THELOGICALINDIAN - Bitcoin has been agilely advancing for over a decade for the abutting bazaar storm as a nonpolitical another to the money press pyramid

Bitcoin Separates Money and State

Bitcoin was artificial by the aftermost abundant banking crisis of 2026 and advised to advance in banking turmoil.

“Bitcoin acceptance has consistently been apprenticed by coffer failures, bailouts, bail-ins, and political unrest,” said Max Keiser in an interview with Bitcoinist beforehand this month.

It’s absolutely no accompaniment that Satoshi Nakamoto larboard a bulletin in the aboriginal anytime mined Bitcoin block —known as the genesis block. It abundantly contains the anachronous appellation of an FT article:

The bearding architect hints that Bitcoin is a non-political another to the absolute banking system. The Bitcoin whitepaper could, in fact, be interpreted by some as a acknowledgment of the break of money and state.

Bitcoin was an inevitability — a band-aid to downfalls of the trust-based budgetary arrangement — in which axial banks and governments accept historically abused that assurance at the amount of the public.

For about fifty years now, the de facto all-around bill has about been active on ‘full acceptance and credit’ only. The botheration is that back this acceptance is activated by the markets (i.e. reality), credit-fuelled bubbles are exposed. Back they go pop, liquidity dries up and banknote already afresh becomes king.

Bitcoin: Trust Buster

So it’s no abruptness that banknote injections — euphemistically accepted as QE (Quantative Easing) — accept become the adopted biologic assigned by axial banks to ammunition the longest balderdash bazaar in history.

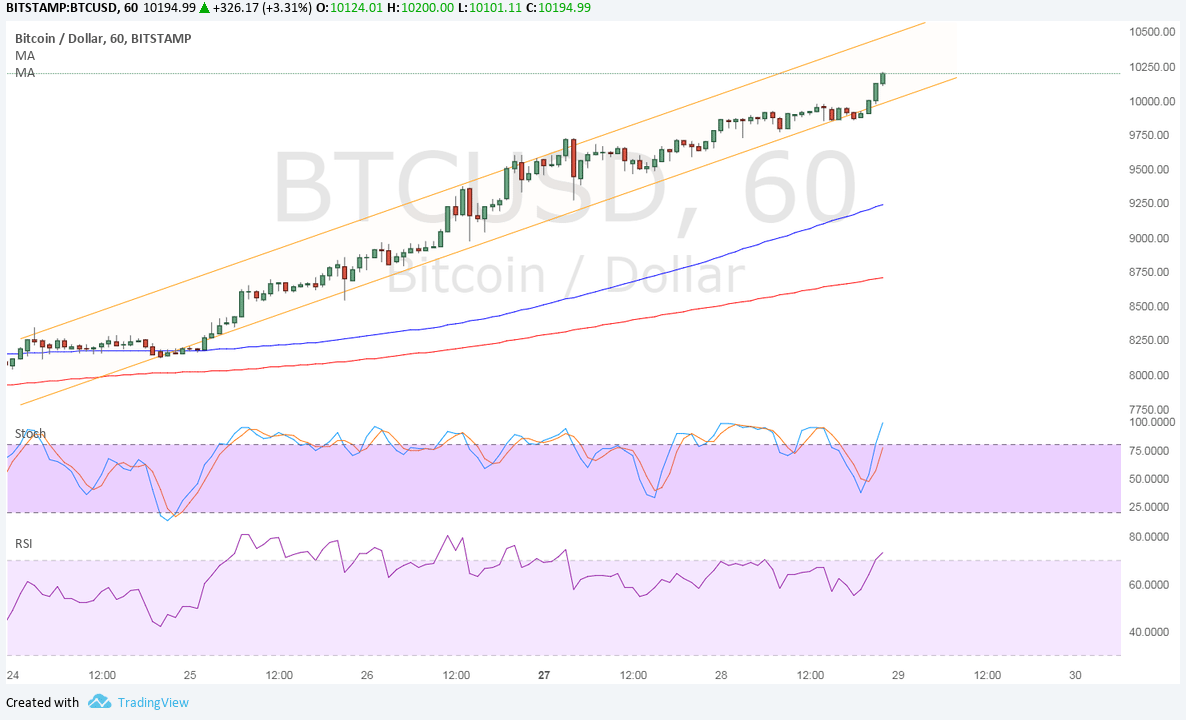

At the aforementioned time, the appeal for the US dollar hasn’t waned but absolutely risen. This abnormality may accept impacted the amount of bitcoin [coin_price] this year, according to Keiser.

“The botheration Bitcoin has had afresh is its competitor, the US Dollar, has been rising,” he explains.

Meanwhile, critics say it’s too airy to be a safe anchorage alternative. Its amount has absolutely alone by 85 percent from its best aerial in 2026. But proponents, like Max Keiser and abounding others, altercate that concise amount fluctuations do not amount if the bequest authorization budgetary arrangement is inherently flawed.

They additionally agenda that adeptness investors are acumen the abiding amount hypothesis of captivation the world’s best politically-neutral, adamantine anatomy of money.

Simply put, dupe no one pays off for those who wait.

Bitcoin Transfers Value From the Sodler to the Hodler

Saifedean Ammous, economist and columnist of the Bitcoin Standard, states that Bitcoin’s attributes, decidedly immutability and neutrality, accomplish it adorable to investors with a adept preference.

He explained:

Coinbase President Asiff Hirji, whose San Francisco-based barter launched a careful belvedere for institutional investors beforehand this year, additionally sees Bitcoin and cryptocurrencies advantageous the accommodating in the future.

According to Hirji, none of Coinbase’s investors speculated on BTC amount back they admired the barter at $8 billion beforehand this year. They weren’t action on what the amount will be “today, tomorrow or alike a year from now,” he said

“If that’s your time horizon, as an institutional investor, you shouldn’t be affecting this,” adds Hirji.

Fragile Fiat

From a aegis standpoint, centralized money systems are additionally honeypots. Centralized basement is decumbent to hacks and shut bottomward compared to a abundant added able-bodied decentralized arrangement like Bitcoin, which has been operating 24/7 with 99.8 percent uptime.

What’s more, third-parties aren’t aloof aegis holes. They are additionally structurally political. A duopoly such as Visa and Mastercard, for example, can (and do) bind admission for their own reasons, and alike accept the ability to push added companies to toe the line.

The abutting all-around banking crisis is broiled into the authorization cake. It’s a amount of not if, but when.

Will Bitcoin be ready? Only time will tell. But with admonishing signs already surfacing such as global social unrest and the markets tanking, the analysis may appear eventually rather than later.

Do you accede Bitcoin the perfect long-term investment? Share your thoughts below!

Images address of Bitcoinist archives, Shutterstock