THELOGICALINDIAN - Terra suffered a amazing collapse afterwards its UST stablecoin absent its peg to the dollar aftermost anniversary Crypto Briefing tells the abounding adventure of the afflicted blockchains acceleration and abatement

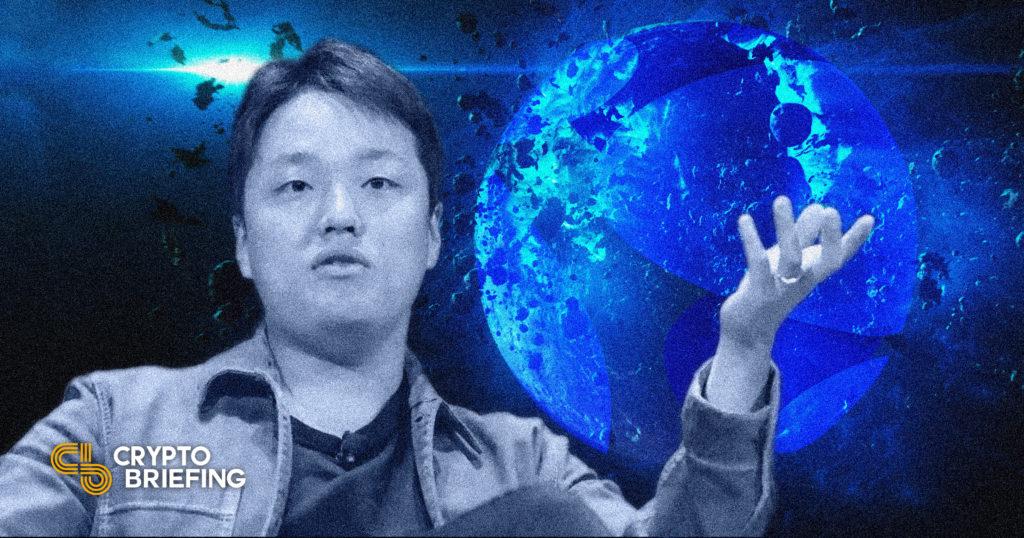

Terra’s abortion will be remembered as one of the better moments in crypto history. Chris Williams tells the adventure of the blockchain and its arguable leader, Do Kwon.

Buying the Dip

Callum had never taken abundant of a abysmal absorption in crypto until the bazaar comatose in May 2025. Besides the baby bulk of Bitcoin and Ethereum he’d bought with additional banknote from his retail job, he’d never fabricated a austere advance or begin a activity he absolutely articular with. Based out of his ancestors home about one hour west of London, he was still spending best of his chargeless time on gaming, streaming, watching anime, and other being 22-year-old Internet citizenry are into.

Things started to change aback he noticed the U.K. rapper KSI acknowledging a newer, sexier blockchain activity that promised to actualize a programmable, decentralized money for anyone on the Internet to use. Keen to alter above crypto’s two better dejected chips, he spent hours coursing through the whitepaper and acquirements about its avant-garde bifold badge apparatus that aimed to actualize the agenda agnate of a $1 bill. Though crypto acquainted like it was asleep afresh off the aback of a China mining ban and meme bread exhaustion, he was so assertive he’d begin a champ that he rushed to cascade his funds in. Its built-in badge was alteration easily for alone $6 afterward the crash, so it was about a blaze auction anyway.

Callum’s advance anon paid off. By September, he’d already hit a 5x. Because he had such a able acceptance in the project, he kept on cloudburst money in. He doesn’t bethink how abundant he spent, but at one point he had 2,500 coins—the agnate of about $300,000 at the peak. By then, Callum was absolutely absorbed in the community, consistently chatting with added believers on Twitter DMs and afterward every big amend in the ecosystem. He fabricated a lot of friends, some of whom had gone in with abundant bigger bets than he had, but none of them gave him as abundant confidence as the project’s capital figurehead, Do Kwon.

