speculators don’t barter anywhere abreast this blazon of volume. Cumberland does accept a best barter abundance of 25,000 BTC ($15 million).