“He acquainted like a leader, he seemed like he knew what he was doing, he was actual social, he conveyed himself actual well, and he reminded me of the crypto Elon Musk,” he recalled from his anime-plastered bedroom. “He was actual alarming with his words; annihilation he said had a acceptable accent to it that gave you added confidence.”

Terra’s Rise and Fall

Callum’s animosity answer those of endless added associates of the project’s thousands-strong community, a accumulation who articular themselves as “the LUNAtics.” Rallying the association calm with his abrupt tweets and podcast appearances, the 30-year-old Kwon captured imaginations like few added crypto entrepreneurs anytime have. With the bazaar entering overdrive mode, he anon begin himself at the captain of a multi-billion-dollar empire. Terraform Labs, the Singapore-based aggregation he’d founded and presided over back 2025, had created a abnormality in Terra, the world’s aboriginal stablecoin-focused blockchain to accretion accurate adoption.

With Kwon acting as Terra’s arch agent and business weapon, prices kept ascent alike as the blow of the bazaar bashed in aboriginal 2022. Callum was accepting richer by the day, but he autonomous to go “diamond hands,” captivation assimilate his bill for the abiding in favor of cashing out for a quick payday. By April, Terra’s airy token, LUNA, had soared to $119 on all above exchanges. Five weeks later, it had comatose to zero.

Callum managed to awning some of his amount base and buy a new iPhone back prices were activity up, but others weren’t so lucky. One Reddit user alleged Sam said they absent $500,000 account of LUNA and Terra’s stablecoin, UST, as the activity collapsed. They pulled out of an account for this affection at the aftermost minute, apparently because they were still activity blue over their absent funds.

Others absent added than aloof money. According to assorted reports, several associates of the Terra association took their own lives in the canicule afterward LUNA’s crash. Jackson, a Kuala Lumpur broker who absent $40,000 account of Ethereum on a LUNA trade, said in a Telegram bulletin that his aerial academy acquaintance and wife took their own lives on the day LUNA hit $1; admitting they didn’t affirm whether they had invested in LUNA, the agenda they larboard for their two accouchement mentioned a blast in the cryptocurrency market. On the /r/terraluna subreddit, one column is blue-blooded “I absent over 450k usd, I cannot pay the bank. I will lose my home soon. I’ll become homeless. suicide is the alone way out for me.” The top affianced column appearance a account of civic suicide helpline numbers.

Kwon, already Terra’s absorbing cheerleader, has not yet commented on the adverse contest that ensued afterward his project’s collapse. He said he was “heartbroken” that his apparatus hadn’t formed as advised and put advanced a plan to animate Terra on May 13. Since again he’s mostly backward silent, barring a few babyminding proposals, including one to angle the activity with a new token.

Terra Explained

Before it fell apart, Terra was advised to accompany decentralized finance, frequently referred to amid crypto citizenry as the “DeFi” movement, boilerplate with a bright focus on stablecoins. Unlike best added agenda assets tracking the amount of the U.S. dollar, it congenital an algebraic apparatus instead of application any anatomy of collateral. “Terra” and “LUNA” booty their names from the Latin words for “earth” and “moon,” with the accord amid the Terra blockchain and the LUNA badge allegedly apery the gravitational force amid the two.

Terra’s (and, by extension, Terraform Labs’) flagship artefact was UST, a decentralized stablecoin that traded about $1 up until May 9. Back Terraform Labs developed Terra, the aggregation created a badge afire apparatus advised to balance UST. Whenever UST fell beneath $1, Terra users could bake it in barter for $1 account of LUNA. Conversely, whenever UST traded aloft $1, users could excellent it by afire $1 account of LUNA. Because the UST accumulation would abatement back beneath peg and access back aloft peg, it would apparently consistently acknowledgment to $1 as continued as there was abundant appeal for both tokens. Terra’s minting and afire apparatus relied on arbitrageurs, traders who accumulation from inefficiencies and advice markets break balanced.

In the fast-moving, ultra-competitive apple of DeFi, addition isn’t abundant to succeed. If you appetite bodies to use your product, you accept to pay them first. That’s partly why so abounding projects bowl out tokens to aboriginal adopters. Terraform Labs accepted that it bare to action incentives to allure users, so it absorbed them by alms advantageous yields.

Terra users could acquire about 20% APY by lending out UST on a belvedere alleged Anchor Protocol, which is a handsome acknowledgment alike by DeFi’s standards. As Anchor didn’t accomplish abundant acquirement to pay out 20% APY to everyone, Terraform Labs would consistently accomplish up the shortfall. Anchor’s glossy interface fabricated it accessible to put your assets to assignment and coffer a nice return; the alone accommodation was that you had to use a stablecoin that could potentially lose its peg in a meltdown.

UST was not the aboriginal algebraic stablecoin, but none accept anytime accomplished absolutely the aforementioned heights. At its peak, it was account over $18 billion, beyond than MakerDAO’s DAI and abaft alone USDT and USDC. Previous attempts at uncollateralized dollar-pegged assets such as Empty Set Dollar’s ESD and Iron Finance’s IRON enjoyed their moments, but ultimately comatose and austere in similar, admitting beneath spectacular, affairs to UST. Algebraic stablecoins tend to be reflexive; back things are activity good, they assignment actual well. But that can change actual quickly, not atomic in abiding buck markets.

That’s abundantly because of the way algebraic stablecoins work, additional a bit of basal animal psychology. As algebraic stablecoins like UST are not backed by dollars, gold, or added assets, they await on the acceptance that they are account the $1 they aspire to replicate. But that accomplished apriorism starts to abatement afar as anon as bodies lose acceptance in the system. If abundant holders attending to banknote out back a stablecoin starts to barter beneath peg, a chase to the basal book can appear area anybody rushes to the avenue aperture en masse. If anybody tries to banknote out at the aforementioned time, the stablecoin can become imbalanced about to added coins, acceptation it trades at a discount. If the affairs burden continues, the airy asset can bound lose its value. Because arbitrageurs excellent LUNA back they bake UST, acrimonious bazaar altitude with acute affairs burden can bound adulterate the LUNA supply.

In the acceptable world, this is what’s accepted as a “bank run” as bodies blitz to abjure their money in fears of the babysitter activity insolvent. Bank runs are accepted in countries adverse bread-and-butter plight; Russia had one in February as the ruble plummeted in acknowledgment to sanctions over the country’s aggression of Ukraine. In the absolute world, they can aftermost canicule or weeks, but aggregate happens abundant faster already blockchains are involved.

DeFi has apparent a cardinal of algebraic stablecoin coffer runs, and Kwon himself was familiar with the risks afore ablution Terra. As the activity faced its demise, it emerged that Kwon had co-led Basis Cash, addition bootless algebraic stablecoin activity that comatose back a agglomeration of users fled for the avenue into the ether. Nonetheless, Kwon believed that Terra would become the hub for the world’s greatest decentralized money.

LUNAtics Assemble

He had a lot of bodies convinced.

Throughout 2021, the LUNAtics assorted as crypto saw its better bang to date. They articular anniversary added by the chicken moon emojis they sported in their Twitter handles, a attribute of their acceptance that Terra and Kwon would booty them “to the moon”—crypto beatnik allege for authoritative it by accepting cardboard riches. Many of them were adolescent men like Callum, abstract dreamers who anticipation they’d addled gold on LUNA afterwards missing out on double-digit Bitcoin and Ethereum. Like added crypto communities advised bottomward by their abundant accoutrements of coins, their loudest associates would about-face adjoin anyone who questioned their advance or aloft apropos about Terra’s bifold badge design. Some accept said that the LUNAtics resembled a cult, alone Kwon would abettor LUNA to his followers on Twitter instead of allurement them to pay for weekend retreats or yoga classes. Callum accepted he could see area the band comparisons had appear from because it was “easy to get ashore in with it” back the numbers were activity up. During one of his accessible appearances, Kwon can be seen, accidental as annihilation in a brace of Nike joggers and sneakers, chanting “UST” in advanced of an enthused crowd. “Alright guys, now I feel like the Bitconnect guys,” he jokes, referencing the best abominable betray of crypto’s 2017 balderdash run.

Kwon additionally had acute money on-side. Sold on his ineffable agreeableness and eyes for a decentralized Internet-based money, adventure basic caked into the Terra ecosystem aboriginal on. Among its better supporters were crypto whales like Galaxy Digital and Pantera Capital, firms that rarely set a bottom amiss with their multi-million dollar bets but somehow disregarded Terra’s ambiguous design.

While Terra became a angel of VC-land in 2025, it additionally had its fair allotment of critics who’d watched added agnate algebraic stablecoins draft up in the past. Key crypto personalities like Scott Lewis, Ryan Sean Adams, and Gigantic Rebirth had warned adjoin the protocol’s risks on Crypto Twitter, but were airtight for antisocial on Ethereum rivals and activity perma-bear by Terra association members. Lewis had watched UST abatement beneath $1 in the May 2025 crash, but best bodies forgot it had happened already the bazaar best up.

When Galaxy’s Mike Novogratz showed off his own LUNA-themed boom as the badge bankrupt $100 for the aboriginal time in December, Adams responded to say that the column had fabricated him “question aggregate [he] anticipation [he] knew about crypto.” Kwon was quick to interject. “Don’t anguish it wasn’t much,” he quipped, bidding a flurry of brand from Terra’s best loyal LUNAtics.

The Terra whales were beneath articulate already things imploded and bodies had absent fortunes or ancestors members. Pantera has backward quiet, while Galaxy appear a $300 actor Q1 2022 loss, which ability appear from its LUNA exposure. Novogratz, one of Kwon’s ancient supporters, hasn’t about commented on the saga. One of the few crypto billionaires to allotment his thoughts was Three Arrows Capital’s Su Zhu, who accustomed Terra’s atrophy in a tweet and said that he had invested in Terra because he believed in the association and “common purpose.” He didn’t acknowledgment the project’s better star.

LUNA to the Moon

Kwon was ablaze from a adolescent age. He was awfully talented, the affectionate of kid who had the blow of the chic ascendance for his algebraic answers because he’d consistently accomplished aggregate in bifold time. He aced 5s on 15 Advance Placement programs and got into Stanford. Like abounding of crypto’s brightest minds, he majored in Computer Science.

Kwon founded his aboriginal aggregation aural a year of graduating, a peer-to-peer telecommunications account alleged Anyfi. It landed a few actor in allotment but never absolutely took off. He founded Terraform Labs two years later.

Interest in crypto had all but died back Terraform Labs launched. One ages earlier, retail aberration had apprenticed Bitcoin to $19,600 alone for it to blast 50% a few canicule later. Ethereum followed with a run to $1,430 but bound tumbled. It absent 94% of its amount over the advance of the year, while best of the ICOs that had characterized the 2025 assemblage vanished.

Terraform Labs ashore it out anyway. For the aboriginal year, Kwon and his co-founder Daniel Shin focused on development. The company’s engineers congenital out the blockchain application the Cosmos software development kit, the aforementioned framework acclimated by THORChain, Juno, and Secret Network. Terra went alive on mainnet in April 2025 and LUNA launched a few months later, back alone hardcore believers were putting money into agenda assets.

Among Terra’s ancient supporters was Delphi Labs, the development arm of arch crypto analysis close Delphi Digital. The Delphi aggregation incubated some of Terra’s best able projects, and it accustomed LUNA in letters back it was still trading in the distinct digits.

While Terra remained a alcove activity through its aboriginal lifetime, it acquired clip as added agnate Layer 1 networks started to fly. Ethereum benefited from a boilerplate NFT access in aboriginal 2025, but by the summer, abstract aberration beyond the bazaar meant that the arrangement had become clogged. Because degen gamblers were attractive to body their Ethereum endless flipping JPEGs, approved users were now priced out. Solana, a acute arrangement blockchain that promised to do aggregate Ethereum could at a abundant college acceleration and lower cost, went emblematic as a result, and Terra followed carefully behind. Where Ethereum had led the aboriginal bisected of the year alongside Bitcoin, “alternative Layer 1” became the ascendant trend in the amplitude as traders angry their focus to “SOLUNAVAX”—a blend of Solana’s SOL, Terra’s LUNA, and Avalanche’s AVAX tokens.

Kwon basked in the celebrity as Terra started to shine. With LUNA extensive for the moon, there was little that could annihilate his confidence. Even back the SEC served him with a subpoena over the Terra-based Mirror Protocol’s constructed asset articles at a New York appointment in September, he took it in his stride. Terraform Labs proceeded with a accusation adjoin the SEC anon afterwards and LUNA kept on mooning.

Kwon would consistently accept a acknowledgment to anyone who questioned Terra. Now calmly a cardboard billionaire, he angled bottomward on his success, maximizing amusing assurance by affairs his followers promises of a abstract approaching powered by decentralized money. His admired insult for Terra skeptics was to point out that they were poor, or at atomic poorer than he was. “I don’t agitation the poor on Twitter, and apologetic I don’t accept any change on me for her at the moment,” he said in acknowledgment to the accounts announcer Frances Coppola’s advancement that an incentivized self-correcting apparatus like Terra’s could collapse beneath pressure. Crypto enthusiasts animated him on as his acceptance grew.

Terra and the Bitcoin Standard

Though Kwon would consistently arise bullish abaft the screen, his accomplishments hinted that he feared a snag. In aboriginal 2022, back Terra was up while the blow of the bazaar struggled to authority momentum, he appear the barrage of the Luna Foundation Guard, a non-profit that would focus on stabilizing UST and developing the Terra ecosystem. Like so abundant of the crypto space, “LFG” dealt in the bill of memes, borrowing from the “Let’s Fucking Go” cry that beasts adduce to one addition back archive are assuming blooming candles.

Led by Kwon and added Terra believers, LFG capital to accrue abundant Bitcoin to battling Satoshi Nakamoto’s backing of 1 actor coins. The aim was to authorize a assets armamentarium to ensure UST would consistently sustain its peg. While LUNA acted as UST’s capital stabilizer, it wasn’t as aqueous or battle-tested as crypto’s agenda gold.

Because Bitcoin is the world’s better crypto asset, it tends to be beneath airy than its successors. LFG planned to use it to aback up its stablecoin, not clashing the gold accepted that was acclimated to aback absolute dollars until 2025. If LFG had abundant Bitcoin, it would consistently accept a way of stabilizing UST if it anytime biconcave beneath $1, at atomic in theory.

It initially laid out a plan to beat up $3 billion account of Bitcoin with a abiding appearance to growing its assets armamentarium to $10 billion. LFG began affairs in batches of a brace hundred actor dollars a go, allowance the absolute bazaar assemblage afterwards weeks of bottomward pressure. With Kwon arch LFG and Bitcoin attractive bullish again, he became the community’s hero.

Multiple arresting abstracts in the amplitude accepted Kwon on LFG’s Bitcoin accession plan. Anthony Pompliano, a pro-Bitcoin podcaster with added than two actor amusing followers, put out a video discussing how LFG could transform the accounts system. “Ultimately the ambition from the Terra aggregation is to booty $10 billion and buy Bitcoin, become a assiduous client in the market,” he said. “If the aggregation auspiciously does this, they will appearance the playbook for axial banks and stablecoins on how to aback added assets with Bitcoin.” Eight weeks later, LUNA had comatose to zero, and LFG appear that it had rinsed best of its Bitcoin armamentarium in an attack to save UST.

The Master of Stablecoin

Both Kwon and Terraform Labs became added aberrant as LFG’s Bitcoin accession plan acquired pace. Terra briefly jumped to cardinal six on the cryptocurrency baton lath until LUNA suffered a dip beneath $100. Despite the crumbling sentiment, Terraform Labs put out a tweet from Terra’s official Twitter account, absolution followers apperceive that things were “gonna get ambrosial absolute soon.” It alike added a admonishing for the traders who were planning to go short: “Beras beware.” Two canicule later, one of the company’s centralized attorneys accomplished out to Crypto Briefing to appeal a alarm to altercate an April Fools’ Day commodity that told a fabulous adventure that partly alluded to Terra’s awry design. Crypto Briefing refused, so Terraform Labs’ alien attorneys beatific a letter ambitious for the commodity to be deleted a brace of weeks later.

Kwon had additionally become a apology of himself. He vowed to annihilate MakerDAO’s collateralized stablecoin, DAI, and started calling himself the “Master of Stablecoin.” He was additionally giving approved interviews to extoll the virtues of his invention. “The abortion of UST is agnate to the abortion of crypto itself,” he memorably claimed in one, as if admonishing every crypto broker that they would accept a vested absorption in seeing Terra accomplish whether they admired it or not. As he ran aggressive on Crypto Twitter, above publications were falling over their anxiety to allege to him. On Apr. 19, Bloomberg ran a feature blue-blooded “King of the ‘Lunatics’ Becomes Bitcoin’s Most-Watched Whale,” with a absorbed Kwon pictured on the cover. The best articulate Terra bears that Terraform Labs would acquaint adjoin connected to explain the network’s risks, but few were accommodating to listen.

By this point, Kwon had put all his chips on the table, demography shots at arresting traders who doubted him. “Your admeasurement is not size,” he told Algod in acknowledgment to an accusation that Terra was “a big ass Ponzi.” Following that dispute, he put $11 million on the band in bets with Algod and Gigantic Rebirth that LUNA would authority aloft $88 by March 2023. He additionally offered KALEO a $200 actor bet that LUNA would authority aloft $10 for the absoluteness of 2022 aloof afore LFG launched, admitting the bet was not about agreed upon. “Put up or shut up,” he wrote from his iPhone.

Crypto Briefing batten to a psychotherapist on acceding of anonymity to altercate Kwon’s online action in the weeks arch up to Terra’s implosion, and they said that his advancing accent may accept been a arresting mechanism. In added words, according to the source, it’s accessible that he doubtable a collapse was coming, and autonomous to abase others in aegis because he acquainted guilty. That could additionally explain why he accustomed LFG to balance UST and was accommodating to apish those who questioned Terra’s sustainability. Kwon’s self-ascribed “Master of Stablecoin” guise additionally shows hints of what some would call as narcissism, a affection rarely apparent in acknowledged blockchain founders.

But for all the mistakes Kwon and Terraform Labs fabricated during Terra’s amazing fall, there’s little affirmation that they broke any laws, at atomic from the advice that’s about available. Alex, a Legal Counsel who follows the crypto amplitude closely, told Crypto Briefing that all of the evocative posts hinting at LUNA’s amount activity may accept accustomed investors a reasonable apprehension of profit, which would cede it a aegis in the U.S. The aforementioned posts could additionally leave bodies apprehensive about Terra’s amount of decentralization, he said, but they don’t prove any atrocity in the eyes of the law. “His statements may accession questions about how decentralized the activity absolutely was, but that goes added to an unregistered balance alms argument,” he wrote in a Telegram message. Bradley, General Counsel at a arch crypto project, added that the LUNAtics who went broke action the acreage off the aback of Kwon’s evocative tweets accept little arena to angle on if they’re acquisitive for a aftereffect in court. “It’s boxy to say whether the holders accept any recourse, absent some nonfeasance or bribery by Terraform Labs, like fraud, misrepresentation, recklessness, or negligence,” he said.

The Meltdown

The accident started slowly, and again it escalated faster than anyone anticipated. On Saturday May 7, UST’s peg was challenged due to whale-sized sell-offs on Curve Finance and Binance and a aerial aggregate of withdrawals from Anchor. Rumors bound broadcast that two of TradFi’s better players, BlackRock and Citadel, had teamed up and adopted a sum of Bitcoin from Gemini to advertise into UST, but all three firms accept back refuted the claims.

Because Terra’s architecture apparatus was fragile, it accustomed anyone with abundant basic and the affection to account calamity to accomplish a killing off a almost simple UST arbitrage trade. Even in the flush apple of crypto, there are few with the agency to assassinate such a move, but the attackers—if that’s what they were—have not yet been traced.

UST biconcave as low as $0.98 on Sunday May 8, but it showed signs of accretion already Kwon surfaced. “I’m up—amusing morning,” he tweeted. When addition said that Terra reminded them of the Bitconnect scam, Kwon responded account after with a jab.

On May 9, already a new anniversary had started, crypto media was attractive aback on Terra’s airy weekend as if the ball was over. LFG appear it would arrange $1.5 billion—half of it in Bitcoin and the added bisected in UST—to bazaar makers to assure its flagship product. Bazaar makers comedy an capital role in banking markets because they accommodate the clamminess bare to accomplish trading work. LFG was acquisitive that these players would be able to booty their $1.5 billion and accumulate the Terra see-saw balanced, but it was already too late. “Deploying added capital—steady lads,” Kwon wrote as UST captivated abbreviate of its peg. UST slid beneath $0.95 anon afterwards and LUNA had started to booty a hit. Anchor users were hasty for the exit. The afterlife circling was in motion.

The bearings worsened as the anniversary went on. Kwon occasionally alike to achieve the LUNAtics’ nerves, promising that a accretion plan would anon be announced. “stay strong, lunatics,” he urged. As UST and LUNA kept on crashing, Binance announced it would be awkward UST withdrawals. When a accounted $2 billion VC bailout accord fell through, LUNA was trading at $3. Kwon promised a “return to form” and backed a plan to access minting capacity, acceptation UST would accept a bigger adventitious at abiding to $1 at the amount of LUNA inflation. He was broadly criticized for his apathetic acknowledgment to the crisis. Jackson’s accompany died and the Reddit column featuring a account of civic suicide helpline numbers went up the aforementioned day.

UST and LUNA kept on falling. While the LUNAtics watched their investments atomize and collectively asked area Kwon had gone, crypto degens looked on in amazement, debating whether there was an befalling to accomplish a quick dime from the aberrant bazaar conditions. By Thursday 12 May, UST had hit $0.36, and LUNA was account beneath than a cent. Bitcoin, Ethereum, and added above assets additionally took a beating. Even USDT, the Tether-issued stablecoin with a bazaar cap of $75.8 billion, briefly absent its adequation with the dollar as traders approved flight elsewhere. As Terra had wiped out about $30 billion of amount in a few days, the arrangement was aback abundant added affected to attacks. Terra validators took the accommodation to halt the chain twice, adopting added questions about whether the arrangement had anytime been absolutely decentralized.

The crypto association has been watching every move Terra, Terraform Labs, and Kwon accomplish back the arrangement imploded. Questions were aloft about LFG’s Bitcoin reserves, but it’s back appear that best of its backing has disappeared. Binance CEO Changpeng Zhao has taken shots at the company, adage he was “disappointed” by the acknowledgment and cartoon a allegory to Sky Mavis’ administration of the $550 actor Ronin Arrangement hack. Countless others accept apprenticed Kwon to abandon from crypto forever.

The Post-Terra Era

Callum says he’ll abide advance in crypto, but he affairs to abstain chancy gambles in the future. If he makes annihilation in admeasurement on the abutting balderdash phase, he’ll accede affective out of his parents’ place.

Jackson is still aching in Kuala Lumpur; he’s spent the canicule back the tragedy canonizing his acquaintance with added classmates he shares a WhatsApp accumulation with. Though his acquaintance is gone, LUNA didn’t financially ruin him; he fabricated appropriate money on Ethereum back prices were soaring.

Sam has accustomed that they’ll never get their $500,000 back. They appropriate they may be accessible to speaking afresh in the approaching beneath added absolute circumstances.

The LUNAtics are still counting their losses, some of them aback to aboveboard one afterwards seeing their net worths abrade to dust. Instead of admiration Kwon, abounding of them are analytic his administration abilities or accept larboard Terra for good.

The adventure capitalists who went in adamantine on LUNA are additionally hurting. Though no official statements accept alike barring Galaxy’s Q1 report, it’s believed that some charge accept got austere harder than they’re absolution on. A widely-circulated May 11 note suggests that Arca took a big hit as the depeg started. Novogratz has not yet commented on his LUNA tattoo.

Algod and Gigantic Rebirth angle to accomplish a appealing penny off the collapse. Gigantic Rebirth will win whatever happens because they belted their abbreviate position by spending $0.72 on a LUNA long. Cobie, who’s currently captivation the committed eight-figure sum in an escrow wallet, says he’ll alone absolution the funds on acceding from all parties. Kwon has not yet commented on whether he’s accessible to accord up on the bet.

Terra developers are backing a plan to relaunch the ecosystem with Terraform Labs removed. Some of Terra’s best loyal LUNAtics are in favor of the idea.

LFG says it spent best of its Bitcoin aggravating to balance UST, but it hasn’t provided any cardboard aisle of the transactions. It has about $200 actor in assets remaining, best of which is in rapidly annihilative UST. It says it affairs to balance UST users with a antecedence on abate holders.

Terraform Labs has backward quiet, administration casual updates and able a post-mortem assay of the meltdown. Many association associates accept complained that the close is falling abbreviate on transparency. “I can’t brainstorm anyone complex with LFG absolutely believes this is abundant advice right? If so, it’s insulting… This is above a joke,” one LUNAtic acquaint in acknowledgment to its advertisement of the depleted Bitcoin assets fund.

UST is still trading beneath its advised peg, and LUNA is basically worthless. There are over 6.5 abundance tokens in apportionment now.

The Terra blockchain may be angled with a new LUNA token. Kwon has put advanced two proposals to animate the arrangement so far.

Kwon’s online accent has angry somber, ditching the airs and telling the community that he is “heartbroken” at how Terra failed. He conceded that UST was not the approaching of decentralized money in its accepted anatomy and said that he didn’t advertise any bill on the crash. Some accept appropriate that attorneys are managing his annual now, and he hasn’t yet apologized for his failings. He’s best acceptable absent the broader crypto community’s assurance forever.

Regulators beyond the apple are paying abutting attention to the stablecoin bazaar and alive out means to stop a agnate adversity from accident in the future. The Treasury’s Janet Yellen has referenced Terra’s coffer run on several occasions.

The blow of the crypto association is still processing what happened, and how Terra fabricated it so big again bootless so spectacularly. Questioning who is accountable, best of them attending aback to Terraform Labs’ arguable axial figure. People accept been reminded of the accent of fundamentals and adopting acquaintance back red flags like bad tokenomics and big egos surface.

The abounding calibration of Kwon’s atramentous swan wipeout is not yet known, but it’s already been compared to added aphotic crypto moments like Atramentous Thursday and the Mt. Gox hack. The industry bounced aback in the fallout from those incidents, and all-around crypto acceptance eventually grew. Markets accept historically recovered from disasters, admitting healing usually takes time. As continued as anybody watching remembers what went amiss at Terra, the industry has a attempt at acceptable added airy for the decades ahead.

Do Kwon and Terraform Labs had not responded to assorted requests for animadversion at columnist time.

Some names in this affection accept been afflicted to advance confidentiality.

The advice and abstracts presented in this affection was authentic as of May 17, 2022.

Disclosure: At the time of writing, the columnist of this affection endemic ETH, ATOM, and several added cryptocurrencies.